How Do I Register A Sole Proprietorship In Illinois

When a business name is different from the owners full legal names the Illinois Assumed Name Act requires sole proprietorships and general partnerships to register with their local county clerks office for registration under the Assumed Name Act. This requirement includes registration for sole proprietorships and general partnerships.

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

Choose a Business Name.

How do i register a sole proprietorship in illinois. In Illinois a sole proprietor may use his or her own given name or may use an assumed business name or trade name. Decide if you will run your business under your legal name or under an assumed business name. Illinois DBA Registration Form Sole proprietorships and partnerships Obtain the Assumed Business Name Application from the County Clerks office in the county where the business is physically located.

If you plan to name. Sole Proprietors and General Partnerships operating under an assumed name must register with the Cook County Clerks Office. To establish a sole proprietorship in Illinois heres everything you need to know.

You will need to register with the Illinois Department of Revenue Business Registration. For help establishing your businesss licensing needs youll need to consult the Registration Licenses Permits page of the Illinois government website. Limited Partnerships Limited Liability Companies LLC and Corporations file with.

View All Individuals doing business in Lake County under an assumed business name are required by law to register the business name with the Lake County Clerks office. File an Assumed Business Name. You need to register for a motor fuel permit You already hold one or more other permits with the Department of Revenue Otherwise - Click on the One Stop Business Registration to register your business with multiple agencies including the Department of Financial Institutions and the Department of Workforce Development.

If you are a sole proprietor use the information in the chart below to help you determine some of the forms that you may be required to file. Even though a sole proprietorship is often seen as an informal structure. There may also be additional steps needed depending on the state.

However if you are the sole member of a domestic limited liability company LLC you are not a sole proprietor if you elect to treat the LLC as a corporation. Illinois Compiled Statute 805 ILCS 405 Assumed Business Name Act. After you obtain the name certificate the next step sole proprietors need to take is to publish the assumed business name in local newspapers within three consecutive weeks.

Sole proprietors must have a Federal Employer Identification Number if they pay wages to one or more employees or file any pension or excise tax. The most common is the business name registration. This includes the licensing of EMT-Basic EMT-Intermediate Advanced EMT Paramedic Lead Instructor Emergency Medical Dispatcher First Responder Pre-Hospital Registered Nurse and Emergency Communications Registered Nurse.

Who Needs to Register Under the Assumed Business Name Act. Sole proprietorships and general partnerships located in DuPage County must register with the DuPage County Clerks Office if the name of the business is any name other than that of the owner s. A handful of counties have this form available to download but most require the form to be picked up in person.

IDPH licenses people in the State of Illinois to assure they are competent and keep current in the practice of Emergency Medical Services. Most state-issued business licenses in Illinois are industry specific and are determined by the goods or services which your sole proprietorship offers. A sole proprietor is someone who owns an unincorporated business by himself or herself.

To register a business name check its availability with a name search learn your business entitys naming rules and file the right paperwork in Illinois. File an assumed business name certificate with. Create a plan for your Illinois business.

Its important to note that by default a single-owner business is automatically considered a sole proprietorship by the IRS. The sole proprietorship isnt a formal legal entity so there is nothing to apply for or register.

Sole Proprietor Page 1 Line 17qq Com

Sole Proprietor Page 1 Line 17qq Com

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

How To Set Up A Sole Proprietorship In Illinois 8 Steps

How To Set Up A Sole Proprietorship In Illinois 8 Steps

5 Super Slick Tips For Your Sole Proprietorship Sole Proprietorship Small Business Coaching Business Books

5 Super Slick Tips For Your Sole Proprietorship Sole Proprietorship Small Business Coaching Business Books

5 Super Slick Tips For Your Sole Proprietorship Small Business Coaching Sole Proprietorship Business Books

5 Super Slick Tips For Your Sole Proprietorship Small Business Coaching Sole Proprietorship Business Books

Why You Should Turn Your Sole Proprietorship Into An Llc

Why You Should Turn Your Sole Proprietorship Into An Llc

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

How To Set Up A Sole Proprietorship In Illinois 8 Steps

How To Set Up A Sole Proprietorship In Illinois 8 Steps

How To Change From A Sole Proprietor To An Llc

How To Change From A Sole Proprietor To An Llc

Illinois Plumbers Sole Proprietor Surety Bond Bond Plumbing Contractor Illinois

Illinois Plumbers Sole Proprietor Surety Bond Bond Plumbing Contractor Illinois

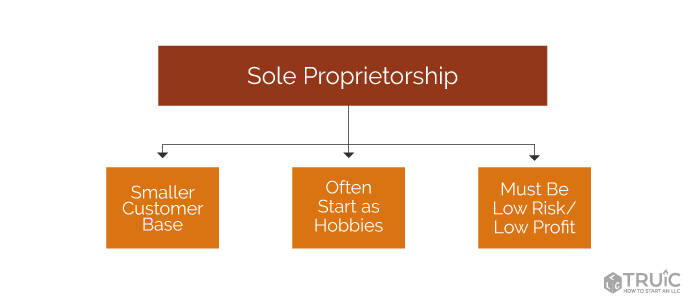

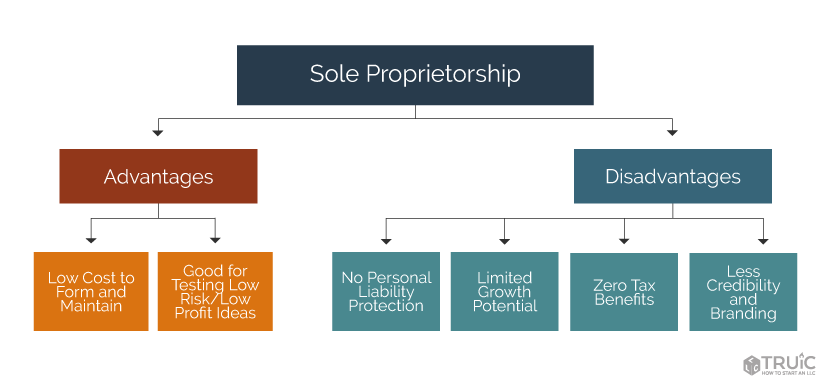

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

Sole Proprietorship Vs S Corp Truic

Sole Proprietorship Vs S Corp Truic

Register Illinois Fictitious Business Name Illinois Trade Name Illinois Dba Business Format Sole Proprietor Illinois

Register Illinois Fictitious Business Name Illinois Trade Name Illinois Dba Business Format Sole Proprietor Illinois

How To Set Up A Sole Proprietorship In Illinois 8 Steps

How To Set Up A Sole Proprietorship In Illinois 8 Steps

When Does A Sole Proprietor Need An Ein How To Start An Llc

When Does A Sole Proprietor Need An Ein How To Start An Llc

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

Sole Proprietorship Laws In Illinois Legalzoom Com

Sole Proprietorship Laws In Illinois Legalzoom Com