What Type Of Companies Need A 1099

This is the equivalent of a W-2 for a person thats not an employee. The form serves two purposes.

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

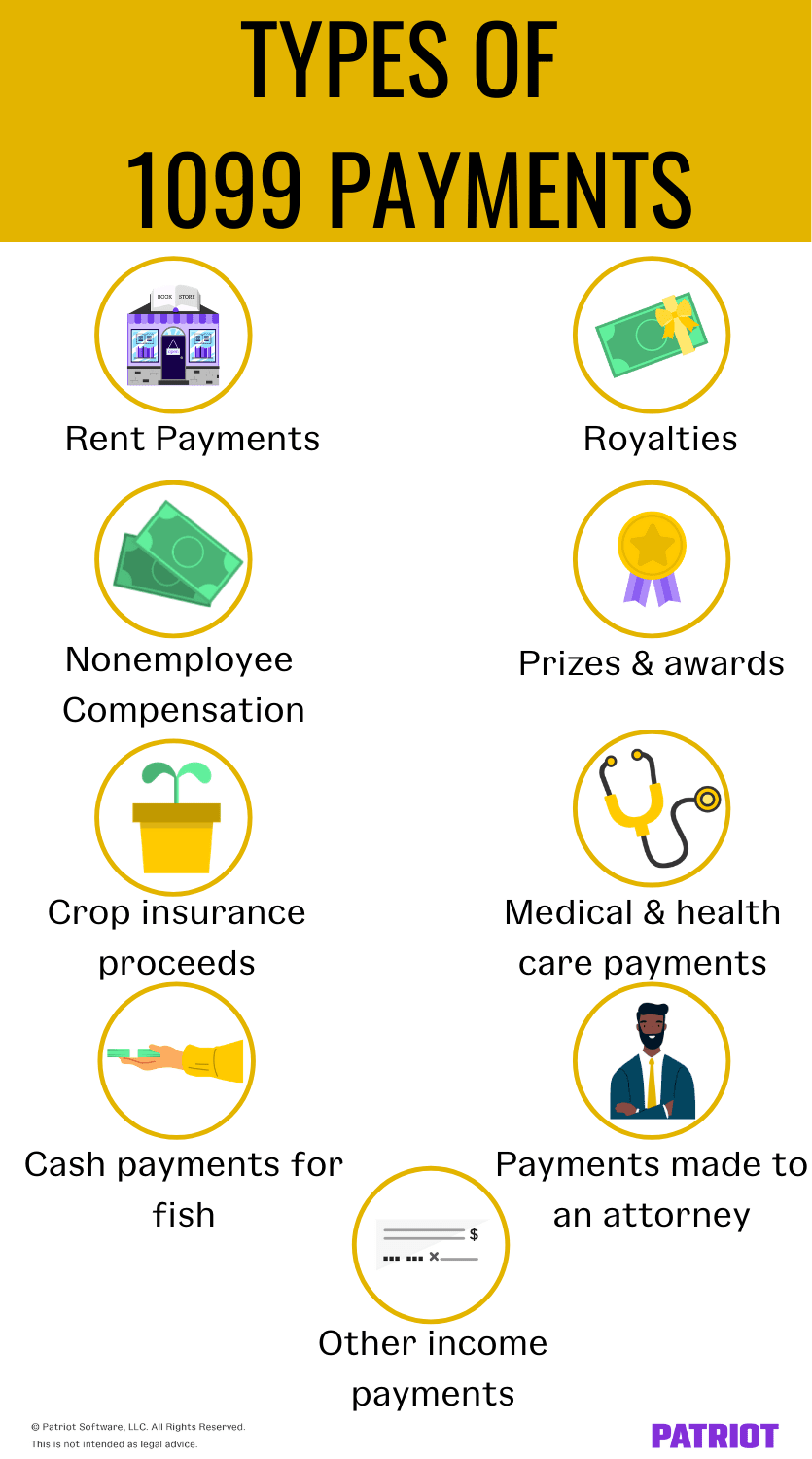

For example if an individual or entity pays you at least 10 in royalties or at least 600 in rent prizes or awards or other income not covered by a different form that person or entity is.

What type of companies need a 1099. The 1099-INT form is usually used by banks brokerage firms credit unions and sometimes even the companies handling your student loans. Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation. You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than 600 and that includes any individual partnership Limited Liability Company LLC Limited Partnership LP or Estate.

Steps to file a 1099 Employee. The credit card payment exception In the case that a company paid for services using a credit card or through a third party payment network the rules for 1099-K are applicable for reporting not a 1099-MISC. If a business buys or rents products or services that amount to more than 600 from one person or LLC during the year it has to file a 1099 for that contractor or vendor.

Independent contractors file taxes independently and pay a self-employment tax. However the IRS generally exempts corporations from. Do I need a written contract with a 1099 employee.

The same date applies to. 1 2021 for the 2020 tax year. Business owners have to file form 1099 as a record of payments they made to independent contractors over the course of the tax year.

Independent contractors freelancers and sole proprietors should receive their 1099-NEC forms from their payers by Feb. Companies that misclassify workers could pay huge fines and be liable for money owed to employees. It allows you to report this wage information to the IRS and also allows your associate to do his or her taxes.

If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. The IRS considers trade or business to include. 1 Operating for gain or profit A non-profit organization including 501 c3 and d organizations.

Typically companies are only required to send 1099-MISCs to contractors whove been paid 600 or more in a calendar year. If you have paid any part-time workers or freelancers more than 600 during the year you will need to send them a 1099 form. Who are considered Vendors or Sub-Contractors.

However if an it is taxed as a partnership the IRS requires it to issue Form 1099-MISC. You will need to provide a 1099 to any vendor who is a. However see Reportable payments to corporations later.

For example you should have received your forms by Feb. A 1099-MISC form is a catchall form for many other types of income you might receive. The majority of small businesses which operate as sole proprietorships partnerships and LLCs require these 1099s if the amounts exceed 600.

The 1099 most commonly applies to the contractor relationship. 1 of the year following the tax year. If you paid a vendor more than 10 in interest youve got to send out a 1099-INT.

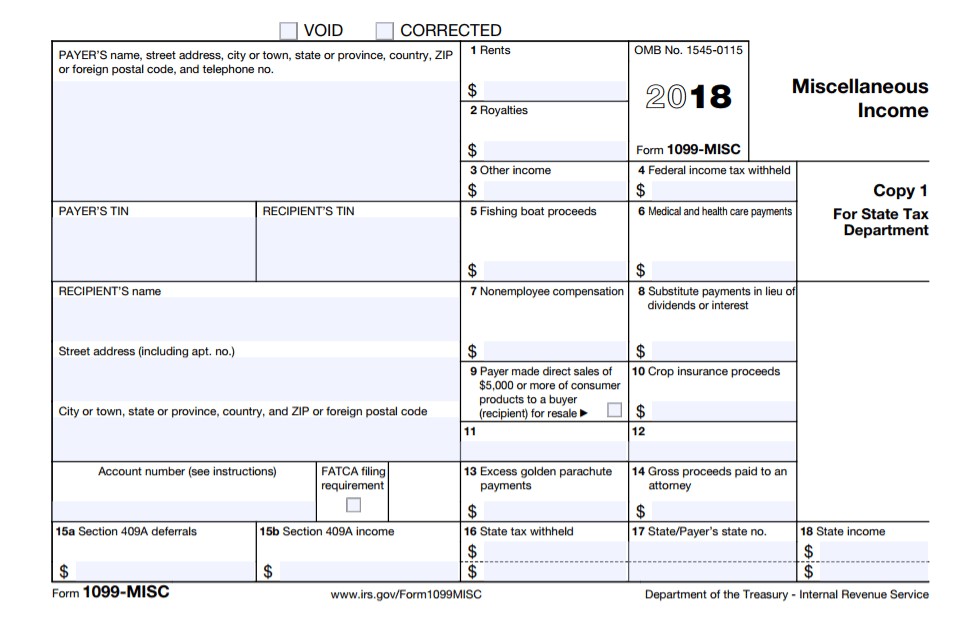

A 1099 form is a tax document filed by an organization or individual that paid you during the tax year. If youre using a 1099 employee you will first want to create a written contract. Form 1099-MISC although they may be taxable to the recipient.

The exception to this rule is with paying attorneys. If you are in a trade or business you must prepare 1099-MISC forms to show the amounts you have paid to others during the year. If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099.

The IRS uses Form 1099-MISC to keep track of how much money or other benefits the LLC has paid an independent contractor subcontractor or other nonemployee. Its not usually legally required but doing so will protect your business. Payments for which a Form 1099-MISC is not required include all of the following.

An LLC that is taxed as a corporation files different forms that replace the use of Form 1099-MISC. If You Paid Someone 10 Or More For Natural Resources Forestry or Conservation Grants.

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

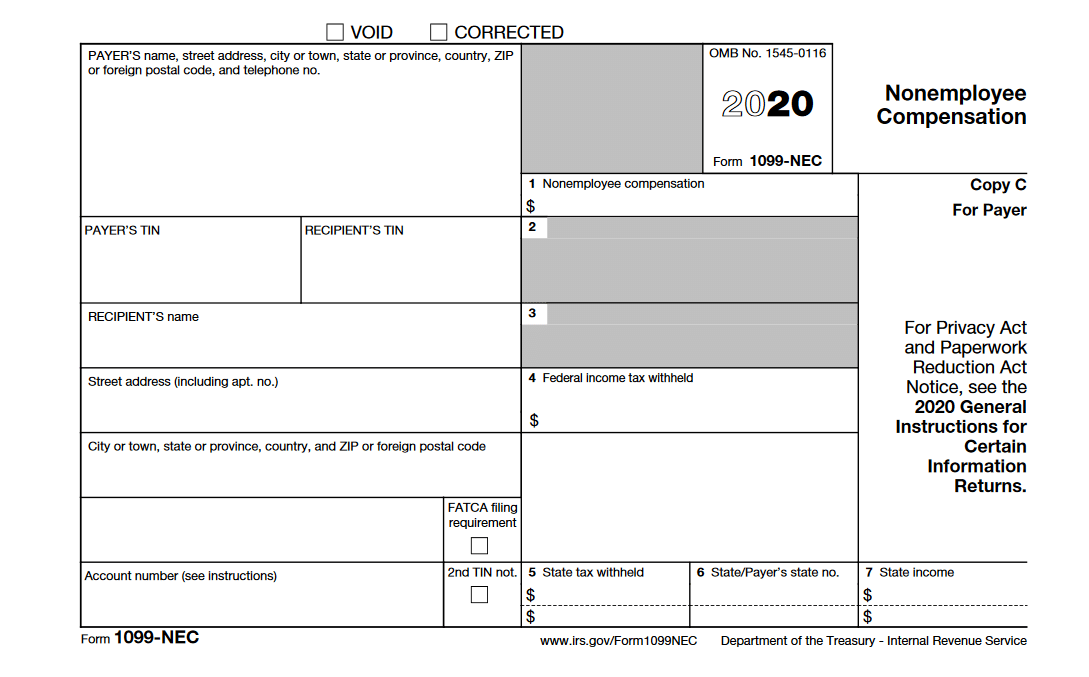

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

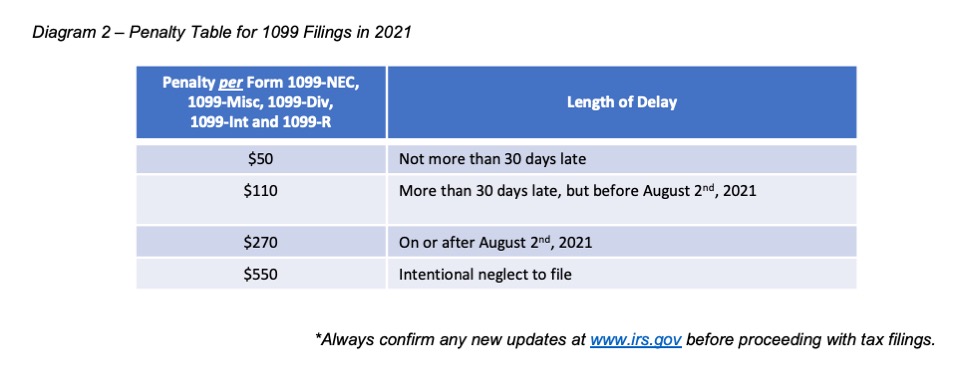

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

1099 Payments How To Report Payments To 1099 Vendors

1099 Payments How To Report Payments To 1099 Vendors

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster