How To File Form 4562

Individuals and businesses can claim deductions for both tangible assets such as a building and intangible assets such as a patent. If the vehicle is Listed Property be sure to indicate that and enter the related information.

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue

Thats why its a good idea to complete Part V first if you have any listed property.

How to file form 4562. Claim your deduction for depreciation and amortization. The Depreciation Module is accessible from four places in. Car.

Form 4562 - Depreciation and Amortization Form 4562 Depreciation and Amortization Including Information on Listed Property is generally completed in TaxSlayer Pro via the Depreciation Module. However complete only one Part I in its entirety when computing your section 179 expense deduction. Price of the asset being depreciated Date of which your asset is put to use Receipt for the asset Total income you are reporting in the corresponding year.

IRS Form 4562 and Depreciation. Provide information on the businessinvestment use of automobiles and other listed property. Use Form 4562 to.

Filing IRS Form 4562 allows you to claim deductions for the properties you use to. If depreciation is being calculated select. On top of those youll need the following to fill out Form 4562.

The price of the asset youre depreciating A receipt for the asset youre depreciating The date the asset was put into use when you started using it for your business The total income youre reporting for the year in question. Claiming Your Depreciation Deductions. If you need more space attach additional sheets.

To properly fill out Form 4562 youll need the following information. File a separate Form 4562 for each business or activity on your return for which Form 4562 is required. However complete only one.

This video will show how to fill out a tax form 4562 if you are interested in taking section 179 for a furniture item. There is no single place in TurboTax to enter depreciable assets. Part I in its entirety when computing your section 179 expense deduction.

When to File IRS Form 4562. If actual expenses will be used select. Car.

Actual expenses use Form 2106 Employee Business Expenses for this purpose. If you need more space attach additional sheets. If youre completing your own tax returns you may want a little more detailed explanation of exactly how to report depreciation deductions.

In most cases your depreciation deductions will be entered on IRS Form 4562 Depreciation and Amortization and then the total amount will be carried over to Line 13 of your Schedule C if you are a sole proprietor or to Form 1120 for a C corporation Form 1120S for an S corporation or to Form. Enter the Vehicle Information. Filing Form 4562 File Form 4562 with your individual or business tax return for any year you are claiming a depreciation deduction or making a Section 179 election.

IRS Form 4562 is used to calculate and claim deductions for depreciation and amortization. Depreciation and Amortization is an Internal Revenue Service IRS tax form used to claim deductions for the depreciation or amortization of a piece of property. When you claim depreciation its incredibly important that you retain copies of all 4562s so you can track your prior deductions and claim the appropriate amount in future years.

Make the election under section 179 to expense certain property. Completing Form 4562. File a separate Form 4562 for each business or activity on your return for which Form 4562 is required.

Instead when you enter your business rental farm or job-related expenses well ask about related assets and apply the depreciation at that point. IRS Form 4562 must be submitted as an attachment to your federal income tax return and is due by April 15 for the previous tax year. Part IV and V In Part IV youll combine certain numbers youve used in other parts of the form including one from line 28 in Part V.

Where do I enter Form 4562.

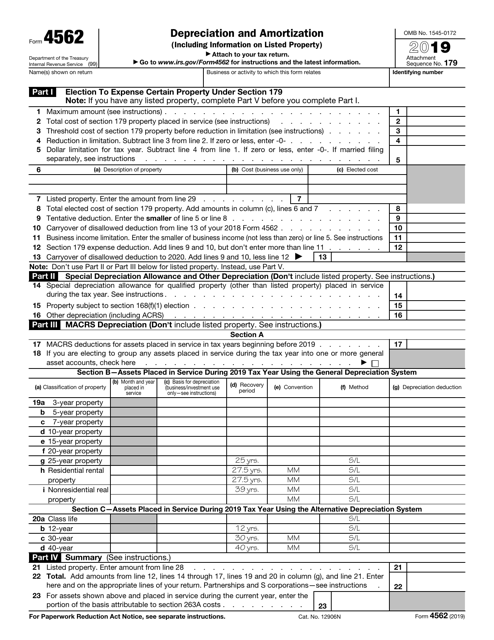

Irs Form 4562 Download Fillable Pdf Or Fill Online Depreciation And Amortization 2019 Templateroller

Irs Form 4562 Download Fillable Pdf Or Fill Online Depreciation And Amortization 2019 Templateroller

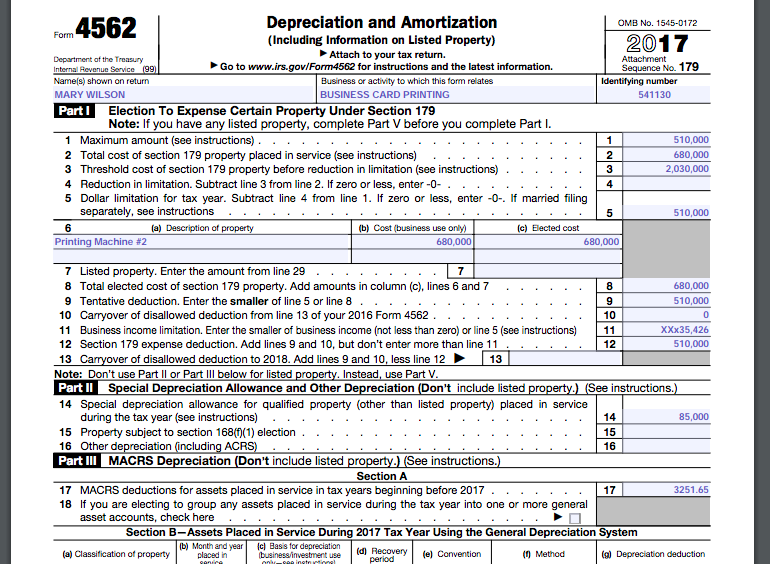

Irs Form 4562 Instructions The Complete Guide

Irs Form 4562 Instructions The Complete Guide

Section 179 Addback Example 1 Sole Proprietor Minnesota Department Of Revenue

Section 179 Addback Example 1 Sole Proprietor Minnesota Department Of Revenue

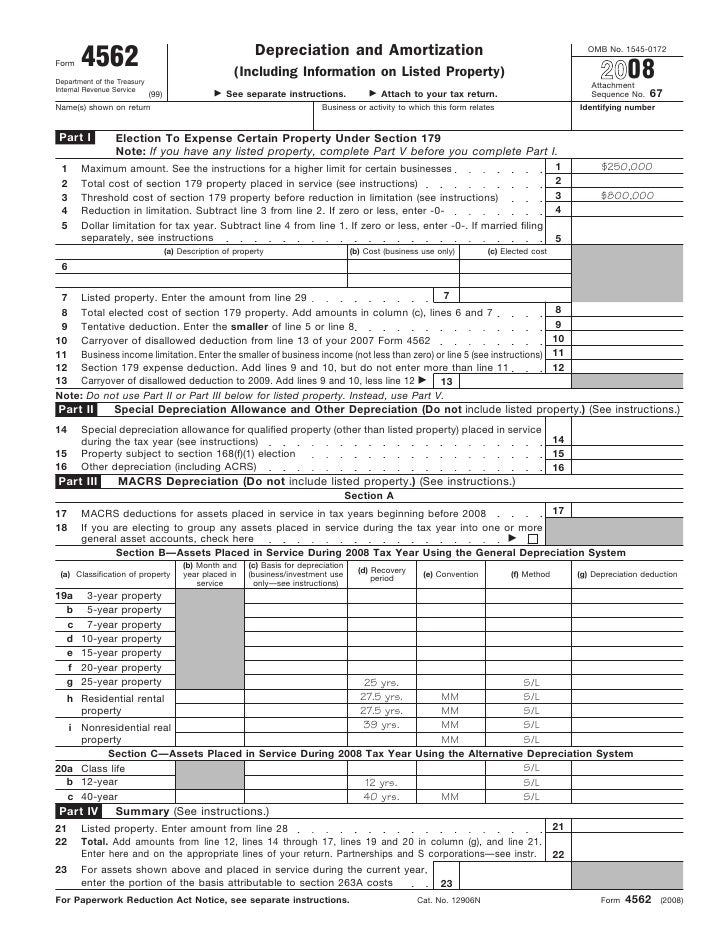

Form 4562 Depreciation And Amortization

Form 4562 Depreciation And Amortization

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue

Need Help Filling Out The First Part Of The Form 4 Chegg Com

Need Help Filling Out The First Part Of The Form 4 Chegg Com

Checklist For Irs Form 4562 Depreciation 2019 Tom Copeland S Taking Care Of Business

Checklist For Irs Form 4562 Depreciation 2019 Tom Copeland S Taking Care Of Business

4562 Listed Property Type 4562

4562 Listed Property Type 4562

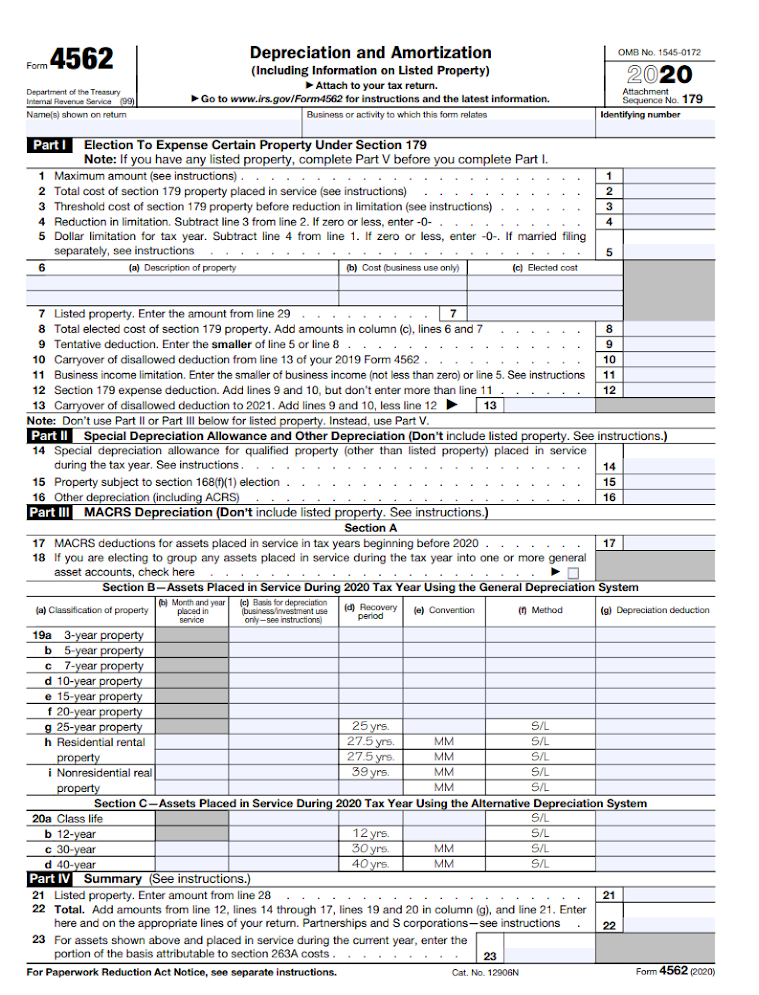

2020 Form Irs 4562 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 4562 Fill Online Printable Fillable Blank Pdffiller

For Fill How To In Irs Form 4562

For Fill How To In Irs Form 4562

Form 4562 Depreciation And Amortization Youtube

Form 4562 Depreciation And Amortization Youtube

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

Learn How To Fill The Form 4562 Depreciation And Amortization Youtube

Learn How To Fill The Form 4562 Depreciation And Amortization Youtube

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue

Irs Form 4562 Explained A Step By Step Guide The Blueprint

Irs Form 4562 Explained A Step By Step Guide The Blueprint

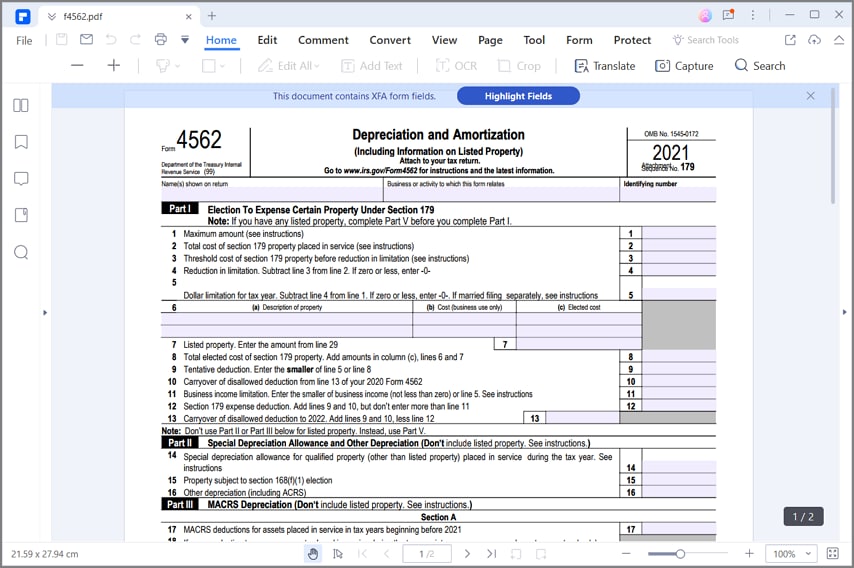

/ScreenShot2021-02-11at9.35.53AM-18b6615f7bd449e6a035c8e074b14521.png) Form 4562 Depreciation And Amortization Definition

Form 4562 Depreciation And Amortization Definition

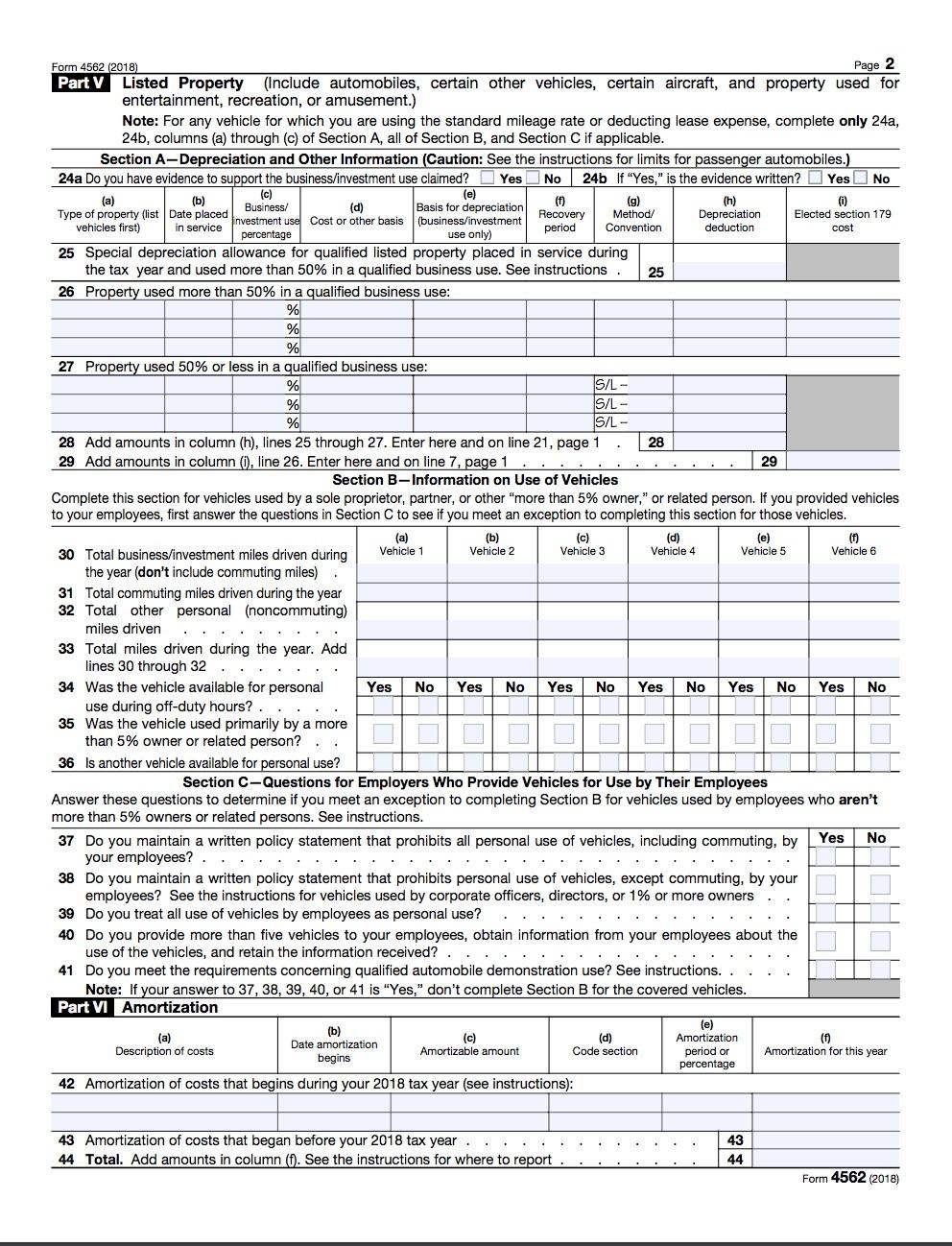

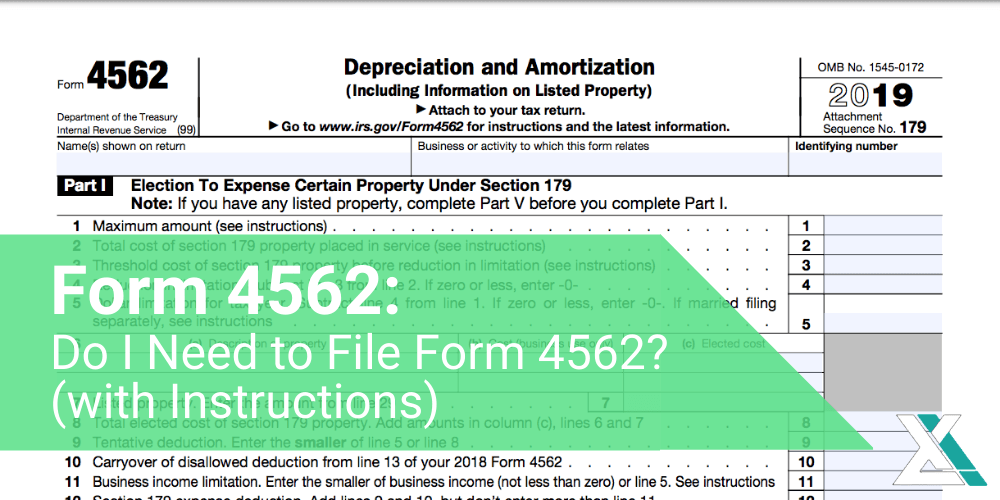

![]() Form 4562 Do I Need To File Form 4562 With Instructions

Form 4562 Do I Need To File Form 4562 With Instructions

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

Form 4562 Do I Need To File Form 4562 With Instructions

Form 4562 Do I Need To File Form 4562 With Instructions