Business Organization Is Established As A Legal Entity Separate From Its Owners

Which Form Of Business Organization Is Established As A Legal Entity Separate From Its Owners. Ownership in business entities can be a sole proprietorship partnership or corporation.

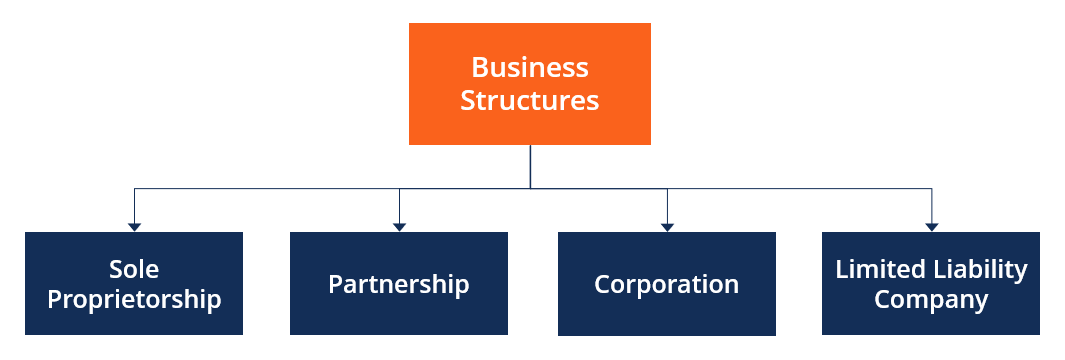

4 Types Of Businesses Business Basics Business Skills Business Savvy

4 Types Of Businesses Business Basics Business Skills Business Savvy

What registration means 11 Separate legal entity that has its own powers As far as the law is concerned a company has a separate legal existence that is distinct from that of its owners managers operators employees and agents.

Business organization is established as a legal entity separate from its owners. A corporation is a legal entity created by the state whose assets and liabilities are separate from its owners. Business entity is any business organization such as super market or accounting firm that exists as an economic unit. The term double taxation refers to which of the following.

Which form of business organization is established as a separate legal entity from its owners. Llc are really popular now as they are simpler to figure out for legal structure taxes etc. But investors like corporations more because of the ability to buy and sell.

It is therefore called an artificial person. A corporation is the resulting legal entity that separates the firms assets and income from its owners and investors. A Sole proprietorship B Partnership C Corporation D None of these.

However firms do not require to turn a gain to certainly be a business. It uses economic resources to provide goods and services to customers in exchange for money. Business entity simply refers to the form of incorporation for a business.

Business entity principle states that a business must be keep accounting records separate from its owners or other businesses. None Of These The Term double Taxation Refers To Which Of The Following. There are two types.

A business entity is a firmorganization created by one or more persons to carry out a trade. When a business incorporates the law recognizes the business as a distinct legal entity which can enter contracts and acquire property among other rights and privileges. A sole prop on its.

Which form of business organization is established as a legal entity separate from its owners. Which form of business organization is established as a legal entity separate from its owners. A Corporations must pay income taxes on their net income and their stockholders must pay income taxes.

A company is a separate legal entity as distinct from its members therefore it is separate at law from its shareholders directors promoters etc and as such is conferred with rights and is subject to certain duties and obligations. Articles of incorporation are legal documents filed with basic information about the. None of these Corporations are owned by shareholders.

Corporations file and pay income taxes on their own. The quest for revenue in and of it self makes an company a business. Corporations generate the largest income and the most sales.

A corporation can be. Organization generally refers to businesses that find gains by providing goods or solutions in exchange for payment. A corporation is a business recognized by the state as a legal entity separate from its owners also known as shareholders.

The term double taxation refers to which of the following. Corporations can be created in nearly all countries in the world and are. Mültiple Choice Sole proprietorship Corporation Partnership None of these COMPANY.

A _____ is a form of business ownership in which the business is considered a legal entity that is separate and distinct from its owners. Which form of business organization is established as a separate legal entity from its owners. Sole Proprietorship and Partnership.

Sole proprietors hip B. A sole proprietorship is the simplest form of business where an. Which form of business organization is established as a separate legal entity from its owners.

Limited liability companies and corporations are common types of legal entities.

Sole Proprietorships Advantages Disadvantages Piktochart Infographic Teaching Business Business Basics Sole Proprietorship

Sole Proprietorships Advantages Disadvantages Piktochart Infographic Teaching Business Business Basics Sole Proprietorship

Benefits Of Incorporating Business Law Small Business Deductions Business

Benefits Of Incorporating Business Law Small Business Deductions Business

Apply For Your Limited Liability Partnership Company Legal Business Organization Business

Apply For Your Limited Liability Partnership Company Legal Business Organization Business

Professional Corporation Is It The Best Business Structure Business Law Business Structure Business

Professional Corporation Is It The Best Business Structure Business Law Business Structure Business

How To Choose The Best Legal Structure For Your Startup Business Infographic Business Entrepreneurship Business Advice

How To Choose The Best Legal Structure For Your Startup Business Infographic Business Entrepreneurship Business Advice

Limited Liability Company Meaning Features Pros Cons Bookkeeping Business Limited Liability Company Business Tax

Limited Liability Company Meaning Features Pros Cons Bookkeeping Business Limited Liability Company Business Tax

Corporate Entity Types Table Bookkeeping Business C Corporation S Corporation

Corporate Entity Types Table Bookkeeping Business C Corporation S Corporation

Pin By Am On Commerce Stuff Legal Business Business Ownership Profit And Loss Statement

Pin By Am On Commerce Stuff Legal Business Business Ownership Profit And Loss Statement

C Corporation Vs S Corporation Vs Llc Bookkeeping Business C Corporation S Corporation

C Corporation Vs S Corporation Vs Llc Bookkeeping Business C Corporation S Corporation

The Types Of Business Ownership Startup Business Plan Bookkeeping Business Business Ownership

The Types Of Business Ownership Startup Business Plan Bookkeeping Business Business Ownership

4 Most Common Business Legal Structures Pathway Lending

4 Most Common Business Legal Structures Pathway Lending

Ellie Photography Business Structure Business Ownership Business

Ellie Photography Business Structure Business Ownership Business

Business Ownership And It S Different Types

Business Ownership And It S Different Types

Business Ownership Structure Types Business Structure Business Basics Business Ownership

Business Ownership Structure Types Business Structure Business Basics Business Ownership

C Corporation Vs S Corporation S Corporation C Corporation Bookkeeping Business

C Corporation Vs S Corporation S Corporation C Corporation Bookkeeping Business

Utah Business Corporate Law Attorney Coulter Law Group Business Law Business Tax Small Business Law

Utah Business Corporate Law Attorney Coulter Law Group Business Law Business Tax Small Business Law

Business Structure Overview Forms How They Work

Business Structure Overview Forms How They Work

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning Attorney

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning Attorney