Unreimbursed Employee Business Expenses 2018

COVID-19 Penalty ReliefYou may ask us to cancel or reduce filing or payment penalties if you have a reasonable cause or are negatively affected by the COVID-19 pandemic. Taxpayers can no longer claim unreimbursed employee expenses as miscellaneous itemized deductions unless they are a qualified employee or an eligible educator.

Council Post When And Why Your Small Business Needs An Accountant Accounting Accounting Services Accounts Payable

Council Post When And Why Your Small Business Needs An Accountant Accounting Accounting Services Accounts Payable

Review the instructions beginning on Page 25 of the PA-40IN to determine if you can deduct expenses from your PA-taxable compensation.

Unreimbursed employee business expenses 2018. You might even be able to go back and file an amended return to claim it if you failed to do so when you. Employee business expenses can be deducted as an adjustment to income only for specific employment categories and eligible educators. Said David Kamin a former economic policy.

To claim unreimbursed travel expenses reservists must be stationed away from the general area of their job or business and return to their regular jobs once released. Unfortunately the new tax reforms sounded a death knell for miscellaneous itemized deductions including unreimbursed employee expenses for the tax years 2018. What changed about deducting unreimbursed job expenses.

You can still claim this deduction if you havent yet filed your 2017 tax return however. By clicking the thumb icon in a post. Mar 17 2020 Beginning in 2018 unreimbursed employee expenses are no longer eligible for a tax deduction on your federal tax return however some states such as California continue to provide a deduction on your state tax return if you qualify.

Feb 01 2018 While people can say theres a doubling of the standard deduction those who have significant unreimbursed business expenses will not do as well. You can deduct only unreimbursed employee expenses that are paid or incurred during your tax year for carrying on your trade or business of being an employee and ordinary and necessary. Dec 04 2018 changes made by the IRS that are effective with the reporting of 2018 federal income taxes.

Jan 29 2018 Unreimbursed expenses even from shareholders are considered an unreimbursed employee business expense. 2018 M1UE Unreimbursed Employee Business Expenses Minnesota Department of Revenue. This means no deduction for 2018 and after or until the tax code is changed allowing the deduction again.

The only way to solve this is to have the company reimburse the expense. Feb 22 2018 The unreimbursed business expenses exemption began with 2018 tax returns. Heres a breakdown of how that tax reform change may impact your 2018 return.

An ordinary expense is one that is common and accepted in your industry. These expenses are used when calculating an automobile. Taxpayers classified as employees can also deduct some of their unreimbursed business expenses.

You can only deduct unreimbursed expenses that are ordinary and necessary to your work as an employee. This form was discontinued after. The TCJA eliminates it for tax years 2018 through 2025.

If you typically deduct unreimbursed job expenses as an employee get prepared for a change this tax season. The UPE adjustment outlined above is for partnerships ONLY. What Were The Previous Rules About Unreimbursed Employee Business Expenses.

A necessary expense is one that is appropriate and helpful to your business. In 2018 The Tax Cuts and Jobs Act eliminated the deduction for unreimbursed employee expenses. Currently unreimbursed employee expenses are reported as a deduction on the borrowers individual federal income tax return IRS Form 2106 or IRS Form 1040 Schedule A or C.

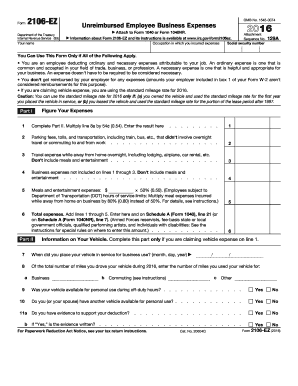

They must complete Form 2106 Employee Business Expenses. Prior to 2018 an employee could deduct unreimbursed job expenses to the extent these expenses along with. Form 2106-EZ was used by employees to deduct job-related expenses including meals hotels airfare and vehicle expenses.

Expenses are deductible only if the reservists pay for meals and lodging at their official military post and only to the extent the expenses exceed Basic. Beginning in 2018 unreimbursed employee expenses are no longer eligible for a tax deduction on your federal tax return however some states such as California continue to provide a deduction on your state tax return if you qualify. An expense is ordinary if it is common and accepted in.

This means employees can no longer offset their taxable income with employee business expenses. Before 2018 employees who incurred job-related expenses such as travel expenses and job-specific expenses were able to deduct itemized deductions on their federal tax returns. 2 days ago This article was published by the IRS.

Jan 03 2021 The deduction for unreimbursed employee business expenses was one of those that were affected. Some costs that you may be able to deduct include. All unreimbursed job expenses for traditional employees are no longer tax deductible.

You can claim a deduction for an unreimbursed employee business expense by filing a PA Schedule UE Allowable Employee Business Expenses form along with your PA-40 Personal Income Tax Return.

Https Www Servantsolutions Org S 08 Auto Business Exp 2021 Pdf

Employee Paid Business Expenses The Cpa Journal

Employee Paid Business Expenses The Cpa Journal

Deducting Unreimbursed Employee Business Expenses Back Alley Taxes

How The New Tax Law Affects Unreimbursed Business Expenses For Pastors The Pastor S Wallet

How The New Tax Law Affects Unreimbursed Business Expenses For Pastors The Pastor S Wallet

What Is Form 2106 Ez Unreimbursed Employee Business Expenses Appcraver

What Is Form 2106 Ez Unreimbursed Employee Business Expenses Appcraver

How Tax Reform Changed Deducting Unreimbursed Employee Expenses

How Tax Reform Changed Deducting Unreimbursed Employee Expenses

Fact Check Does The 2017 Tax Reform Bill Eliminate Small Business Deductions

Fact Check Does The 2017 Tax Reform Bill Eliminate Small Business Deductions

2106 Employee Business Expenses 2106 Schedule1

2106 Employee Business Expenses 2106 Schedule1

Unreimbursed Employee Job Expenses And The Suspension Of The Miscellaneous Itemized Deduction Everycrsreport Com

Unreimbursed Employee Job Expenses And The Suspension Of The Miscellaneous Itemized Deduction Everycrsreport Com

Guest Post Unreimbursed Employee Business Expenses What Do You Mean I Have To Pay For That Nitram Financial Solutions

Guest Post Unreimbursed Employee Business Expenses What Do You Mean I Have To Pay For That Nitram Financial Solutions

What Law Firms Should Know About Employee Deductions Under The Trump Tax Bill Saville Dodgen Company

What Law Firms Should Know About Employee Deductions Under The Trump Tax Bill Saville Dodgen Company

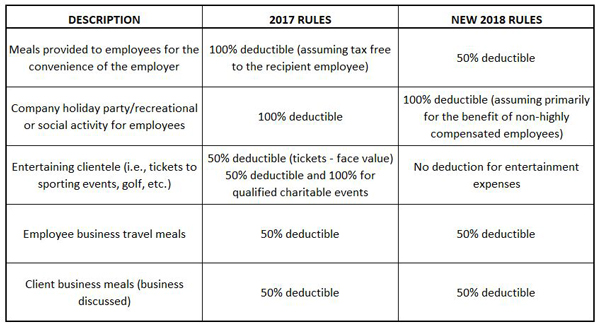

Reduced Tax Benefits For Meals Entertainment In 2018 Kruggel Lawton Cpas

Reduced Tax Benefits For Meals Entertainment In 2018 Kruggel Lawton Cpas

Big Changes As You Start Filing Your Taxes

Big Changes As You Start Filing Your Taxes

Unreimbursed Business Expenses W2 Employees Does Your Employer Have An Accountable Plan

Unreimbursed Business Expenses W2 Employees Does Your Employer Have An Accountable Plan

Can I Deduct Unreimbursed Employee Business Expenses In 2019

Can I Deduct Unreimbursed Employee Business Expenses In 2019

Can I Deduct Unreimbursed Job Expenses The Official Blog Of Taxslayer

Can I Deduct Unreimbursed Job Expenses The Official Blog Of Taxslayer

How The New Tax Law Affects Unreimbursed Business Expenses For Pastors The Pastor S Wallet

How The New Tax Law Affects Unreimbursed Business Expenses For Pastors The Pastor S Wallet

Fillable Online 2016 Form 2106 Ez Unreimbursed Employee Business Expenses Fax Email Print Pdffiller

Fillable Online 2016 Form 2106 Ez Unreimbursed Employee Business Expenses Fax Email Print Pdffiller

Unreimbursed Employee Expenses

Unreimbursed Employee Expenses