What Forms Are Included In Turbotax Home And Business

You can use TurboTax Self-Employed TurboTax Self-Employed Live TurboTax Home Business for Windows and TurboTax Business to create W-2 and 1099 forms including 1099-NEC and 1099-MISC for your employees and contractors. When you locate your form or schedule there will dates for Print and in most cases E-file availability.

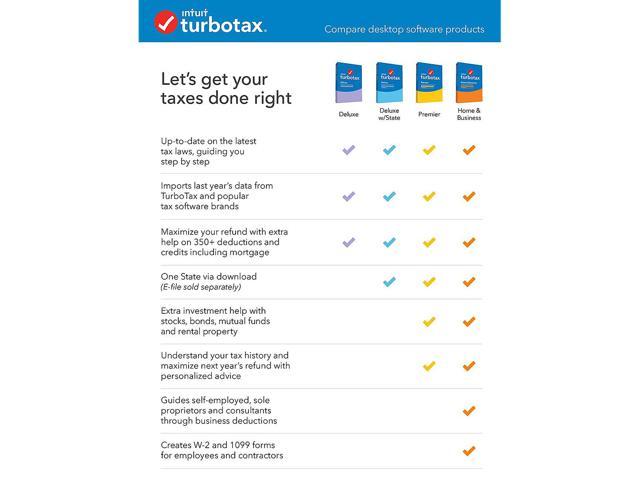

Personal Finance Tax And Legal 158906 2018 Intuit Turbotax Home And Business Personal Self Employed Tax Software New Turbotax Tax Software Tax Preparation

Personal Finance Tax And Legal 158906 2018 Intuit Turbotax Home And Business Personal Self Employed Tax Software New Turbotax Tax Software Tax Preparation

Guides you through start-up costs new businesses can deduct.

What forms are included in turbotax home and business. Other Tax Forms and Schedules. Do you only have Form-1099s. How do I file a 1120S with TurboTax Home and Business.

Included with all TurboTax Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service or prior year PLUS benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312022. The Form 1099s the Basic version supports are. Terms and conditions may vary and are subject to change without notice.

Creates W-2 and 1099 tax forms for employees and contractors. Forms and schedules missing from the table arent supported in TurboTax. In order to file non-individualbusiness forms 1120C 1120S 1065 etc you would need TurboTax Business not TurboTax Home and Business.

Extra coaching to maximize small business and self-employment tax deductions such as home office vehicle phone and supplies. TurboTax Home Business is recommended if you received income from a side job or are self-employed an independent contractor freelancer consultant or sole proprietor you prepare W-2 and 1099 MISC forms for employees or contractors you file your personal and self-employed tax together if you own an S Corp C Corp Partnership or multiple-owner LLC choose TurboTax Business. Forms missing from the table arent supported in TurboTax.

You prepare W-2 1099-MISC forms for employees contractors. TurboTax security and fraud protection. TurboTax Home Business is recommended if you received income from a side job or are self employed an independent contractor freelancer consultant or sole proprietor you prepare W 2 and 1099 MISC forms for employees or contractors you file your personal and self employed tax together if you own an S Corp C Corp Partnership or multiple owner LLC choose TurboTax Business.

TurboTax Home Business is recommended if. If you only have a W-2 from work and various Form 1099s you may only need the TurboTax Free Edition. Schedule EIC Earned Income Credit.

TurboTax Home Business is recommended if. Each one includes tech support but only Premier and Home Business include phone support and guidance from Certified Public Accountants. Instructions for TurboTax Self-Employed and TurboTax Self-Employed Live.

Coronavirus and your taxes. Schedule SE Self-Employment Tax. State e-file sold separately.

Terms and conditions may vary and are subject to change without notice. You file personal self-employed taxes together. Choose TurboTax Home Business if any of the following apply to you.

1099-MISC Miscellaneous Income. However if the E-file form is listed as unsupported the form or schedule must be printed and youll need to mail your return. Based TurboTax product support.

Free product support via phone. Included with all TurboTax Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service or prior year PLUS benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312022. Form 1040-ES Estimated Tax for Individuals.

Unemployment Benefits and Taxes. You are a sole proprietor consultant 1099 contractor or single-owner LLC You receive income from a side job or self-employment You prepare W-2 and 1099-MISC forms for employees or contractors. You would need separate software one for your individual return one for your business return.

Schedule E Supplemental Income and Loss including rental property. You are self-employed an independent contractor a freelancer a small business owner a sole proprietor have a home office or home-based business Includes 5 free federal e-files and one download of a TurboTax state product dollar 40 value. Tax forms included with TurboTax.

You are a sole proprietor consultant 1099 contractor or single-owner LLC You receive income from a side job or self-employment You prepare W-2 and 1099-MISC forms for employees or contractors. If the E-file form is listed as unsupported the form or schedule must be printed and youll need to mail your return. When you locate your form or schedule there will be dates for Print and for some states E-file availability.

Self Employed COVID-19 Relief. TurboTax Home Business includes everything taxpayers need for self-employment and personal income taxes. You are self-employed independent contractor freelancer consultant or a sole proprietor.

Form 982 Reduction of Tax Attributes Due to Discharge of Indebtedness. Choose TurboTax Home Business if any of the following apply to you. Designed for taxpayers who have their own business TurboTax Home Business includes everything in TurboTax Premier plus an expanded interview that guides customers step-by-step through Schedule C categorizing business expenses maximizing home office deductions and.

You receive income from a side job.

Turbotax Tax Software Deluxe State 2019 Amazon Exclusive Pc Mac Disc In 2020 Turbotax Tax Software Tax Refund

Turbotax Tax Software Deluxe State 2019 Amazon Exclusive Pc Mac Disc In 2020 Turbotax Tax Software Tax Refund

Old Version Turbotax Home Business State 2019 Download 028287558649 61 99 Softwarediscountusa Com Your Premier Source For Discounted Software

Old Version Turbotax Home Business State 2019 Download 028287558649 61 99 Softwarediscountusa Com Your Premier Source For Discounted Software

Turbotax Home Business Federal State 2019 Windows Digital Int940800v507 Best Buy

Turbotax Home Business Federal State 2019 Windows Digital Int940800v507 Best Buy

Myths About Quarterly Taxes For The 1099 Tax Form Turbotax Tax Tips Amp Videos 1099 Tax Form Quarterly Taxes Tax Forms

Myths About Quarterly Taxes For The 1099 Tax Form Turbotax Tax Tips Amp Videos 1099 Tax Form Quarterly Taxes Tax Forms

Turbotax Home Business State 2020 Download 028287563438 63 99 Softwarediscountusa Com Your Premier Source For Discounted Software

Turbotax Home Business State 2020 Download 028287563438 63 99 Softwarediscountusa Com Your Premier Source For Discounted Software

Pin On Amazon Best Selling Products

Pin On Amazon Best Selling Products

Intuit Turbotax Home Business Federal Efile State 2020 1 User Mac Windows Int940800f104 Best Buy

Intuit Turbotax Home Business Federal Efile State 2020 1 User Mac Windows Int940800f104 Best Buy

Turbotax Business 2017 Fed Efile Pc Download Read More Reviews Of The Product By Visiting The Link On The Image This Is An Turbotax Tax Software Efile

Turbotax Business 2017 Fed Efile Pc Download Read More Reviews Of The Product By Visiting The Link On The Image This Is An Turbotax Tax Software Efile

Turbotax Home Business 2020 Desktop Tax Software Federal And State Return Federal E File State E File Additional Software Meijer Grocery Pharmacy Home More

Turbotax Home Business 2020 Desktop Tax Software Federal And State Return Federal E File State E File Additional Software Meijer Grocery Pharmacy Home More

What Is The Purpose Of An Irs W 9 Form Irs Turbotax Irs Forms

What Is The Purpose Of An Irs W 9 Form Irs Turbotax Irs Forms

Turbotax Business 2018 Tax Software Pc Download Free Download Review Tax Software Turbotax Software

Turbotax Business 2018 Tax Software Pc Download Free Download Review Tax Software Turbotax Software

Turbotax A Critical Analysis Ux Design Teardown Ux Collective Turbotax Analysis Make Sense

Turbotax A Critical Analysis Ux Design Teardown Ux Collective Turbotax Analysis Make Sense

Amazon Com Old Version Turbotax Deluxe State 2018 Tax Software Pc Download Amazon Exclusive Software Turbotax Tax Software Software

Amazon Com Old Version Turbotax Deluxe State 2018 Tax Software Pc Download Amazon Exclusive Software Turbotax Tax Software Software

Comparing The Prices Of Turbotax Deluxe Premier Home Business With H R Block Federal Deluxe And Premier And Taxact Plus And Prem Turbotax Taxact Hr Block

Comparing The Prices Of Turbotax Deluxe Premier Home Business With H R Block Federal Deluxe And Premier And Taxact Plus And Prem Turbotax Taxact Hr Block

Intuit Turbotax Home Business 2018 Win Mac Download Version Turbotax Tax Software Business Downloads

Intuit Turbotax Home Business 2018 Win Mac Download Version Turbotax Tax Software Business Downloads

Turbotax Home Business 2020 Desktop Tax Software Federal And State Returns Federal E File State E File Additional Mac Download Newegg Com

Turbotax Home Business 2020 Desktop Tax Software Federal And State Returns Federal E File State E File Additional Mac Download Newegg Com

Pin On Income Taxes Tax Software And Solutions

Pin On Income Taxes Tax Software And Solutions