How To Change Email Id In Vat Registration Uae

Copy of passport of the old and new email holder Copy of Emirates ID of. If you are a non-UAE resident selling goods that are located in the UAE to a UAE customer then you will be required to register for VAT irrespective of the level of turnover from such sales.

Must Vat Be Paid On Uae Exports Qafila

Must Vat Be Paid On Uae Exports Qafila

Each of the prospective members of the Tax group must.

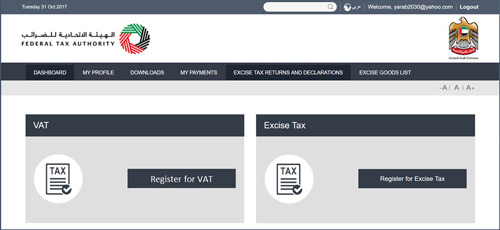

How to change email id in vat registration uae. Our team will collect all required documents and information for registering your company for VAT. For general inquiries about tax registration andor application you may contact Federal Tax Authority through the enquiry form or send an email to infotaxgovae. For more details about VAT registration please read VAT registration User Guide PDF.

Click on Sign up and carefully fill in the details such as e-mail Id password security code and security question in the form on your devices screen. Signed and stamped Letter from Authorized Signatory of the company requesting the email change request and providing the details name email address passport number etc of the old and new email holder. Log-in to your account with your credentials User Name and password.

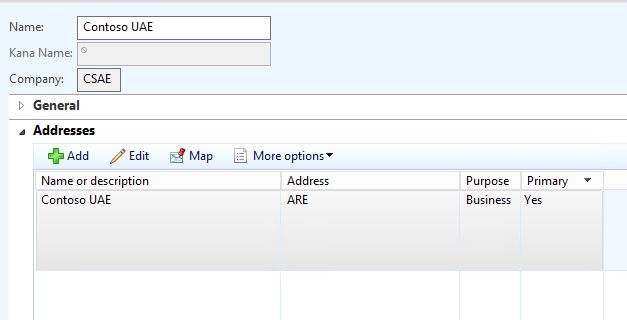

Business activities of the applicant section. Xact Auditing is offering VAT registration services and Tax Group registration services. How to register for VAT in UAE.

Know everything about VAT in UAE Bahrain. Value Added Tax VAT Everything you need to know about VAT implementation in the UAE This page provides general information on Value Added Tax that was introduced in January 2018 at a rate of 5 its role in effective fiscal management at the federal level and the impact it has on individuals and businesses throughout the UAE. However the reason as to why your business will undergo VAT deregistration in UAE has to fall under conditions that are defined in VAT regulations in the country.

Visit the website of FTA. When there are changes in their account details maintained with the FTA it is important that these changes should be notified to the FTA. There are several reasons why a business would opt to cancel registration for VAT.

The FTA will amend the VAT registration accordingly. Be a legal person Be resident in the UAE. It is strongly recommended that you read each of the sections carefully.

The tax authority hast the right in approving or rejecting applications for deregistration for UAE VAT. According to tax regulations in UAE VAT registration has to be done by businesses if they reach the mandatory VAT registration threshold of Dh 375000. Sections where EDIT button can be used.

Request for the change of email address and click on the Submit for Approval button. You may provide those details by email. Completing the VAT registration form.

This type of change is applicable to persons who are registered under VAT in UAE. Our team do the registration services also for your company. Customs Registration Information section.

After completing and submitting the form an automatic email will be sent to your registered email id. This article talks about VAT registration in UAE including the VAT registration process VAT registration threshold in UAE TRN VAT number Online VAT registration in Dubai and VAT deregistration in UAE. VAT registration application form can be accessed and provide all required information and documents.

Once you have done so check the Click here box to confirm that you have read it in order to move forward. Changing email id used in VAT registration Signed and stamped Letter from Authorized Signatory of the company requesting the email change request and providing. In order to avail our services you may please contact the below representatives.

Online VAT registration in UAE is available on the Federal Tax Authority web portal to get the Tax Registration Number TRN. A business must apply for VAT registration if the taxable supplies and imports exceed the mandatory registration threshold of AED 375000. We support the clients by guiding for Online VAT registration.

VAT registration for international companies selling through amazon in UAE is mandatory. Value Added Tax VAT is one type of indirect tax levied in more than 180 countries around the world. As per the latest information available from the Federal Tax Authority VAT registration is now open.

SAB will assist you to get the Tax Registration Number TRN for your business. Supporting documents would be. In case you wish to make changes to your registration details click on the Edit or Amendment button which is placed within the VAT box under the Dashboard tab.

And not a member of another Tax group. The proposed rate of VAT in UAE will be up to 5. International companies must register under VAT and get the VAT number before start selling in UAE through Amazon.

Registration Number TRN for VAT or submit a VAT registration application at the time of applying to form a Tax Group. You can also call on 600 599 994 or 04-7775777. Bahrain Government to introduce VAT in UAE by January 2019.

This video highlights the procedure to Change VAT registered email id and Myths about VAT registartionOur Social Media HandlesWebsite. Upon the approval of the application for UAE VAT registration a registered business will be supplied with a unique tax registration number TRN. Sign up using the email ID and register the business.

Then select e-services through which VAT registration application can be made. VAT Consultant Services Dubai. Online VAT Registration in UAE has been started for the businesses to get register and get the Tax Registration Number TRN.

312 Steps for completing the VAT registration form There are 8 sections that must be completed on the VAT registration form.

3 Simple Steps In De Registering Or Amending A Tax Group Vat In Uae De Registration Of Vat

3 Simple Steps In De Registering Or Amending A Tax Group Vat In Uae De Registration Of Vat

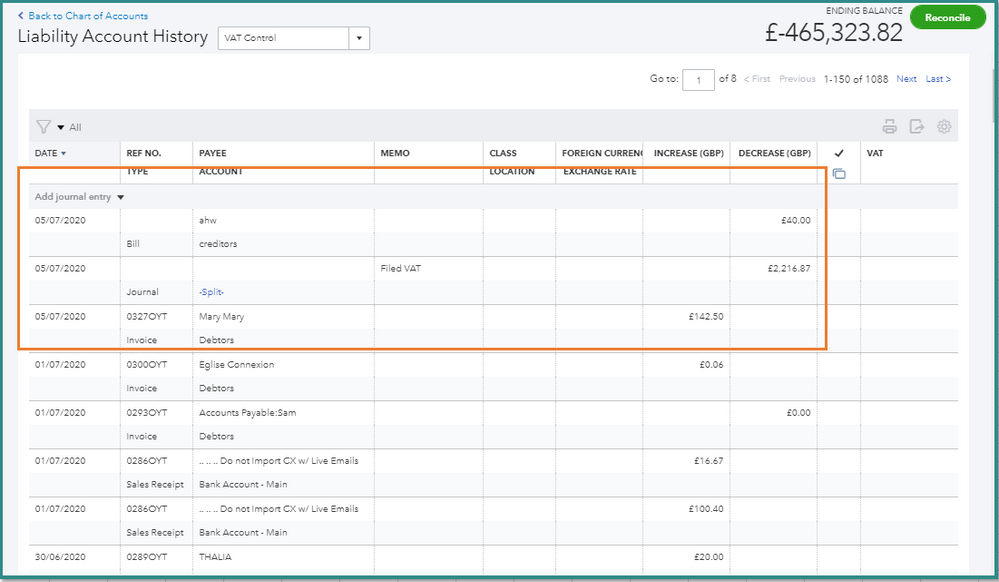

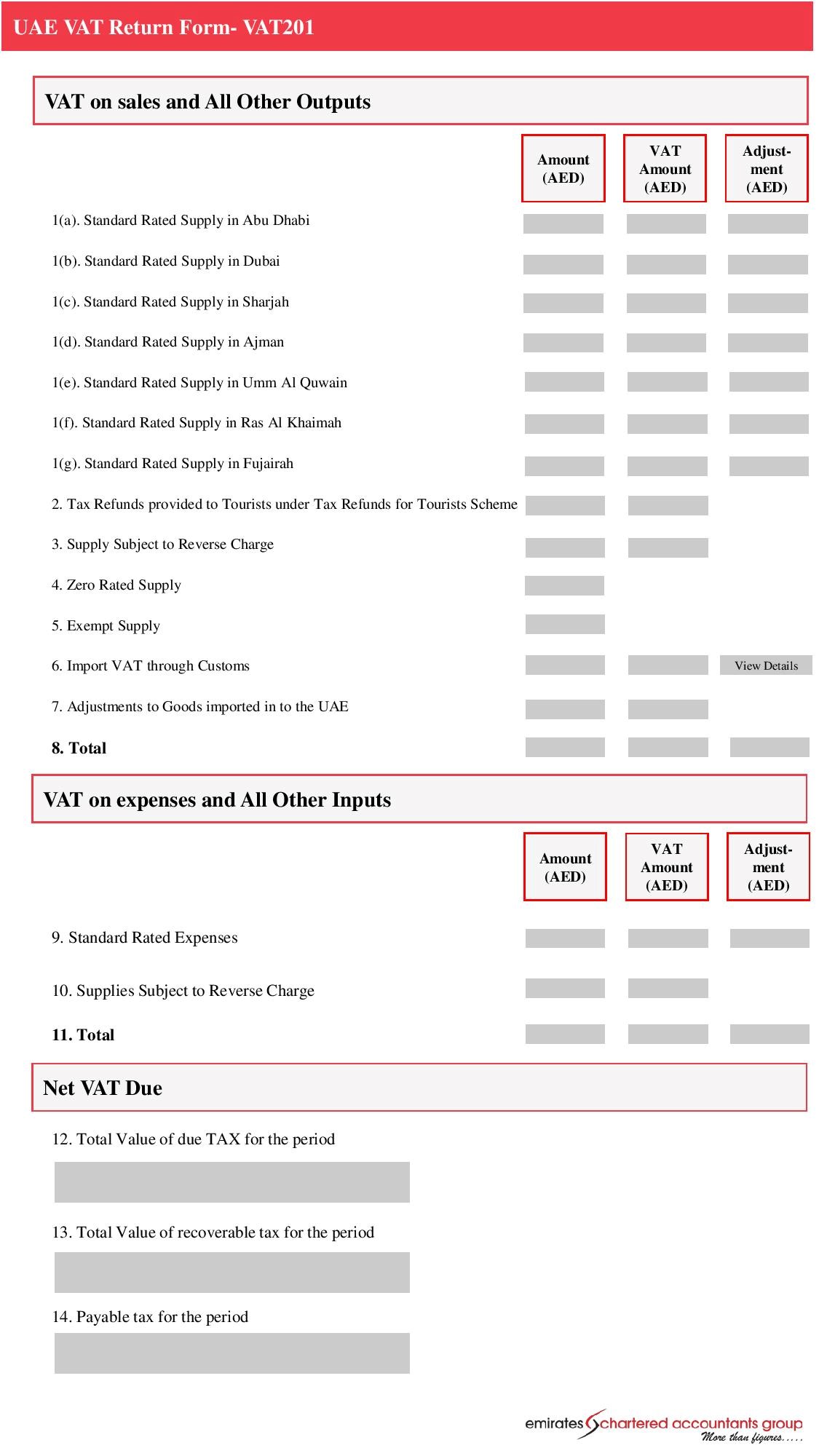

15 Easy Steps You Can Turn Uae Vat Return Filing Into Success

15 Easy Steps You Can Turn Uae Vat Return Filing Into Success

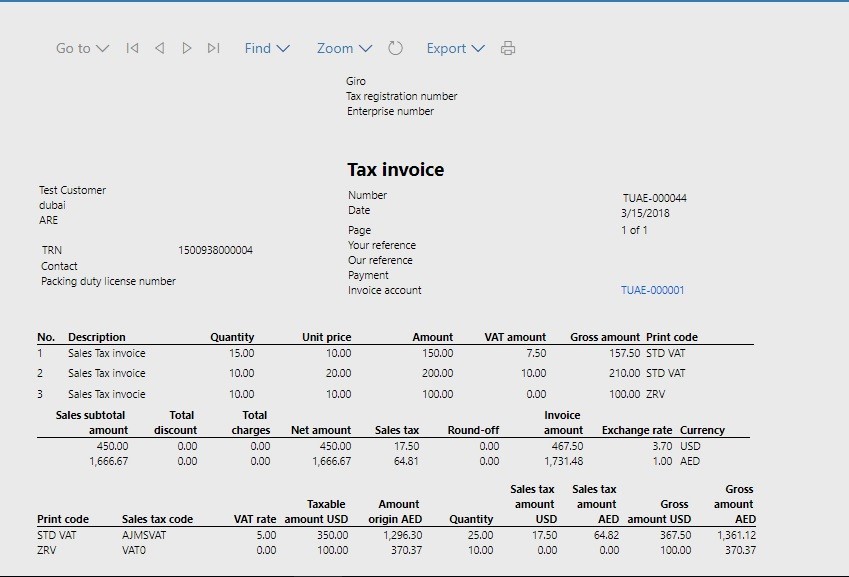

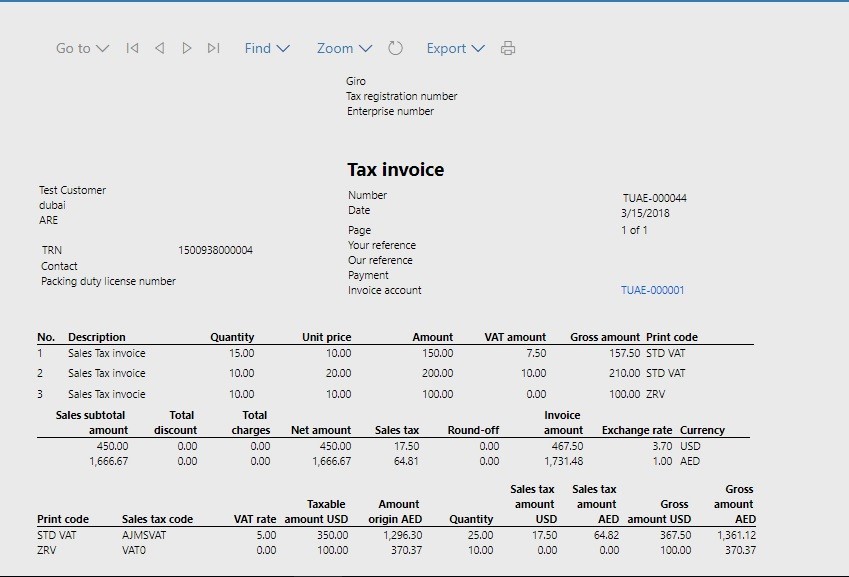

Set Up And Report Value Added Tax Vat Finance Dynamics 365 Microsoft Docs

Set Up And Report Value Added Tax Vat Finance Dynamics 365 Microsoft Docs

Changing Email Id Used In Vat Registration

Changing Email Id Used In Vat Registration

Value Added Tax Vat By Venkat Training Disclaimer

Value Added Tax Vat By Venkat Training Disclaimer

7 Uae Vat Excel Templates By Exceldatapro By Mohammed Fahim Medium

7 Uae Vat Excel Templates By Exceldatapro By Mohammed Fahim Medium

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

Dubai Free Zone License Dial 00971544472157 Dubai Business Consulting Business Dubai

Dubai Free Zone License Dial 00971544472157 Dubai Business Consulting Business Dubai

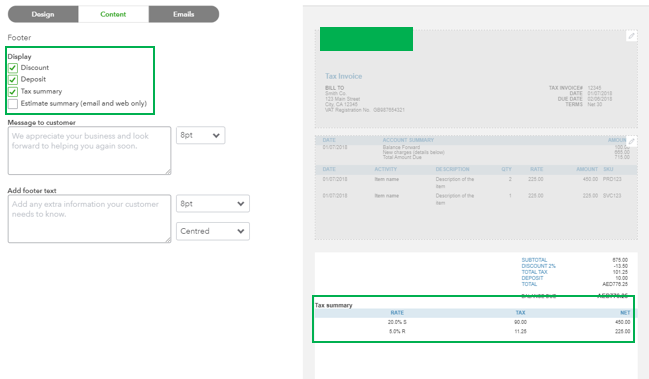

How Can We Have An Invoice Format In Line With Uae Vat Regulations You Don T Have An Option Of Linewise Vat This Is Not Possible Through Importing Invoice Styles

How Can We Have An Invoice Format In Line With Uae Vat Regulations You Don T Have An Option Of Linewise Vat This Is Not Possible Through Importing Invoice Styles

Pin By Ads Auditing And Accounting Ll On Accounting Firm In Uae Accounting Firms Budget Forecasting Financial Strategies

Pin By Ads Auditing And Accounting Ll On Accounting Firm In Uae Accounting Firms Budget Forecasting Financial Strategies

How To Apply For Vat Registration In Uae Tally

How To Apply For Vat Registration In Uae Tally

Uae Vat Reporting Update For Dynamics Ax 2012r3 V 6 3

Uae Vat Reporting Update For Dynamics Ax 2012r3 V 6 3

Avail The Vat Return Service Bookkeeping Services Accounting Services Bookkeeping

Avail The Vat Return Service Bookkeeping Services Accounting Services Bookkeeping