How Can I Get My 1099 G Form From Unemployment

You can log into CONNECT and click on My 1099G49T to view and print the forms. Regardless of the initial method of delivery all claimants can access copies of their 1099-G form in multiple ways.

People Now Receiving Tax Form Tied To Fake Unemployment Claims

People Now Receiving Tax Form Tied To Fake Unemployment Claims

Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form.

How can i get my 1099 g form from unemployment. Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application. After you are logged in you can also request or discontinue federal and state income tax withholding from each unemployment benefit payment. These forms are available online from the NC DES or in.

Unemployment is taxable income. The 1099-G will be mailed to the address on file with the Maryland Department of Labor. Log on using your username and password then go to the Unemployment Services menu to access your 1099-G tax forms.

1099-G The 1099-G is the tax form the department issues in January for the purposes of filing your taxes. How to requestRequest your unemployment benefits 1099-G. As an alternative you can contact the Oklahoma Unemployment.

You may download a copy of your current IRS Form 1099-G through your online account at desncgov at no charge. IDES began sending 1099-G forms to all claimants via their preferred method of correspondence email or mail in late January. After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile.

For Pandemic Unemployment Assistance PUA claimants the. To obtain your 1099-G From from the Oklahoma Unemployment Security Commission you can visit this link httpsunemploymentstateokus to request the form online. Your 1099-G will be sent to your mailing address on record the last week of January.

If you have additional questions about accessing your 1099-G form please call IDES at 800 244-5631. It will be mailed by January 31 of the following year. You can also download your 1099-G income statement from your unemployment benefits portal.

Written requests for a hard copy of your 1099-G form from 2018 2019 2020 or 2021 may be. If you have questions about your user name and password see our frequently asked questions for accessing online benefit services. Getting Your 1099-G Tax Form.

Log in to your UI Online account. You can log-in to CONNECT and go to My 1099- G in the main menu to view the last five years of your 1099-G Form document. Instructions for the form can be found on the IRS website.

The 1099-G tax form is commonly used to report unemployment compensation. Click on View and request 1099-G on the left navigation bar. The fastest way to receive a copy of your 1099-G Form is by selecting electronic as your preferred method for correspondence.

Enter the Social Security number that appears first on your New Jersey Gross Income Tax return and the tax year you wish to view. Unemployment benefits are taxable income meaning benefit payments must be reported on your federal tax return when filing taxes with the Internal Revenue Service IRS. These forms will be mailed to the address that DES has on file for you.

Second opinion How can I get my 1099-G information from the IRS. You can receive a copy of your 1099-G Form multiple ways. For additional questions please review our 1099-G frequently asked questions here.

We do not issue Form 1099-G for pensions or unemployment or family leave insurancefamily leave during unemploymentdisability during unemployment. Click on the down arrow to select the right year. Click on View 1099-G and print the page.

If you received unemployment insurance benefits during any calendar year ending 1231 from January 1 - December 31 you will receive a 1099-G for that year only. To request the form you would scroll down to the bottom of the page and click on Claimant Access and continue through the screens to request the 1099-G. 1099-Gs for years from 2018 forward are available through your online account.

Look for the 1099-G form youll be getting online or in the mail. You can view 1099-G forms for the past 6 years. I have been unable to get my correct 1099-G form from Florida EDD unemployment and I need the information not the form just the info to do my taxesI have tried going through the IRS menus at length and end up at a recording that says they cannot take my call at this time.

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Printable 1099 G Form Get 2020 Blank And Fill It

Printable 1099 G Form Get 2020 Blank And Fill It

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Ct Dept Of Labor Recent Irs Guidance On The 1099g Tax Form

Ct Dept Of Labor Recent Irs Guidance On The 1099g Tax Form

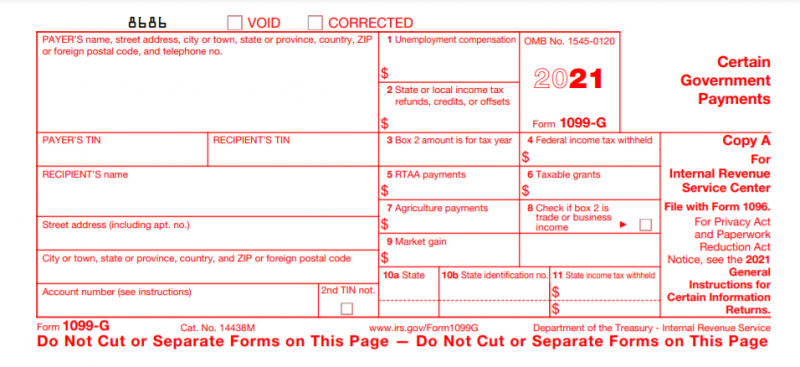

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

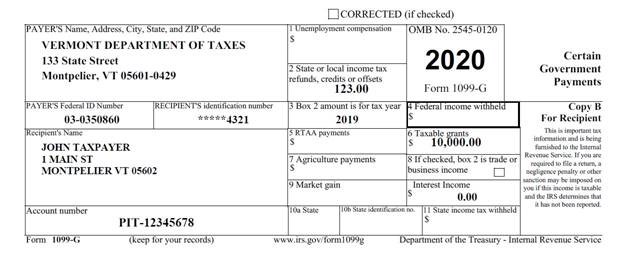

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

1099 Form Available For 2017 Unemployment Recipients

1099 Form Available For 2017 Unemployment Recipients

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

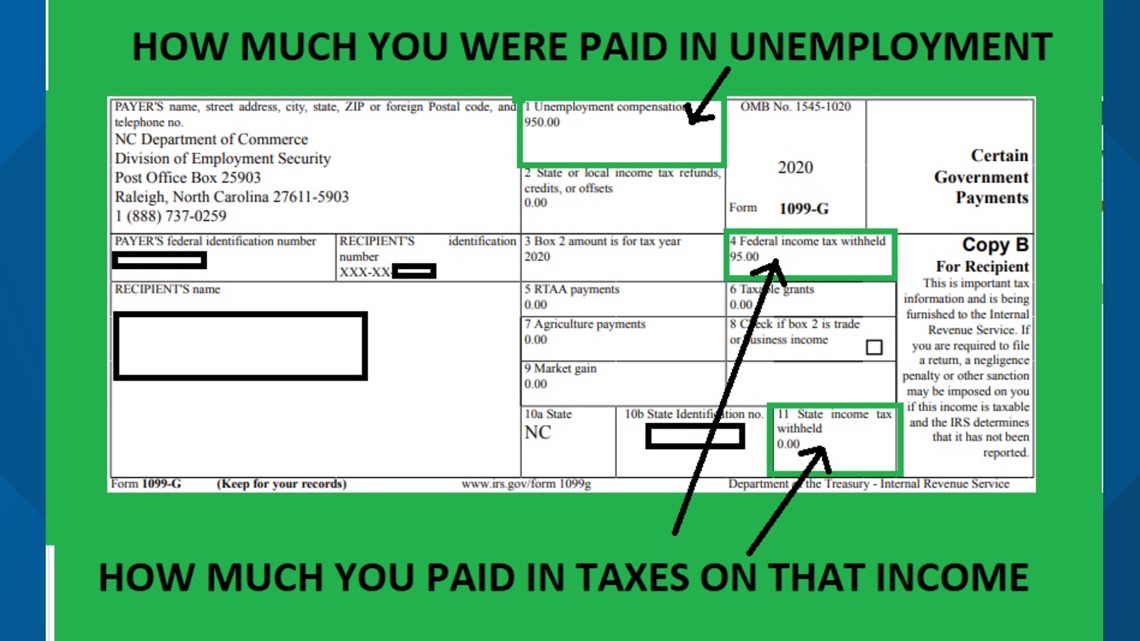

Unemployment Benefits Are Taxable Look For A 1099 G Form 13newsnow Com

Unemployment Benefits Are Taxable Look For A 1099 G Form 13newsnow Com

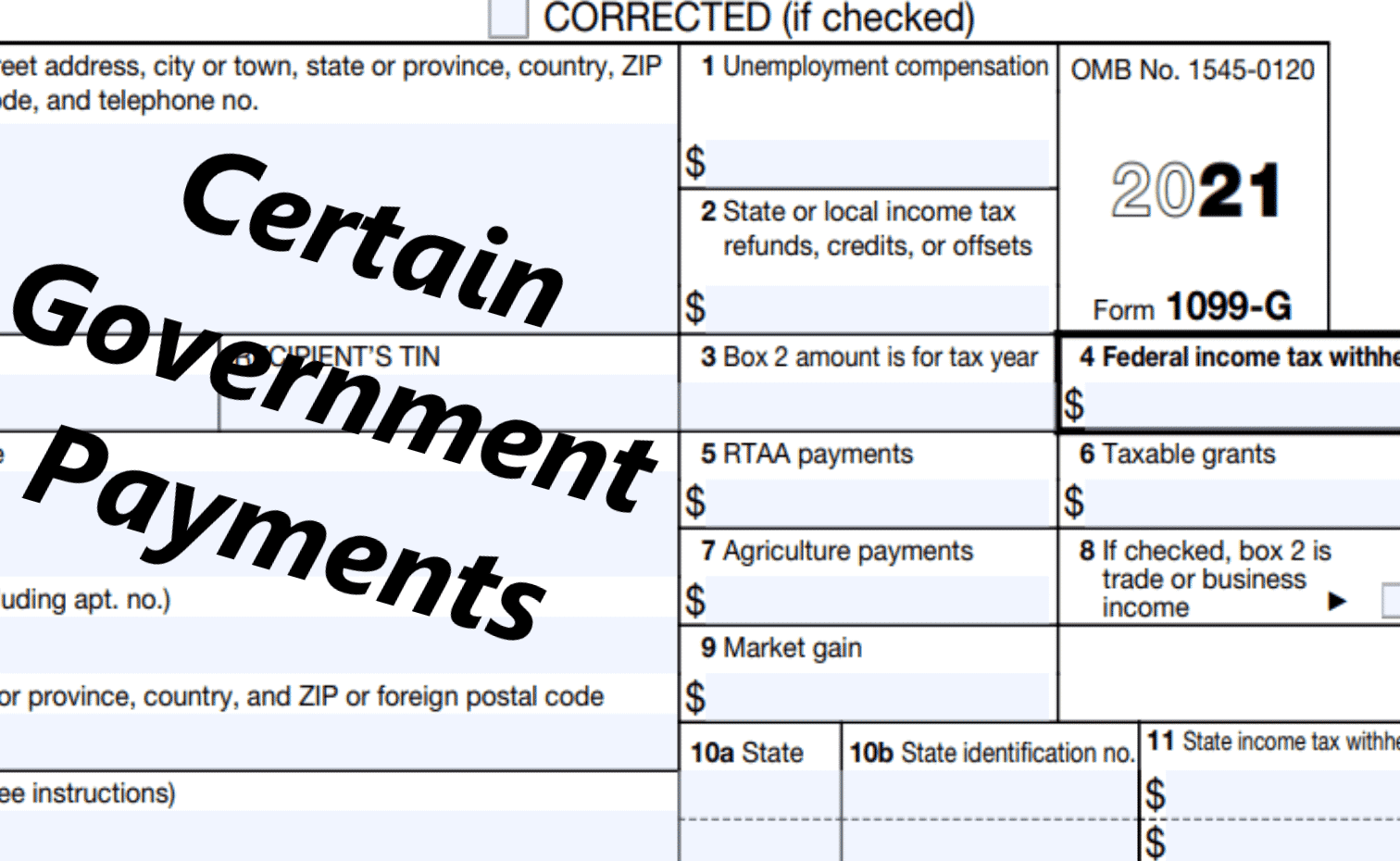

1099 G Form 2021 Irs Forms Zrivo

1099 G Form 2021 Irs Forms Zrivo

Florida Residents Report Problems Accessing 1099 G Form Youtube

Florida Residents Report Problems Accessing 1099 G Form Youtube

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor