Former Employer Won't Send W2

If your employer didnt send W2 then its up to you to act fast to sidestep the consequences that come with late tax-filing or. Employers name address and phone number.

2013 W2 Form W 4 W2 Forms Form Sales Tax

2013 W2 Form W 4 W2 Forms Form Sales Tax

It now rests on you to act fast so that you can pay your taxes as per the law and also get your refunds on time.

Former employer won't send w2. The deadline for employers to send out W2s to their employees is January 31st. Your name address Social Security number and phone number. You can use the Form 4852 in the event that.

Its basically a printout PDF of all the data in all the forms they have on you for the year. This will take some time but its essential. According to the IRS if the employer does not send the form to the employee by Feb15 the employer should ask the IRS to demand the form from the employer.

August 19 2020 Tax Forms. Your employerpayers name address including ZIP code and phone number If known your employerpayers identification number. If the employer fails to file a W-2 go ahead and use the last paystub.

The IRS will send you a letter with instructions and Form 4852 Substitute for Form W-2 Wage and Tax Statement or Form 1099-R Distributions from Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. The IRS will also send you a Form 4852 Substitute for Form W-2 Wage and Tax Statement or Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing. If the employer files a W-2 but doesnt send you a copy you can get it by requesting a transcript for the 2017 tax year from the IRS.

If this is the case you need to notify your employer of the error. The IRS will send a letter to your employer on your behalf. My former employer is.

If my former employer refuses to send my w2 what can I do. The phone number for this is 1-800-829-1040 2 Next to file your taxes without the W-21099 fill out substitution form 4852 for the IRS and substitution form. If the EIN isnt on a pay stub and you received a W-2 from the errant employer in prior years the tax number will be on the old statements.

So if your employer doesnt send your W2 in time then theres a problem brewing. If your former employer does not act on your request for following up on your W-2 or you are unable to reach them then it is time to reach out to the IRS. The IRS will contact the employerpayer for you and request the missing or corrected form.

If your employer hasnt sent you the form yet contact them and ask for a copy. Provide the IRS with. Employers may leave out a 0 or they may spell your last name wrong by a letter.

As they are required to provide threaten them with this before you file. If you have not received your W2 at this point and have made an effort you will need to use your paystubs to complete a substitute W2. Employer Obligation When the employer does not send the W-2 the employee should ask the employer to provide it.

If your employer refuses to give you your W-2 let her know that the IRS requires her to issue it. While your employer may have a valid reason for the delay such as incomplete records or incorrect personal details you need to know your. Youll need the following when you call.

You dont have to have the EIN but it will help when. Make sure they have your correct address. The IRS recommends contacting it at 800-829-1040 if you dont receive your W-2 by Feb.

Like all documents you should scan your W2 form thoroughly upon receiving it. The IRS will send your employer a letter requesting that they furnish you a corrected Form W-2 within ten days. What Can I Do if My Employer Refuses to Issue My W-2.

Form W -2 Wage and Tax Statement to file an accurate federal tax return. Your name address Social Security number and phone number. Former employer wont send W-2 IRS is too flooded with calls It is getting late into March I know I should have done this much sooner but didnt realize what was happening.

Talk to Your Employer. One of the most difficult and frustrating processes you can go through when filing a tax return is to have to wait for your W-2 or any document from a previous employer especially when you desperately need your refund. If youre unable to get your Form W-2 from your employer contact the Internal Revenue Service at 800-TAX-1040.

You will explain to the IRS that your former employer refused. A 1 If the employer does not comply the first step is to contact the IRS and report the issue to them. If you are unable to get a copy from your employer you may call the IRS at 800-829-1040 after Feb.

Accountant Hialeah Turbo Tax Irs Audit Letter Must Read To Under Sta Free Basic Templates Tax Debt Audit

Accountant Hialeah Turbo Tax Irs Audit Letter Must Read To Under Sta Free Basic Templates Tax Debt Audit

Missing Your W 2 Here S What To Do Liberty Tax Tax Services Miss You

Missing Your W 2 Here S What To Do Liberty Tax Tax Services Miss You

Editable 1099 Form 2016 Beautiful Irs Fillable Tax Forms 2016 Models Form Ideas Tax Forms Employee Tax Forms Irs Forms

Editable 1099 Form 2016 Beautiful Irs Fillable Tax Forms 2016 Models Form Ideas Tax Forms Employee Tax Forms Irs Forms

How To Correct A W 2 Form Irs Form W 2c Instructions

How To Correct A W 2 Form Irs Form W 2c Instructions

2015 Irs W9 Form Downloadable Us Gov Forms W9 Free Tax Irs Forms Doctors Note Template Business Letter Format

2015 Irs W9 Form Downloadable Us Gov Forms W9 Free Tax Irs Forms Doctors Note Template Business Letter Format

How To Get Your W2 Form Online For Free 2020 2021

How To Get Your W2 Form Online For Free 2020 2021

We Make You A Personalized W2 Tax Statement Great For Income Tax Purposes Or Proof Of Income For Self Employed Contractors Bar Income Statement Income Tax

We Make You A Personalized W2 Tax Statement Great For Income Tax Purposes Or Proof Of Income For Self Employed Contractors Bar Income Statement Income Tax

Federal Form 1099 Misc Deadline Irs Irs Forms 1099 Tax Form

Federal Form 1099 Misc Deadline Irs Irs Forms 1099 Tax Form

Pin On Statement Of Account Sample And Template

Pin On Statement Of Account Sample And Template

How Does An Irs 1099 Misc Different From A W 9 When Filing Taxes Filing Taxes Irs Forms Employer Identification Number

How Does An Irs 1099 Misc Different From A W 9 When Filing Taxes Filing Taxes Irs Forms Employer Identification Number

W 4 Form 2020 What Is It And How To Fill Accountsconfidant Tax Consulting Irs Forms Tax Preparation

W 4 Form 2020 What Is It And How To Fill Accountsconfidant Tax Consulting Irs Forms Tax Preparation

Is Your Employer Legally Obligated To Give You Your W2 Form Quora

4 Things To Do If You Don T Get Your W 2 On Time Primepay

4 Things To Do If You Don T Get Your W 2 On Time Primepay

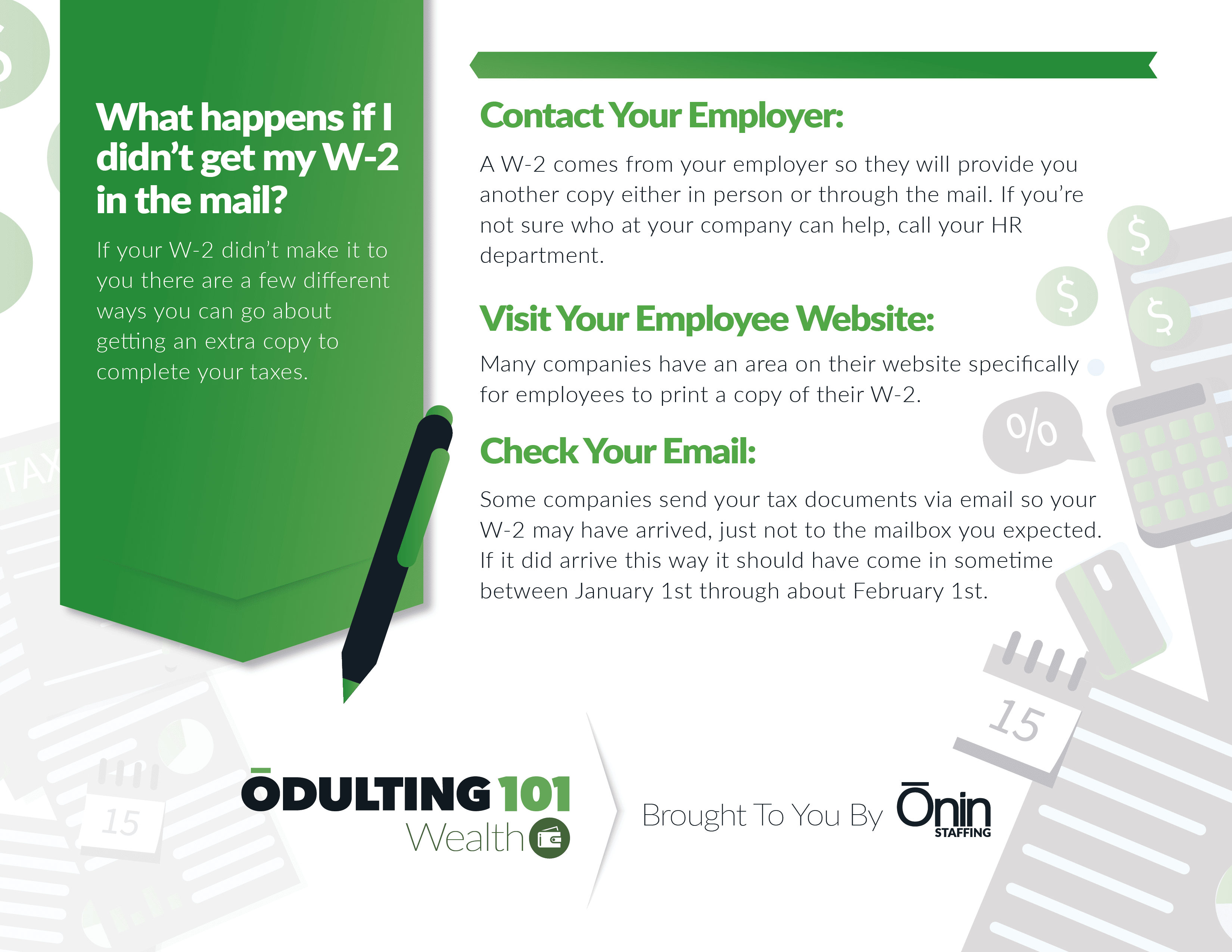

What To Do When You Don T Get A W 2 ōnin Staffing

What To Do When You Don T Get A W 2 ōnin Staffing

Crypto Users Are Receiving Irs Tax Warning Letters Again Irs Taxes Irs Tax

Crypto Users Are Receiving Irs Tax Warning Letters Again Irs Taxes Irs Tax

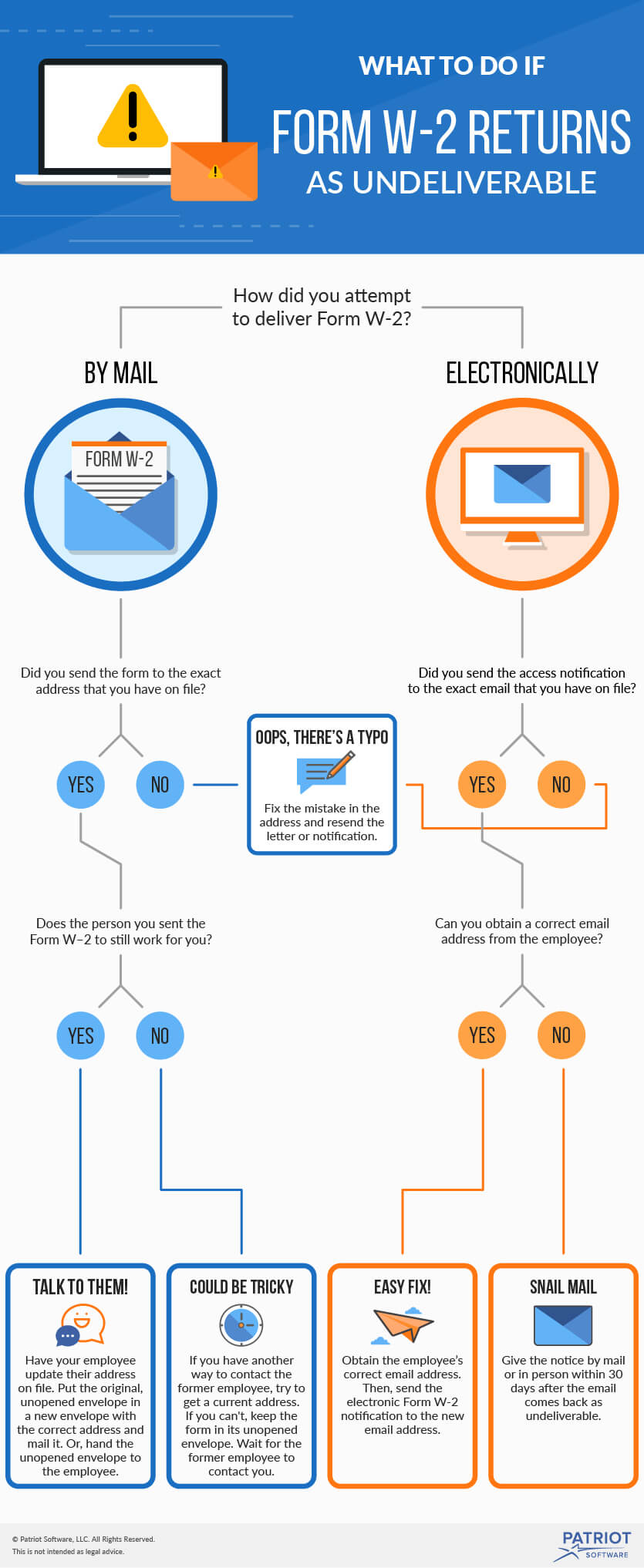

Form W 2 Returned To Employer Follow These Steps

Form W 2 Returned To Employer Follow These Steps

Replacing A Missing W 2 Form H R Block

Replacing A Missing W 2 Form H R Block

Didn T Get Your W2 Here S What To Do Now The Motley Fool

Didn T Get Your W2 Here S What To Do Now The Motley Fool

W15 Form Single Example 15 Fantastic Vacation Ideas For W15 Form Single Example Power Of Attorney Form Tax Forms Real Id

W15 Form Single Example 15 Fantastic Vacation Ideas For W15 Form Single Example Power Of Attorney Form Tax Forms Real Id