Does An Llc Company Get A 1099

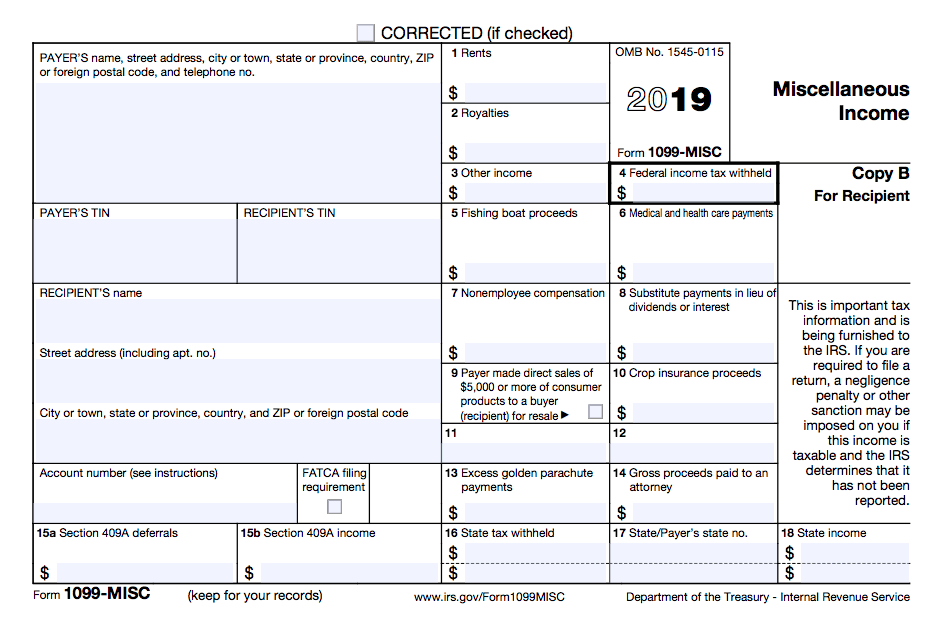

You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than 600 and that includes any individual partnership Limited Liability Company LLC Limited Partnership LP or Estate. Payments for which a Form 1099-MISC is not required include all of the following.

E File 1099 And W 2 Tax Forms Online With Efile4biz Com Filing Taxes Business Tax Tax Forms

E File 1099 And W 2 Tax Forms Online With Efile4biz Com Filing Taxes Business Tax Tax Forms

The IRS has a form for businesses to use when they retain the services of an LLC that may trigger a 1099 filing requirement.

Does an llc company get a 1099. Few businesses may still give a limited liability company a 1099. In general Form 1099-Misc must be issued to any business or person to whom your LLC made payments totaling 600 or more for rents services prizes or awards or other payments of income. If established as a single-member LLC they file their taxes as an individual so you will provide them with the Form 1099.

In a 2 member LLC being issued 1099-MISC using or EIN and We will both be salaried employees of the LLC how do we file our taxes The business will file its own tax return - a partnership return. You do need to issue the LLC a 1099 MISC. The statement gets replaced when working with Type C LLCs because these businesses have specific rigid rules and forms required for reporting income to the Internal Revenue Service.

This includes S-Corporations and C-Corporations -- they also dont receive 1099 1099-MISCs. In this case a manager or member of a company can file a 1099 for that person since for tax purposes the LLC is treated as a person For contractors that operate and file taxes as corporations such as a C-corp. On the other hand for all contractors who are set up as LLCs but not filing as corporations taxed as a partnership or single-member LLC your business will need to file 1099 forms for them.

Employment Excise or Alcohol Tobacco and Firearms. Do you have a Keogh plan. If their LLC is taxed as an S- or a C-Corp you do not unless an exception applies as described above.

When your business engages an LLC contractor send the company a Request for Taxpayer Identification Number and Certification which requires the LLC to disclose its EIN or the Social Security number of its sole owner and whether its taxed as a corporation or partnership. If the LLC has multiple members and is not taxed as a corporation the LLC is taxed as a partnership. In the family of 1099 forms the 1099-MISC is probably the most widely used.

1099-MISCs should be sent to single-member limited liability company or LLCs or a one-person Ltd. Some payments do not have to be reported on Form 1099-MISC although they may be taxable to the recipient. A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and elects to be.

There are a few narrow exceptions to the rule including medical and health care payments made to a corporation attorneys fees and fish purchased for cash. Since the IRS requires that you furnish a copy of the 1099-MISC to the LLC by Jan 31 in the year after the relevant tax year youll need to have these information reporting tasks completed rather. If you did business with a corporation you typically do not need to send them a Form 1099 MISC even if you did do over 600 in business with them.

For that you will need TurboTax Business which is not the same as Home and Business. Basically you do not have to issue a 1099 MISC to a LLC that has elected to be taxed as a corporation. Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity.

In addition the form must be issued to anyone to whom the LLC made royalty payments of. A Limited Liability Company LLC is an entity created by state statute. An LLC that is taxed as a corporation files different forms that replace the use of Form 1099-MISC.

For tax purposes theyre treated as corporations so in general they dont get a 1099. Do you withhold taxes on income other than wages paid to a non-resident alien. Unfortunately if your contractor has their own LLC by which they do business it is not so easy.

The IRS uses Form 1099-MISC to keep track of how much money or other benefits the LLC has paid an independent contractor subcontractor or other nonemployee. If the LLC files as a corporation then no 1099 is required or you dont need to send 1099 to the LLC. Who are considered Vendors or Sub-Contractors.

But not an LLC thats treated as an S-Corporation or C-Corporation. Any business including an LLC must issue a 1099 to any independent contractor who is paid more than 600. Heres another way to remember.

It will essentially boil down to what type of LLC they are. Sole proprietor Do send 1099-MISC. Do you file any of these tax returns.

However if an it is taxed as a partnership the IRS requires it to issue Form 1099-MISC. Do you operate your business as a corporation or a partnership. Generally payments to a corporation including a limited liability company LLC.

A limited liability company that has elected to keep corporation status does not need a 1099. If the W-9 indicates they are an LLC that is taxed as a sole proprietorship you need to send a 1099.

Ask The Taxgirl Form 1099 Misc Mistake Tax Forms Doctors Note Template Important Life Lessons

Ask The Taxgirl Form 1099 Misc Mistake Tax Forms Doctors Note Template Important Life Lessons

Do I Need A 1099 For An Llc Llc Limited Liability Company Irs Forms

Do I Need A 1099 For An Llc Llc Limited Liability Company Irs Forms

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Financial Planning For Couples Small Business Bookkeeping Bookkeeping Business

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Financial Planning For Couples Small Business Bookkeeping Bookkeeping Business

What Is A 1099 Employee What Is A 1099 Tax Forms Independent Contractor

What Is A 1099 Employee What Is A 1099 Tax Forms Independent Contractor

Replace An Ssa 1099 1042s Social Security Benefits Social Security Social Security Disability

Replace An Ssa 1099 1042s Social Security Benefits Social Security Social Security Disability

What Happens If A Payer Doesn T Send 1099 Misc Irs Irs Forms 1099 Tax Form

What Happens If A Payer Doesn T Send 1099 Misc Irs Irs Forms 1099 Tax Form

Free Download W9 Form W 9 Form Fillable Printable Download Free 2018 Tax Forms Letter Templates Free Professional Resignation Letter

Free Download W9 Form W 9 Form Fillable Printable Download Free 2018 Tax Forms Letter Templates Free Professional Resignation Letter

What Is 1099 Misc Form How To File It Complete Guide

What Is 1099 Misc Form How To File It Complete Guide

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

1099 Misc Check 1042s Check Irs B Notices Check Realized Your Vendor Master File Needs Teaching Management Accounts Payable Cybersecurity Training

1099 Misc Check 1042s Check Irs B Notices Check Realized Your Vendor Master File Needs Teaching Management Accounts Payable Cybersecurity Training

1099 Misc Form Reporting Requirements Chicago Accounting Company

1099 Misc Form Reporting Requirements Chicago Accounting Company

Llc Business Tips Llc Business How To Start A Blog Business Tips

Llc Business Tips Llc Business How To Start A Blog Business Tips

The 1099 Decoded The What Who Why How 1099s Small Business Finance Small Business Bookkeeping Business Tax

The 1099 Decoded The What Who Why How 1099s Small Business Finance Small Business Bookkeeping Business Tax

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition