Cares Act Small Business 1099 Employees

Keeping on top of all the changes in todays world is enough for any small business owner. Under the CARES Act small business owners sole proprietorships independent contractors and other self-employed individuals were eligible to apply for Economic Injury Disaster Loans EIDL which seeks to alleviate loss of revenue due to COVID-19.

1099 Form Complete Guide For Businesses Contractors Zipbooks

Why Does the Application Ask If You Have 1099 Employees If You Cant Include Them.

Cares act small business 1099 employees. The CARES Act Provides Assistance to Small Businesses The Paycheck Protection Program is providing small businesses with the resources they need to maintain their payroll hire back employees who may have been laid off and cover applicable overhead. Salaries wages or compensation for employees and contractors. The grant funding will help businesses pay for a variety of expenses including mortgage or rent payments.

You were in operation on February 15 2020 and either had employees for whom you paid salaries and payroll taxes or paid independent contractors as reported on a Form 1099-MISC. However your business and tax accounting needs shouldnt be a cause of stress. The program is designed to allow small businesses to keep workers on payroll during the pandemic.

This means that if you drive an Uber or are an independent business consultant you. Generally employers with 50 or fewer employees may be eligible to buy coverage through the Small Business Health Options Program or SHOP Marketplace. The bill is expected to provide relief for eligible small business through a loan guarantee program the postponement of certain tax payments and a tax credit.

If you have fewer than 25 full-time employees including full-time equivalent employees you may be eligible for a Small Business Health Care Tax Credit to help cover the cost of providing coverage. CARES Act Small Business Relief Posted on March 30 2020 The Coronavirus Aid Relief and Economic Security CARES Act allocated 350 billion to help small businesses keep their workers employed during the COVID-19 pandemic and economic downturn. No 1099 employees should not be included in a small businesss payroll calculations for their PPP loans.

As much of American life has been put on hold in all sectorsmost particularly the entertainment travel and. Second you typically need to have at least one employee on regular payroll. It is possible that people you pay with IRS Form 1099 on a contract basis could still be considered employees in some states for the purpose of small business health insurance plans.

1099 employees are considered their own businesses under the PPP. The package includes 125 million in CARES Act funding to provide grants to small businesses with no more than 25 employees. You can be an LLC an S-Corporation a sole proprietor or operate as a 1099 contractor or self-employed individual.

First you need to show that you have employees. On March 27 2020 the Coronavirus Aid Relief and Economic Security Act or CARES Act the Act was passed. The early information released by the Small Business Administration created a lot of confusion on this topic.

Did you know that any small business sole proprietorship 1099gig workers private non-profit with 500 employees or under with payroll expenses that were in operation prior to Feb 15 2020 can apply to get a forgivable loan equal to 25 times their average monthly payroll to fully pay for 8 weeks of payroll expenses. Tribal business concern described in section 31b2C of the Small Business Act or any other business. The program is for any small business with less than 500 employees including sole proprietorships independent contractions self-employed persons private non-profit organizations or 501c19 veterans organizations.

Most small businesses with fewer than 500 employees are eligible. The Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020 is designed to encourage Eligible Employers to keep employees on their payroll despite experiencing economic hardship related to COVID-19 with an employee retention tax credit Employee. The Coronavirus Aid Relief and Economic Security Act known as the CARES Act was signed into law by President Trump on Friday March 27 2020.

This may include yourself. Chamber of Commerce has issued this guide and cheat sheet to help independent contractors and self-employed individuals prepare to file for a loan from the CARES Acts Paycheck Protection Program PPP loans grants SBAs Economic Injury Disaster Loans EIDL andor Unemployment Compensation for losses of income related to the coronavirus pandemic. The CARES Act allocated 350 billion to small businesses under the Paycheck Protection Program.

Help with CARES Act tax questions for your small business. Were here to help if you need tax bookkeeping or payroll solutions for your small business. Business supplies or equipment.

The program provides 100 federally guaranteed loans to. The Paycheck Protection Program provides 100 federally guaranteed loans to small businesses. Several people have asked how the Paycheck Protection Program forgivable loans sometimes referred to as grants created by the CARES Act apply to 1099 independent contractors.

As of April 10 2020 1099 employees are eligible to apply for their own PPP loan. The CARES Act is intended to provide relief to the economy as a result of the unprecedented financial and social effects of COVID-19. On April 2 the SBA released new regulations that clarified it.

Irs Form 1095 C E File Through Taxseer Irs Forms Irs Irs Extension

Irs Form 1095 C E File Through Taxseer Irs Forms Irs Irs Extension

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Efile Form 1099 Nec Online 2020 Online Efile Irs Forms

Efile Form 1099 Nec Online 2020 Online Efile Irs Forms

Important Changes For 2019 And 2020 Filing Forms 1099 Misc Irs Forms Irs Efile

Important Changes For 2019 And 2020 Filing Forms 1099 Misc Irs Forms Irs Efile

1099 Int Software To Create Print And E File Irs Form 1099 Int Letter Of Employment Tax Forms 1099 Tax Form

1099 Int Software To Create Print And E File Irs Form 1099 Int Letter Of Employment Tax Forms 1099 Tax Form

1099 Div Software To Create Print And E File Irs Form 1099 Div For 2020 Letter Of Employment Tax Forms 1099 Tax Form

1099 Div Software To Create Print And E File Irs Form 1099 Div For 2020 Letter Of Employment Tax Forms 1099 Tax Form

Music Advocacy Organizations Have Created A Website To Provide Guidance Around The Cares Act It Wil Small Business Resources Business Benefits Emergency Loans

Music Advocacy Organizations Have Created A Website To Provide Guidance Around The Cares Act It Wil Small Business Resources Business Benefits Emergency Loans

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

How To Apply For The 1099 Ppp Loan

How To Apply For The 1099 Ppp Loan

2015 W2 Fillable Form Fillable Form Ia W 4 Employee Withholding Allowance Fillable Forms 1099 Tax Form Power Of Attorney Form

2015 W2 Fillable Form Fillable Form Ia W 4 Employee Withholding Allowance Fillable Forms 1099 Tax Form Power Of Attorney Form

How To Successfully Hire Your First Independent Contractor Hiring Independent Contractor Contractors

How To Successfully Hire Your First Independent Contractor Hiring Independent Contractor Contractors

1099 Form Fillable Independent Contractors Vs Employees Not As Simple As 1099 Tax Form Tax Forms Fillable Forms

1099 Form Fillable Independent Contractors Vs Employees Not As Simple As 1099 Tax Form Tax Forms Fillable Forms

Form 1099 Nec What Does It Mean For Your Business

Form 1099 Nec What Does It Mean For Your Business

How To Report And Pay Independent Contractor Taxes Independent Contractor Tax Guide Independent

How To Report And Pay Independent Contractor Taxes Independent Contractor Tax Guide Independent

1099 Nec Tax Services Accounting Firms Accounting Services

1099 Nec Tax Services Accounting Firms Accounting Services

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

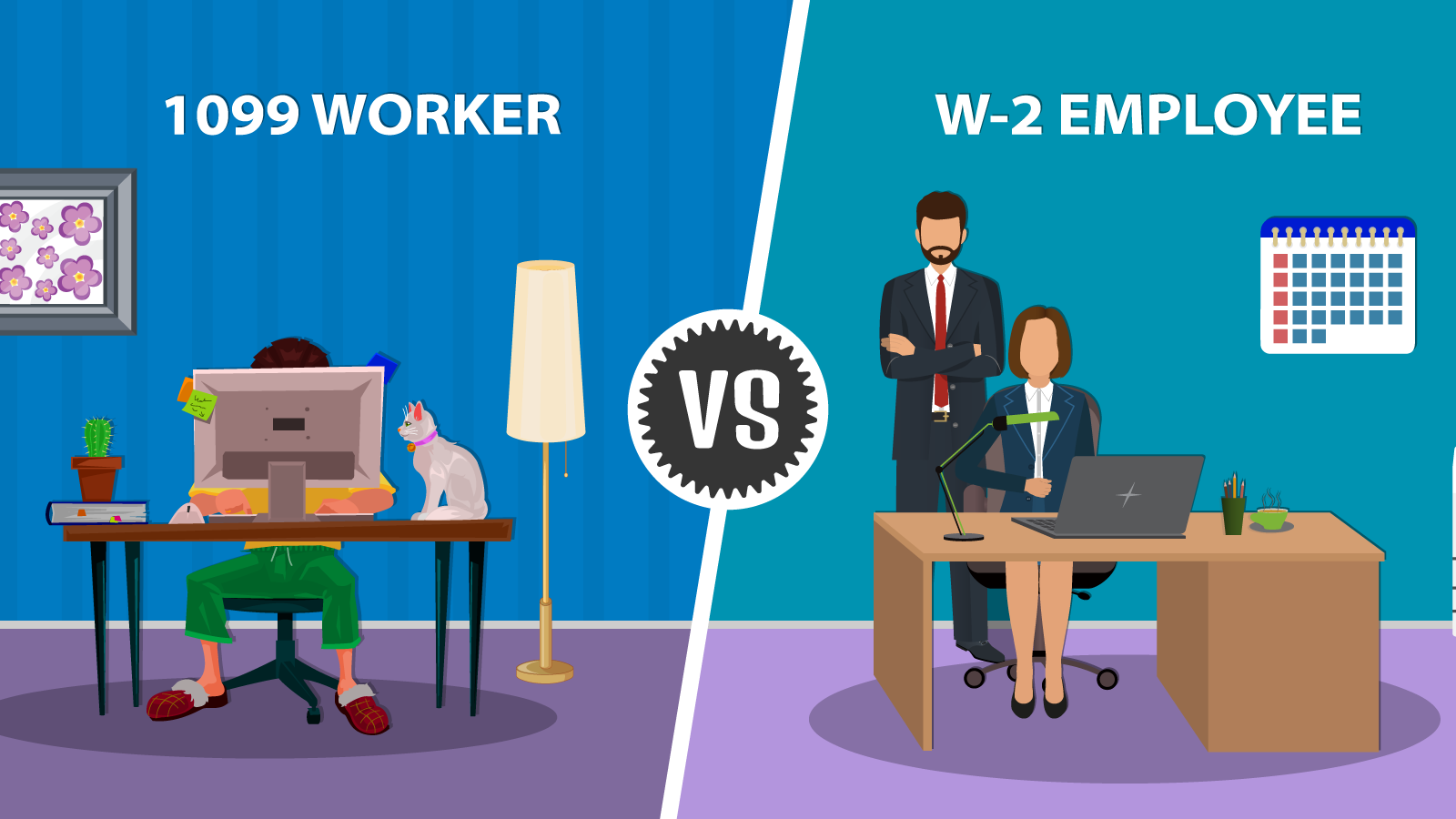

1099 Workers Vs W 2 Employees In California A Legal Guide 2021

1099 Workers Vs W 2 Employees In California A Legal Guide 2021

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template