2018 Form 1040 Unreimbursed Business Expenses

Generally the following expenses are deducted on Schedule A Form 1040 line 21 or Schedule A Form 1040NR line 7. Most of the categories of employees who are able to claim deductions for unreimbursed employees report these deductions as an adjustment to income on Schedule 1 Form 1040 discussed next.

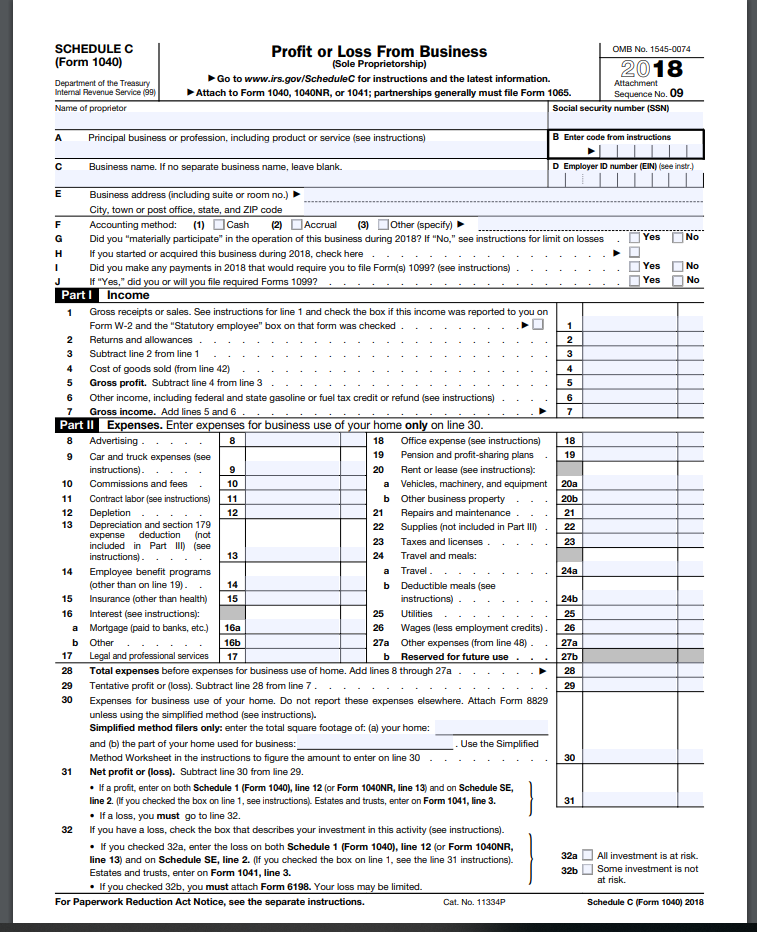

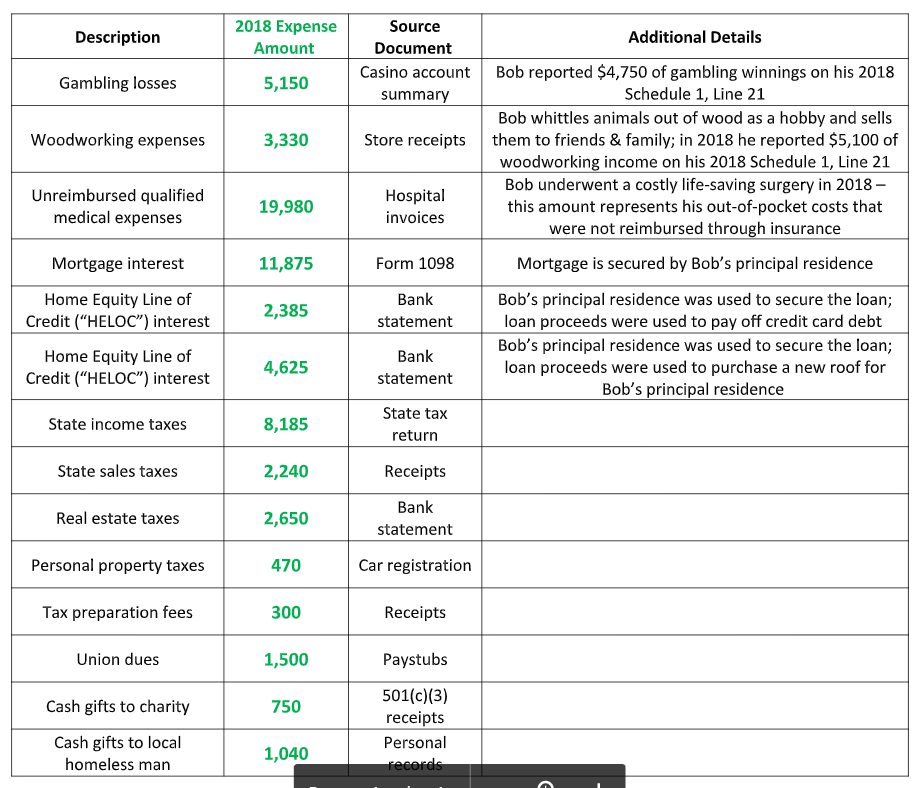

Preparation Calculating Correct Entries For Self E Chegg Com

Preparation Calculating Correct Entries For Self E Chegg Com

Check box c on Schedule 4 Form 1040 line 62 or box b on Form 1040NR line 60.

2018 form 1040 unreimbursed business expenses. The Tax Cuts and Jobs Act disallows this deduction for tax years 2018-2025. Enter here and on Schedule SE Section A line 2. Currently unreimbursed employee expenses are reported as a deduction on the borrowers individual federal income tax return IRS Form 2106 or IRS Form 1040 Schedule A or C.

This means no deduction for 2018 and after or until the tax code is changed allowing the deduction again. You can deduct only unreimbursed employee expen- ses that are. Or Section B line 2.

Beginning in 2018 unreimbursed employee expenses are no longer eligible for a tax deduction on your federal tax return however some states such as California continue to provide a deduction on your state tax return if you qualify. For 2018 and 2019 you may go to the Instructions for Schedule SE Form 1040 or 1040. The UPE adjustment outlined above is for partnerships ONLY.

The deduction for unreimbursed employee business expenses was one of those that were affected. Jan 03 2021 The Effect of 2018 Tax Reform The Tax Cuts and Jobs Act TCJA sounded at least a temporary death knell for a good many itemized deductions when it was signed into law in December 2017. Jan 08 2021 For returns filed before tax year 2018 employees can deduct any unreimbursed expenses that exceed 2 of their adjusted gross income.

Subtract line 7 from line 4. Dec 04 2018 changes made by the IRS that are effective with the reporting of 2018 federal income taxes. Jan 29 2018 Unreimbursed expenses even from shareholders are considered an unreimbursed employee business expense.

Enter unreimbursed partnership expenses not deductible as an itemized deduction on Schedule A directly on the Schedule K-1 form in the Additional Information section. The only way to solve this is to have the company reimburse the expense. The TCJA eliminates it for tax years 2018 through 2025.

However it is scheduled to return for tax year 2026. Download or print the 2020 Federal Form 2106-EZ Unreimbursed Employee Business Expenses for FREE from the Federal Internal Revenue Service. Paying taxes is inevitablebut finding.

View 2018 Schedule E Form 1040pdf from ACT 406 at Colorado State University Global Campus. MSA at the end of 2017. Paid or incurred during your tax year For carrying on your trade or business of being an em- ployee and Ordinary and necessary.

Employee Business Expenses and Reimbursements Part I Step 1 Enter Your Expenses. To claim unreimbursed travel expenses reservists must be stationed away from the general area of their job or business and return to their regular jobs once released. Expenses are deductible only if the reservists pay for meals and lodging at their official military post and only to the extent the expenses exceed Basic.

To enter the business expenses of reservists in TaxSlayer Pro from. Enter Med MSA and the amount on the line next to the box. Feb 11 2021 Total business expenses not deducted in lines 1 and 2 above add lines 5 and 6.

May 17 2018 The instructions for Form 1040 Schedule E state that unreimbursed ordinary and necessary partnership expenses paid on behalf of the partnership may be deducted on Schedule E if a partner was required to pay these expenses under the partnership agreement. For Paperwork Reduction Act Notice see your tax return. These expenses are used when calculating an automobile.

This amount will also. Also include this amount in the total on Schedule 4 Form 1040 line 62 or Form 1040NR line 60. However employees with impairment-related work expenses on Form 2106 report these expenses on Schedule A Form 1040.

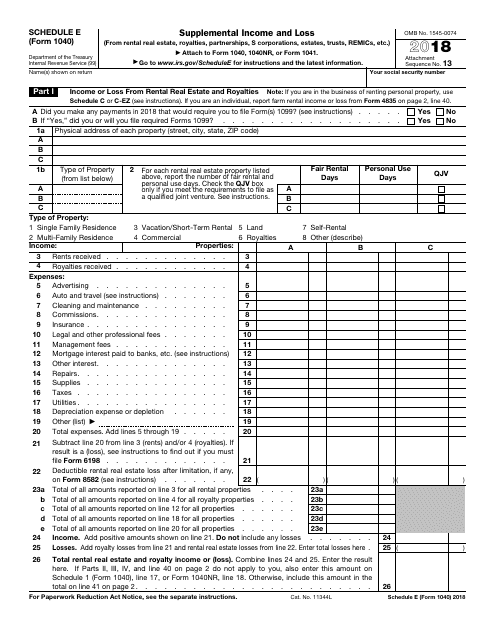

SCHEDULE E Form 1040 Department of the Treasury Internal Revenue Service 99 Supplemental Income and. The removed line from 2018 and 2019 will be added back for the 2020 revision. Unfortunately the new tax reforms sounded a death knell for miscellaneous itemized deductions.

Attach to Form 1040 or Form 1040NR. Occupation in which you incurred expenses. Go to wwwirsgovForm2106 for instructions and the latest information.

These deductions belong on Schedule A as miscellaneous itemized deductions. The total amount of unreimbursed partnership expenses will flow to Schedule E page 2. In 2018 The Tax Cuts and Jobs Act eliminated the deduction for unreimbursed employee expenses.

Jan 22 2018 IRS Rules related to business expenses for 2018 Posted on January 22 2018 With the deletion of 2 Miscellaneous Itemized Deductions in 2018 employees can no longer deduct unreimbursed business expenses including mileage on Schedule A of form 1040. The name on Line 28 of Schedule E will be reflected as UPE unreimbursed partnership expenses. Before 2018 employees who incurred job-related expenses such as travel expenses and job-specific expenses were able to deduct itemized deductions on their federal tax returns.

For tax years prior to 2018 only any expenses in excess of these amounts can be claimed only as a miscellaneous itemized deduction subject to the 2 limit on Schedule A Form 1040.

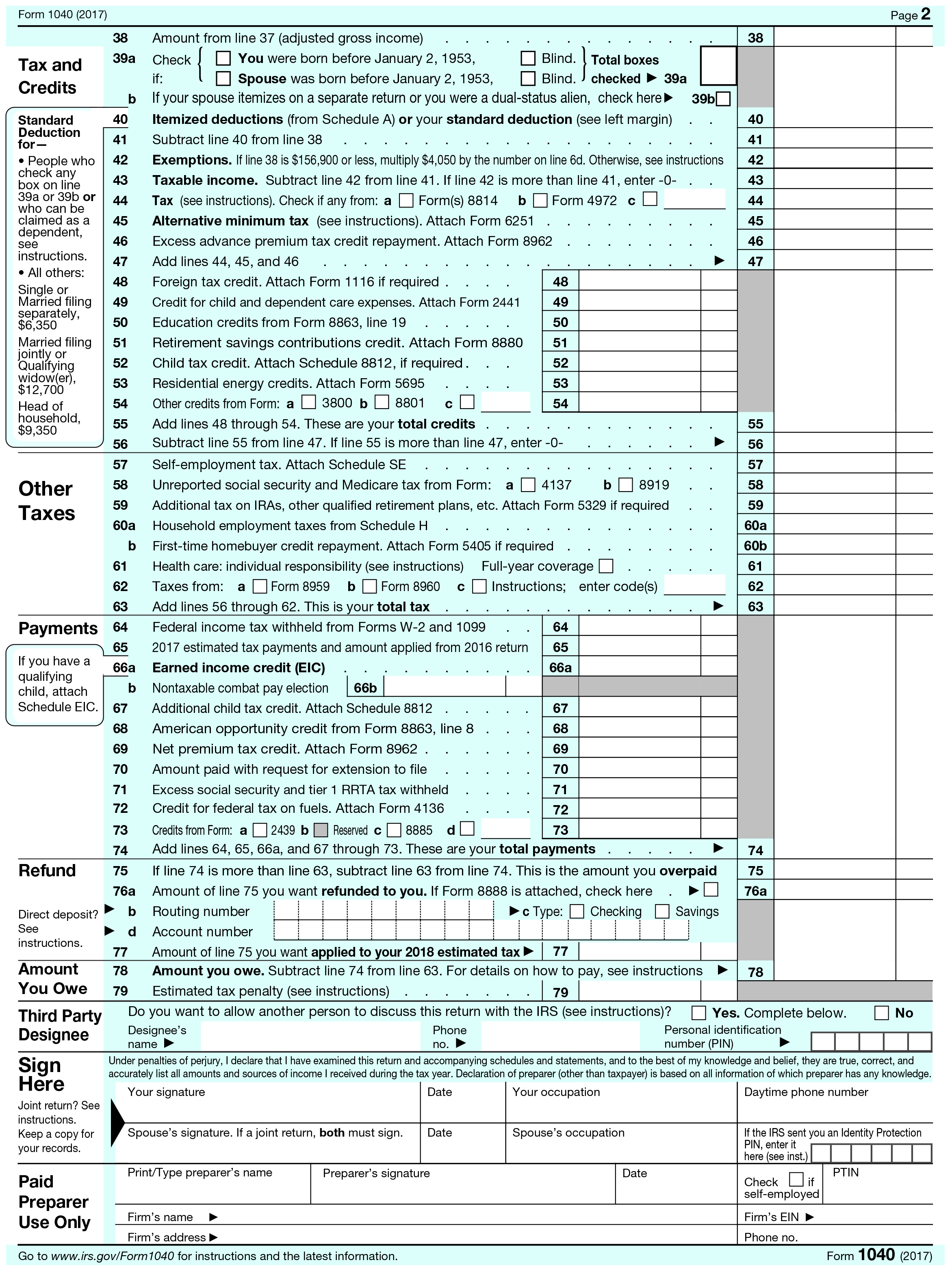

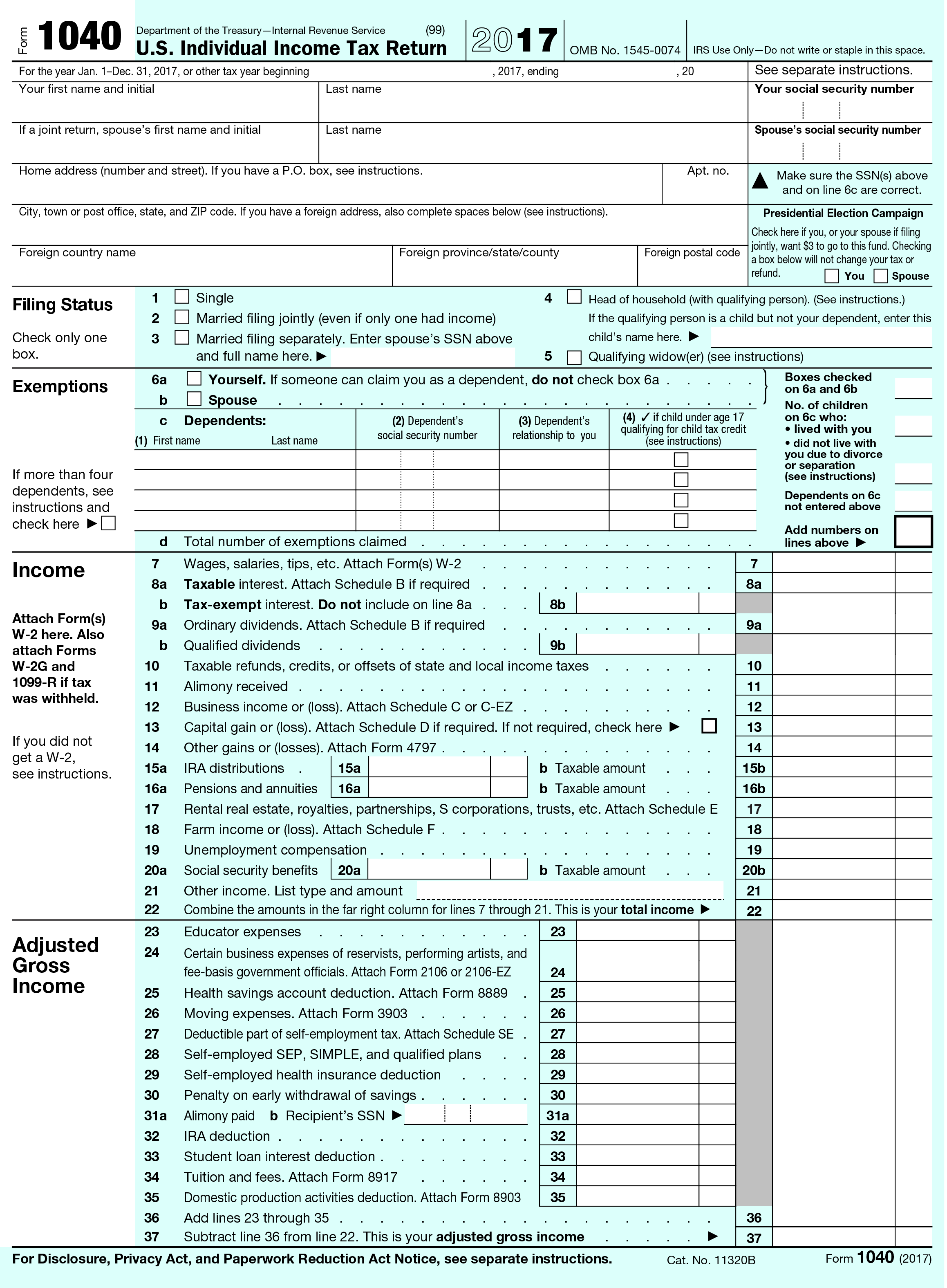

How To Fill Out Irs Form 1040 For 2018 Irs Forms Irs Tax Forms

How To Fill Out Irs Form 1040 For 2018 Irs Forms Irs Tax Forms

Irs Breaking News On 2018 Tax Forms Irs Tax Forms Tax Forms Irs

Irs Breaking News On 2018 Tax Forms Irs Tax Forms Tax Forms Irs

Tax Changes By Form Taxchanges Us

Tax Changes By Form Taxchanges Us

1040 Excel Spreadsheet 2018 Spreadsheets Gave Us The Potential To Input Adapt And Estimate Inisial

1040 Excel Spreadsheet 2018 Spreadsheets Gave Us The Potential To Input Adapt And Estimate Inisial

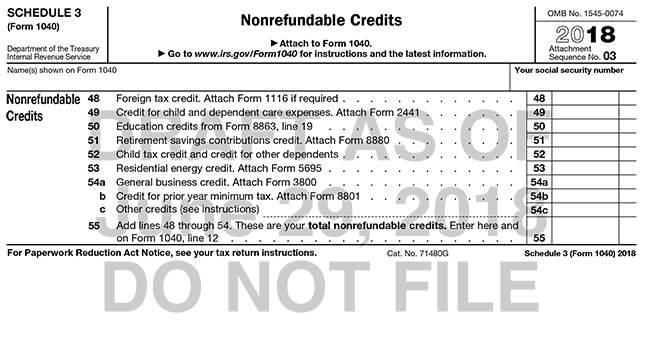

2018 Form 1040 Schedule 3 Abacus Abacus

2018 Form 1040 Schedule 3 Abacus Abacus

Update On Claiming Business Deduction For Work Related Education Business Valuation Masters In Business Administration Education

Update On Claiming Business Deduction For Work Related Education Business Valuation Masters In Business Administration Education

Tcja Changes Form 1040 And Your 2018 Tax Returns State Taxes Are Generally Unchanged Don T Throw Away Your Receipts Opelika Observer

Tcja Changes Form 1040 And Your 2018 Tax Returns State Taxes Are Generally Unchanged Don T Throw Away Your Receipts Opelika Observer

Bob Is Working On His 2018 Form 1040 He Just Fin Chegg Com

Bob Is Working On His 2018 Form 1040 He Just Fin Chegg Com

Tax Changes By Form Taxchanges Us

Tax Changes By Form Taxchanges Us

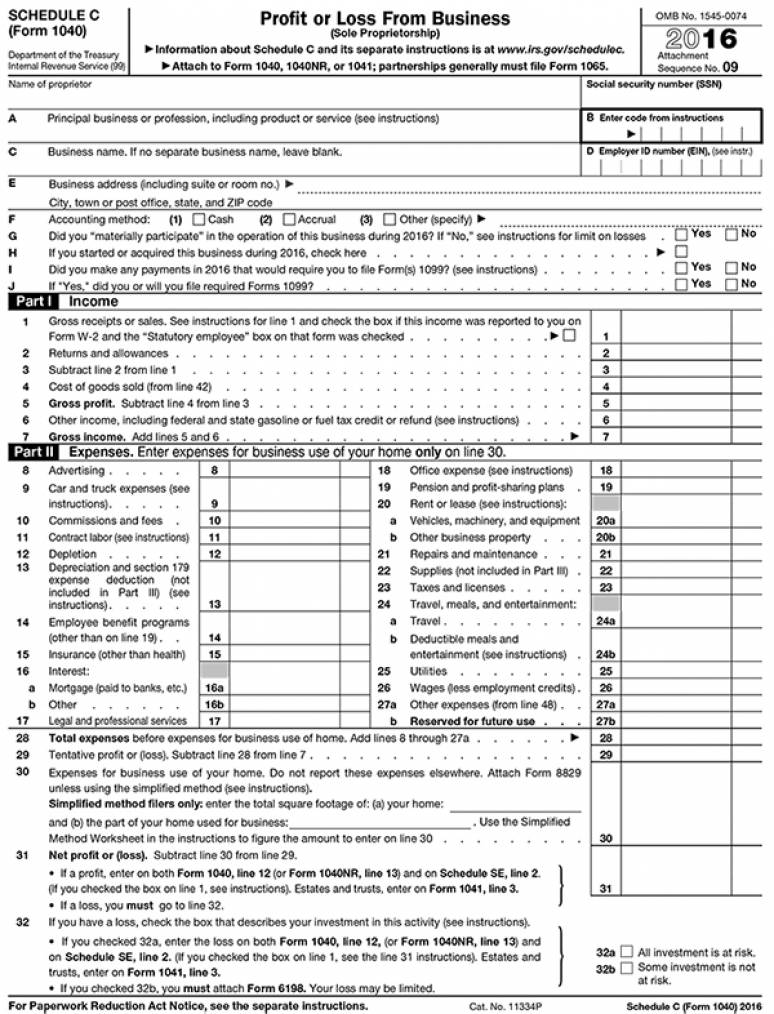

Profit Or Loss From Business Sole Proprietorship Irs Tax Form 1040 Schedule C 2016 Package Of 100 U S Government Bookstore

Profit Or Loss From Business Sole Proprietorship Irs Tax Form 1040 Schedule C 2016 Package Of 100 U S Government Bookstore

Form 9 Agi 9 Precautions You Must Take Before Attending Form 9 Agi Power Of Attorney Form Tax Return Student Loan Interest

Form 9 Agi 9 Precautions You Must Take Before Attending Form 9 Agi Power Of Attorney Form Tax Return Student Loan Interest

Irs Form 1040 Schedule E Download Fillable Pdf Or Fill Online Supplemental Income And Loss 2018 Templateroller

Irs Form 1040 Schedule E Download Fillable Pdf Or Fill Online Supplemental Income And Loss 2018 Templateroller

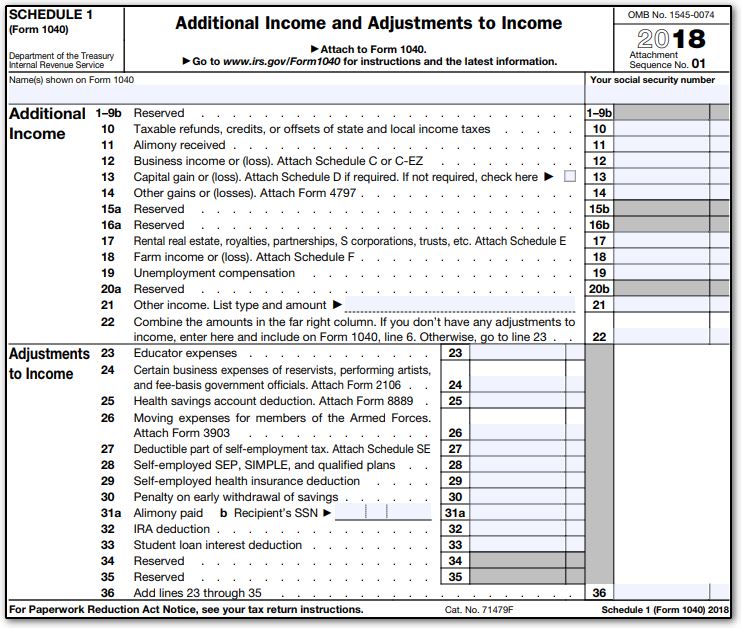

1040 Schedule 1 Drake18 And Drake19 Schedule1

1040 Schedule 1 Drake18 And Drake19 Schedule1

Irs Breaking News On 2018 Tax Forms Tax Forms Irs Income Tax Return

Irs Breaking News On 2018 Tax Forms Tax Forms Irs Income Tax Return

There Are Six New Schedules Some Taxpayers Will File With The New Form 1040 Cozby Company

There Are Six New Schedules Some Taxpayers Will File With The New Form 1040 Cozby Company

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1040 Gets A Makeover For 2018 Insights Blum

Form 1040 Gets A Makeover For 2018 Insights Blum

Schedule A Form 1040 Itemized Deductions Omb No 1845 0074 Go To Www Gov Scheduled For Instructions And The Latest Information If You Are Course Hero