Do Corporations Get A 1099 Nec

In general you dont have to issue 1099-NEC forms to C-Corporations and S-Corporations. It is made for services in the course of your trade or business.

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

I have a s corporation and I received a form 1099 nec.

Do corporations get a 1099 nec. Heres what the form does. In general you will use Form 1099-NEC if. Businesses must send out Forms 1099 by Jan.

Businesses will need to use this form if they made payments totaling 600 or more to a nonemployee such as an independent contractor. Even if you dont receive a Form. Knowing whether or not your LLC gets a 1099 or what the proper tax documents are for your particular business can be one of the scariest things about being a business owner.

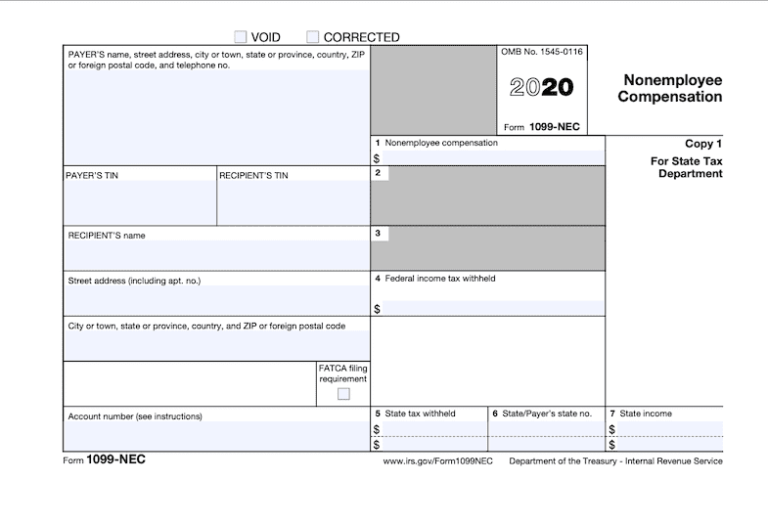

Its a common belief that businesses dont need to send out 1099-NEC forms to corporations. IRS uses form 1099MISC and 1099-NEC to track payments. The formal name of the Form 1099-NEC is Nonemployee Compensation How does form 1099-NEC work.

201 accelerated the due date for filing Form 1099 that includes nonemployee compensation NEC from February 28 to January 31 and eliminated the automatic 30-day extension for forms that include NEC. Beginning with the 2020 tax year the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC. For the last few decades business owners were responsible for using Form 1099-MISC to report nonemployee compensation.

Most payments to incorporated businesses do not require that you issue a 1099 form. Here are some examples of payments you need to report on the 1099-NEC. After a 38-year absence Form 1099-NEC made its return in the 2020 tax year.

The answer is no because the kitchen remodeling was for personal not business reasons. It is made to someone who is not your employee. Note that we said anything except non-employee compensation This is because the new Form 1099-NEC is specifically for the kind of income that used to go into Box 7 of the 1099.

This exception also applies to limited. But now businesses will have to use the 1099-NEC form it is short for non-employee. The PATH Act PL.

Beginning with tax year 2020 use Form 1099-NEC to report nonemployee compensation. Non-employees receive a form each year at the same time as employees receive W-2 formsthat is at the end of Januaryso the information can be included in the recipients income tax return. A 1099-NEC form is used to report amounts paid to non-employees independent contractors and other businesses to whom payments are made.

We use cookies to give you the best possible experience on our website. 31 but dont assume youre off the hook if you dont receive one. If you are self-employed.

Do you need to issue a 1099-NEC. The major exception to the 1099 requirement is payments to corporations. All businesses must file a Form 1099-NEC form for nonemployee compensation if all four of these conditions are met.

Although most payments to corporations are not 1099-MISC and 1099-NEC reportable there are some exceptions. One is regarding the 1099-MISC form. No corporations S Corps and C Corps are exempted from requiring a 1099-MISC therefore you do not normally have to send this form to any corporations including an S Corporation.

It was made to an individual partnership estate or corporation. Do LLC S corporations get a 1099. Thats right corporations are by definition not independent contractors.

After all there is so much to keep track of as a business owner such as receipts deductible expenses and keeping track of which tax. And this is true. If - Answered by a verified Tax Professional.

Do I file that on my personal taxes or business taxes. If your company as a client paid an independent contractor more than 600 during the year you will be required to file the new Form 1099-NEC. If your business paid an independent contractor 600 or more during 2020 for services you are required to prepare and file Form 1099-NEC and to provide a copy of the form to the independent contractor.

Form 1099 NEC is a new federal tax form that payers must file with the Internal Revenue Service to report payments paid to none-employees such as contractors vendors consultants and the self-employed. Traditionally this has been used to report contractor income. The reportable payments need to be made in the course of your trade or business.

Certain payments to corporations are reportable on Forms 1099-MISC. But with Form 1099-NEC employers can say hello to a revamped form and goodbye to reporting nonemployee compensation on Form 1099-MISC. You paid someone who is not an employee for services related to your trade or business.

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Irs Update New Form 1099 Nec Alfano Company Llc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

I Received A Form 1099 Nec What Should I Do Godaddy Blog

1099 Nec A New Way To Report Non Employee Compensation

Ready For The 1099 Nec White Nelson Diehl Evans Cpas

Form 1099 Nec For Nonemployee Compensation H R Block

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Form 1099 Nec Instructions And Tax Reporting Guide

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

New Irs Form 1099 Nec Used To Report Payments To Nonemployee Service Providers

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

1099 Misc And 1099 Nec Deadline Feb 1 2021 Tax Practice Advisor

Form 1099 Misc Vs Form 1099 Nec How Are They Different