Do Sole Proprietors Need A Business License In Georgia

Follow the instructions to complete the registration. Check out Georgia Municipal Association.

Register Georgia Fictitious Business Name Georgia Trade Name Georgia Dba Business Names Names Business Format

Register Georgia Fictitious Business Name Georgia Trade Name Georgia Dba Business Names Names Business Format

Sole proprietors and general partners do not have to apply for a business license with the state of Georgia.

Do sole proprietors need a business license in georgia. The license must be renewed on an annual basis. But like all businesses you need to obtain the necessary licenses and permits. There isnt a requirement in Georgia for sole proprietors to acquire a general business license but depending on the nature of your business you may need other licenses andor permits to operate in a compliant fashion.

Sole Proprietor Business Licenses In Georgia Wedding Planner Wedding Planner. A sole proprietor must withhold and pay employment taxes for his employees. In Georgia you can establish a sole proprietorship without filing any legal documents with the Georgia Secretary of State.

Rules for business registration vary depending on location and what the business does. Member Cities for contact information. Obtain an Employer Identification Number.

There are four simple steps you should take. Select Register a New Georgia Business. Your businesss structure may help determine the type and amount of taxes you will pay.

You can learn about how to register for a business license or service license and download an application by visiting wwwgeorgiagov. There is no general state of Georgia business license however many cities require businesses to apply for an occupational tax certificate in order to operate. File a trade name with the Superior Court.

Starting my own business Ie Start a Wedding Planner business in 30144 Kennesaw Georgia. Entities doing business in Georgia may need to register for one or more tax types in order to obtain the specific identification numbers permits andor licenses required. Before registering for any tax type learn more about the differences and requirements for each of the tax types by visiting Tax Registration.

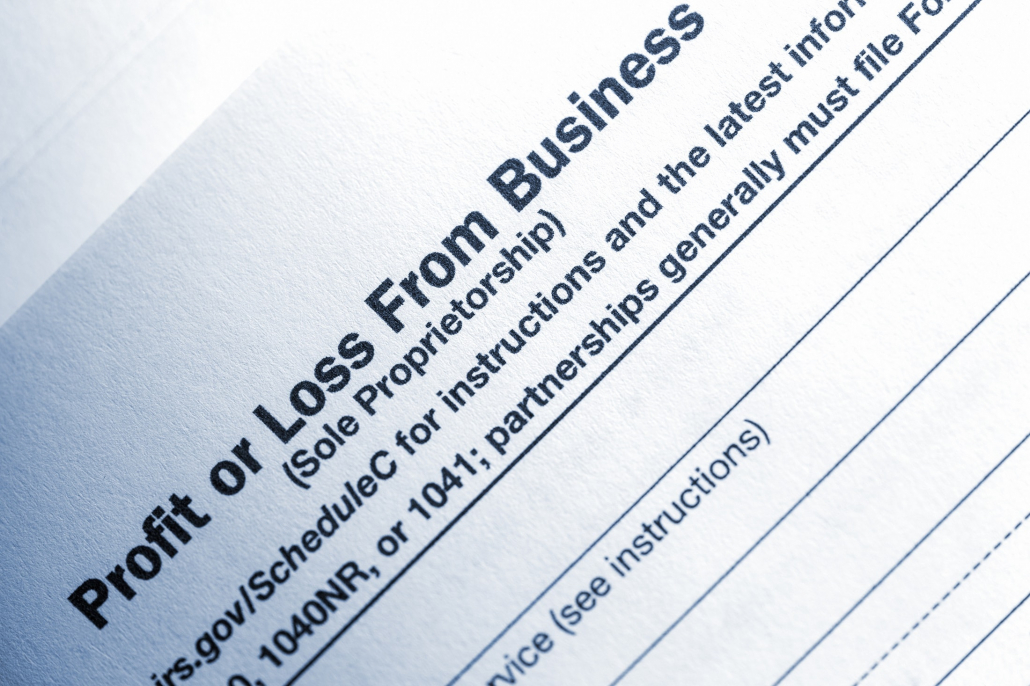

You will need to complete a New Business Registration as a Sole Proprietor on Georgia Tax Center. In Georgia you do this by registering with the Clerk of Superior Court of the county where your business is principally located. Do Sole Proprietors Need A Business License In addition to getting licenses a sole owner must pay taxes on Income A sole owner needs to report all business income or losses on his or her individual income tax return -- IRS Form 1040 with Schedule C attached.

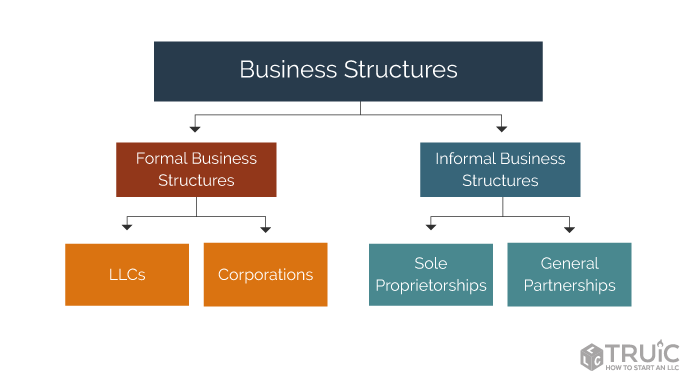

Structures include a sole proprietorship limited liability company limited partnership and corporation. Choose a business name. Georgia does not issue business licenses at the state-level but you may need to obtain a business license from the county or city where your business is located.

A buying service license is valid for one year and costs 50. For Sole Proprietors Who Have Not Filed a Georgia Return. Use the Licensing Permits tool to find a listing of federal state and local permits licenses and registrations youll need to run a business.

The cost of a business license will depend too on the gross receipts of the business in some cities. Sole proprietors will have to file their income taxes as an individual but will collect and pay other taxes in the same manner as other businesses. If you will be operating your sole proprietorship under a name that is different from your own name then you will need to register the name as a fictitious or assumed business name.

Regulations vary by industry state and locality. As previously stated operating a sole proprietorship in the state of Georgia requires no formal filing. What are the licensing requirements in Georgia.

Obtain licenses permits and zoning clearance. Residential House cleaning service businesses must apply for a business license at their city or county clerks office. If you are a freelance writer for example you are a sole proprietor.

In order to be self-insured you must be approved as a member of the Georgia Self-Insurers Guaranty Trust Fund and certified by the State Board of Workers Compensation. There is no one license or permit that all business owners must have but most businesses will need to obtain some type of license from the state depending on the kind of business you are operating. However some professions require licensing and permits in the state and existing as a sole proprietorship does not allow an individual to avoid them.

Follow the instructions to complete. Select Register as a Sole Proprietor. Youll need to contact your county andor city to determine your licensing requirements.

Georgia allows owners of a sole proprietorship to use their own name as their business name. Select Sole Proprietor from the Business Type drop-down list.

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

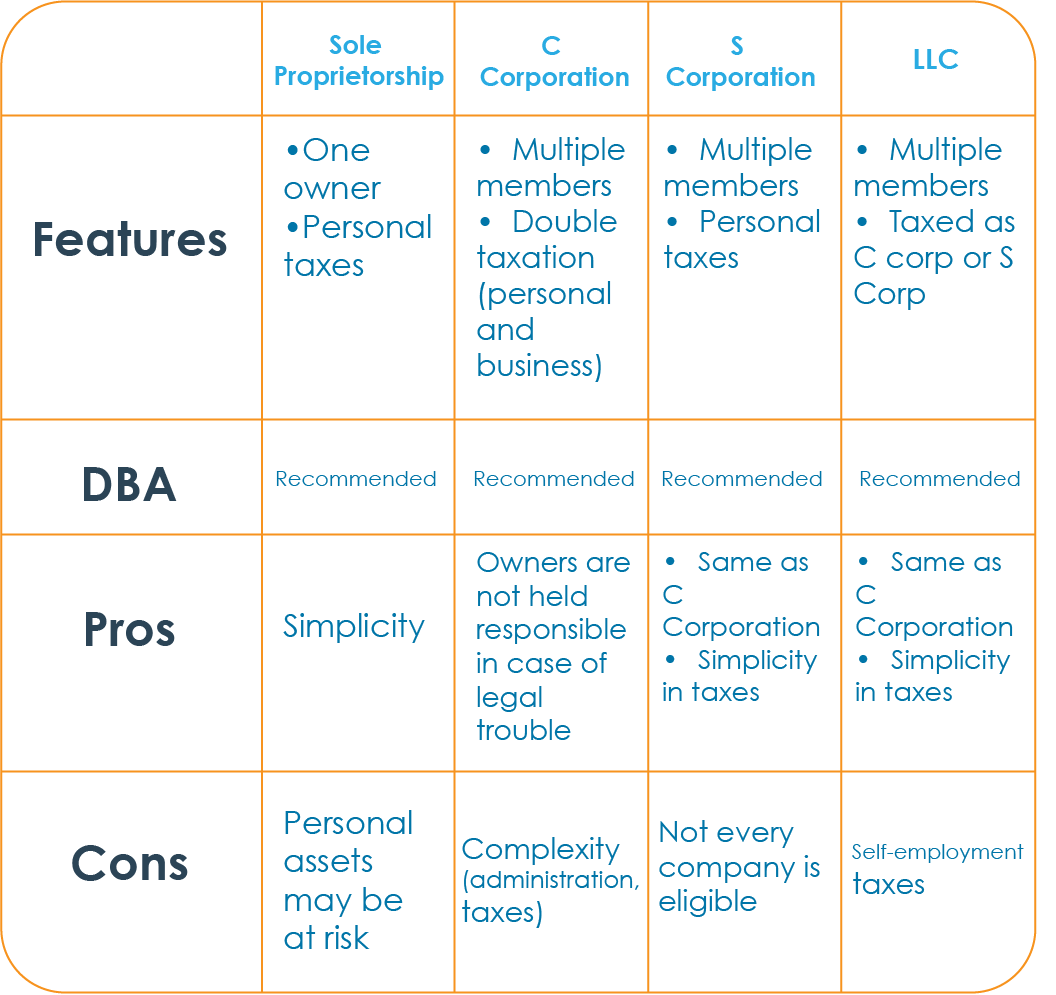

What S The Difference Between Dba Sole Proprietorship Llc And Corporation Camino Financial

What S The Difference Between Dba Sole Proprietorship Llc And Corporation Camino Financial

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

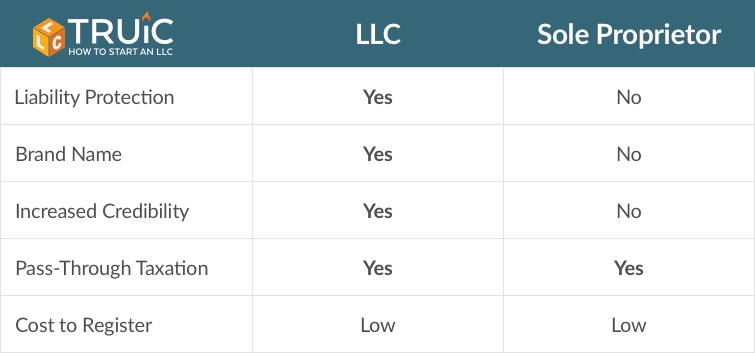

Comparison Of Business Entities Startingyourbusiness Com

Comparison Of Business Entities Startingyourbusiness Com

Business Taxes Llc Vs Sole Proprietorship

Business Taxes Llc Vs Sole Proprietorship

When Does A Sole Proprietor Need An Ein How To Start An Llc

When Does A Sole Proprietor Need An Ein How To Start An Llc

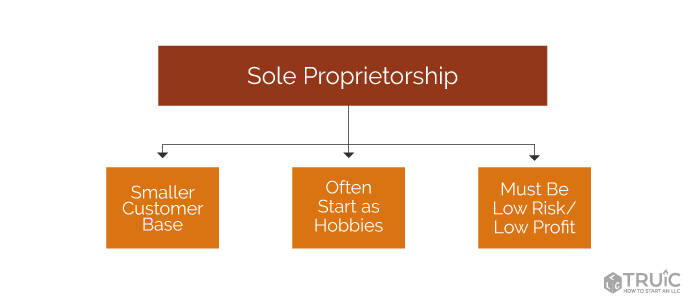

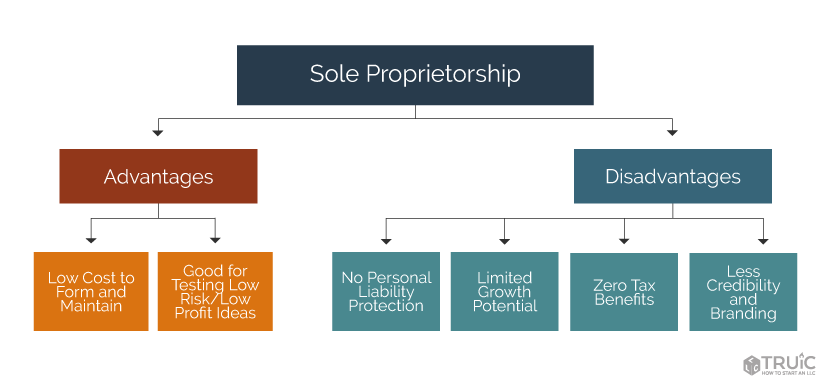

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

Should I Stay A Sole Proprietorship Kapitus

Should I Stay A Sole Proprietorship Kapitus

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

How To Start Your Own Business All About Taxes And Recordkeeping Sole Proprietorship Business Checks Finance Saving

How To Start Your Own Business All About Taxes And Recordkeeping Sole Proprietorship Business Checks Finance Saving

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Guide To Business Loans For Sole Proprietors Funding Circle

A Guide To Business Loans For Sole Proprietors Funding Circle

Business Taxes Llc Vs Sole Proprietorship

Business Taxes Llc Vs Sole Proprietorship

Why You Should Turn Your Sole Proprietorship Into An Llc

Why You Should Turn Your Sole Proprietorship Into An Llc

How To Do Bookkeeping For Sole Proprietor Explained

How To Do Bookkeeping For Sole Proprietor Explained