Form 2106 Business Use Of Home

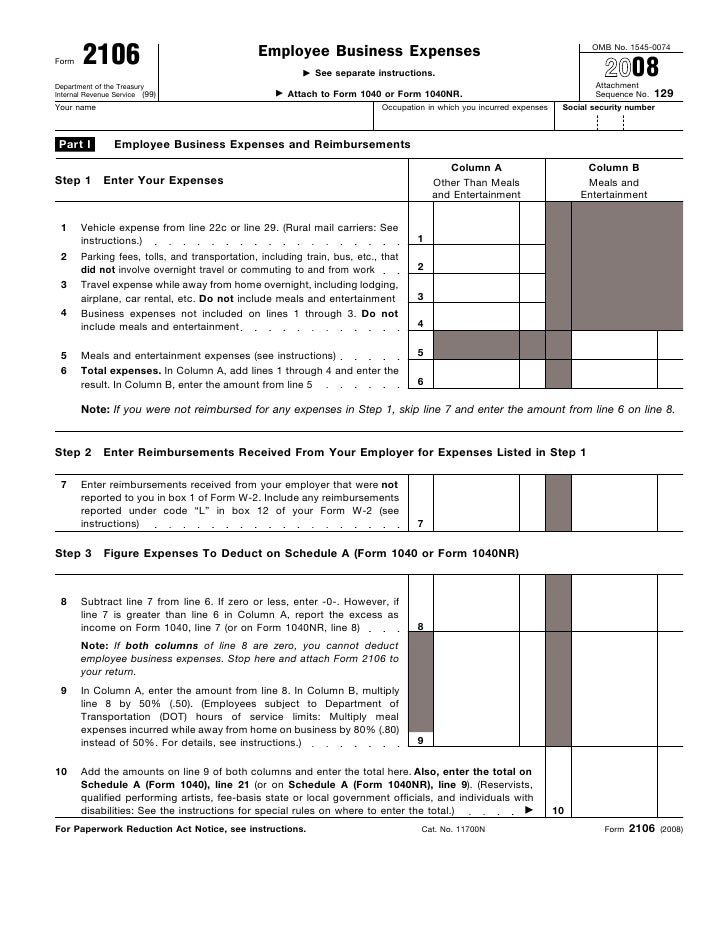

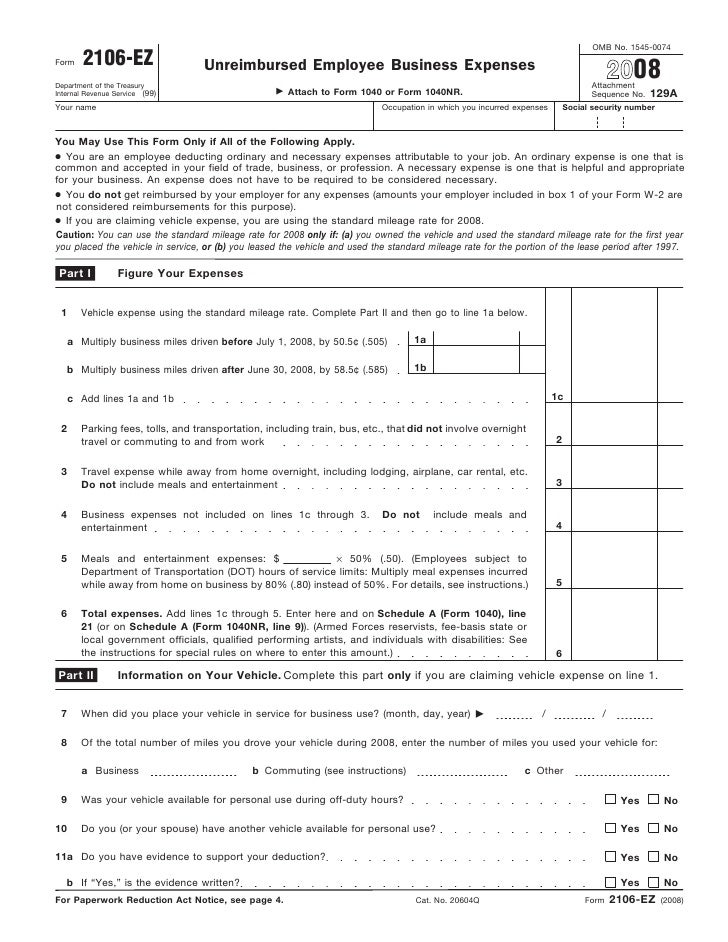

Form 2106 2020 Employee Business Expenses for use only by Armed Forces reservists qualified performing artists fee-basis state or local government officials. If you file Form 2106 or Form 2106-EZ report on line 4 the following expenses.

Instructions For Form 2106 2020 Internal Revenue Service

Instructions For Form 2106 2020 Internal Revenue Service

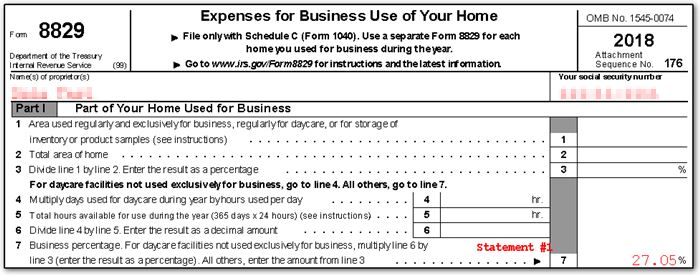

However if you want to deduct the use of part of your home as a business expense use IRS Form 8829 and read on to learn about what can be deducted.

Form 2106 business use of home. If you view the worksheet supporting Line 4 Business use of your home of IRS Form 2106 Employee Business Expenses you will see that the direct portion of Mortgage Interest and Real Estate Taxes flows to Line 4 of Form 2106 but the indirect portion does not. Click the pink Printer icon above the worksheet to print. Form 2106 is used by employees to deduct ordinary and necessary expenses related to their jobs.

Total home mortgage interest and total real estate taxes should be entered on IRS Form 2106 Business Use of Home Worksheet in the Indirect expenses column on Lines 6 and 7. Note that 2106 expenses end up on Schedule A Line 21 subject to the 2 limitation. Also if you wish to only print preview the worksheet check Print Preview.

Click Form 2106 Sch. IRS Form 2106 entered on Form 2106 Business Use of Home Worksheet. Go to line 4 and link F9 on the F9 business use of home worksheet field and link to the NEW Office Wkt - Employee Office In The Home Worksheet.

To view the Business Use of Home Worksheet when the business use of home is linked to anything other than the Sch. Types of Home Office Deductible Expenses. 2017 Federal Form 4797 Sales of Business Property and its instructions information for partners and shareholders IRS Publication 551 1218 Basis of Assets page 7 Basis other than cost 2017 Federal Form 8829 Expenses for Business Use of Your Home and its instructions.

Whats New Standard mileage rate. Form 8829 will be produced only if Interview Form M-15 is attach to a Schedule C. Select Bus Use Home.

You cant work for four hours in your kitchen and deduct your new refrigerator for instance. The Tax Cuts and Jobs Act of 2017 removed the home office deduction for most employees. If it is attached to any other entity Schedule A Schedule F or Form 2106 the Business Use of Home worksheet will be.

F or K-1 Business Use of Home - Employee Farmer or Partner Business Use of Home Worksheet then double-click the individual worksheet. The business part of your otherwise nondeductible expenses utilities maintenance insurance depreciation etc that do not exceed the deduction limit. Next you can only deduct expenses for the portions of your home that are exclusively used for business.

There are two types of deductible home office expenses. Direct and indirect expenses. To qualify to deduct the expenses for the business use of your home under the principal place of business test your home must be your principal place of business.

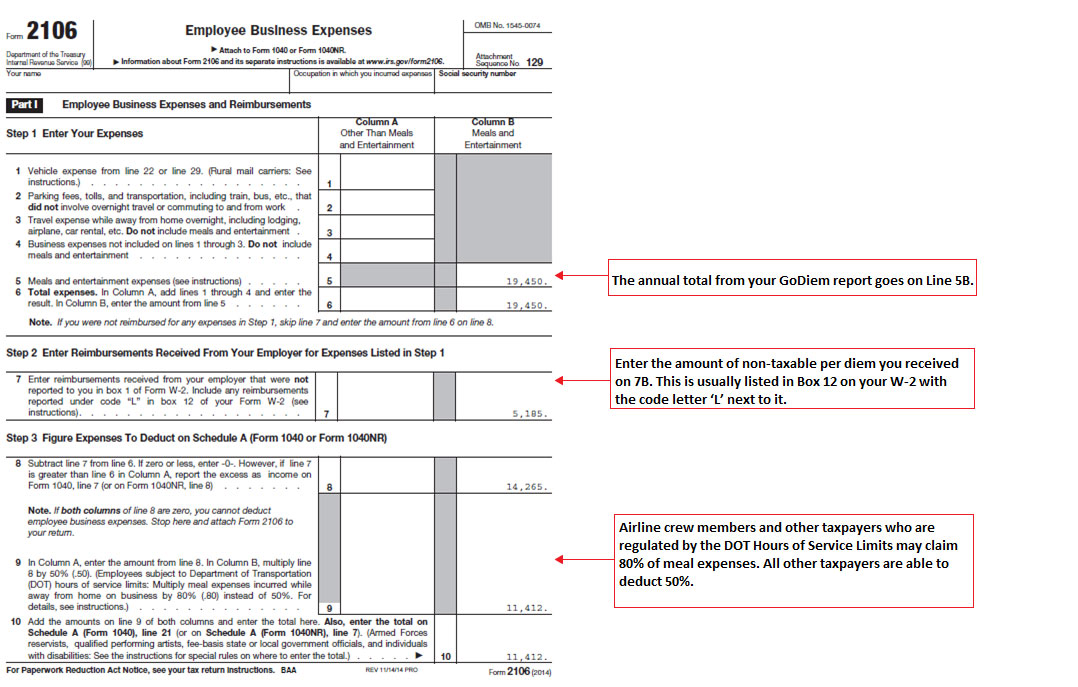

For those who still qualify Employee Business Use of Home expenses are reported on Line 4 of IRS Form 2106 Employee Business Expenses which flows to Schedule 1 Form 1040 Line 24. Direct home office expenses relate to the actual workspace so. You can send the output to a printer or a PDF document.

This form is used by Armed Forces reservists qualified performing artists fee-basis state or local. Employee Business Use of Home expenses are reported on Line 4 of IRS Form 2106 Employee Business Expenses and on Line 21 of Schedule A as an itemized deduction. You can have more than one business location including your home for a single trade or business.

Form 2106 and its instructions such as legislation enacted after they were published go to IRSgovForms-Pubs About-Form-2106. For tax years through 2017 use IRS Form 2106 if you itemize deductions for non-reimbursed work-related expenses such as travel meals entertainment or transportation. To access the QA interview screens to enter your home office expenses.

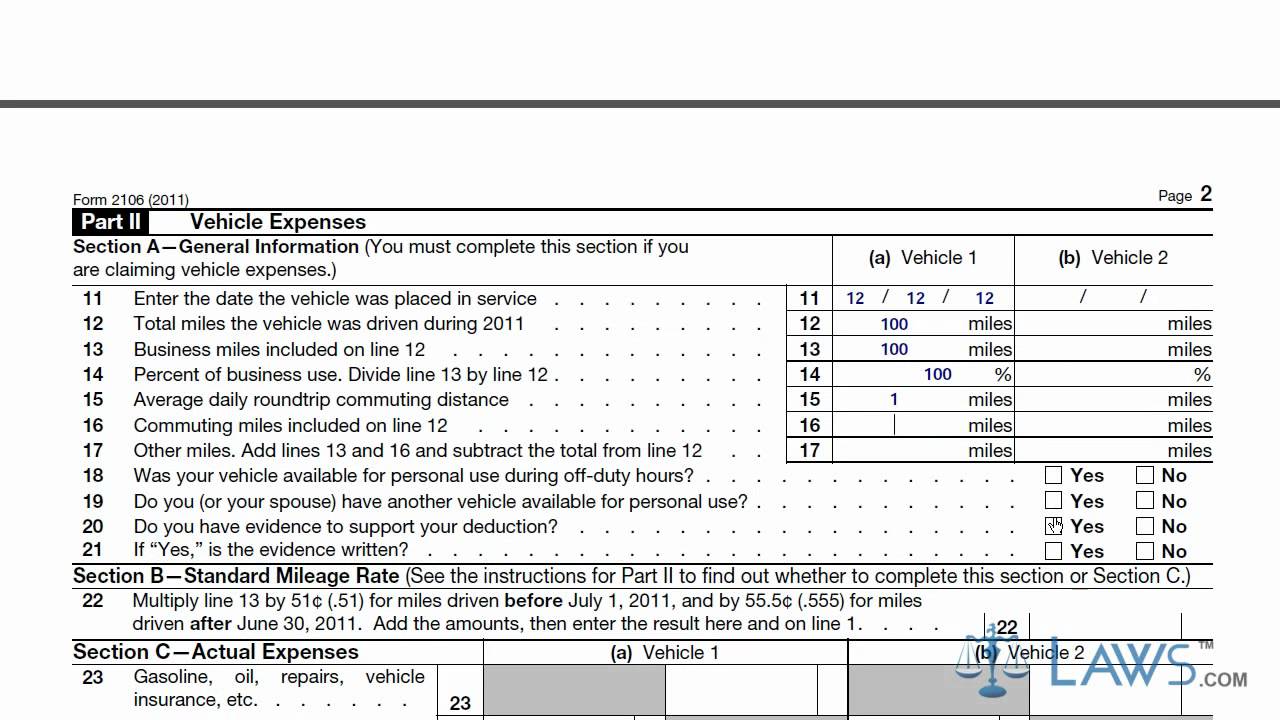

The 2020 rate for business use of your vehicle is 575 cents 0575 a mile. Go to the Fed Government Tab. Principal Place of Business.

The employee business expenses. For tax years 2018 - 2025 specific occupations can take this deduction. Per 2017 IRS Publication 587 Business Use of Your Home page 22 Consequently if the 8829 screen is pointed to a 2106 and has amounts for either of these items they are not included on the Wks 8829 but flow directly to lines 10 11 or 6 of Schedule A.

The additional first-year limit on depreciation for vehicles acquired. First the area you use for work in your home must be your principal place of business. Depreciation limits on vehicles.

From within your TaxAct return Online or. Go to line 21 and link F9 to Form 2106 Pg 1 - Employee Business Expenses Pg 1. To enter home office expenses on Form 2106 Open the return and go to Schedule A 1040.

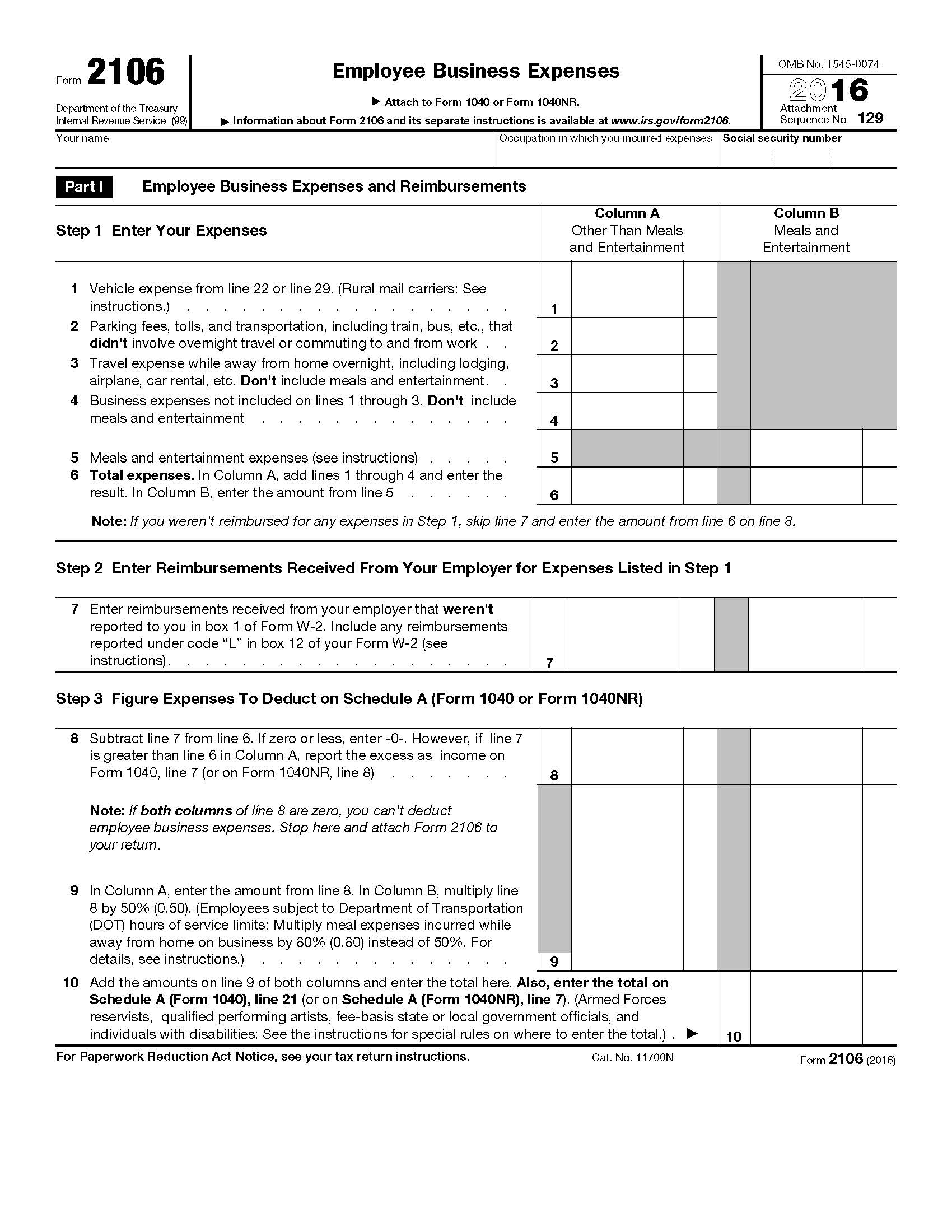

Form 2106 Employee Business Expenses

Form 2106 Employee Business Expenses

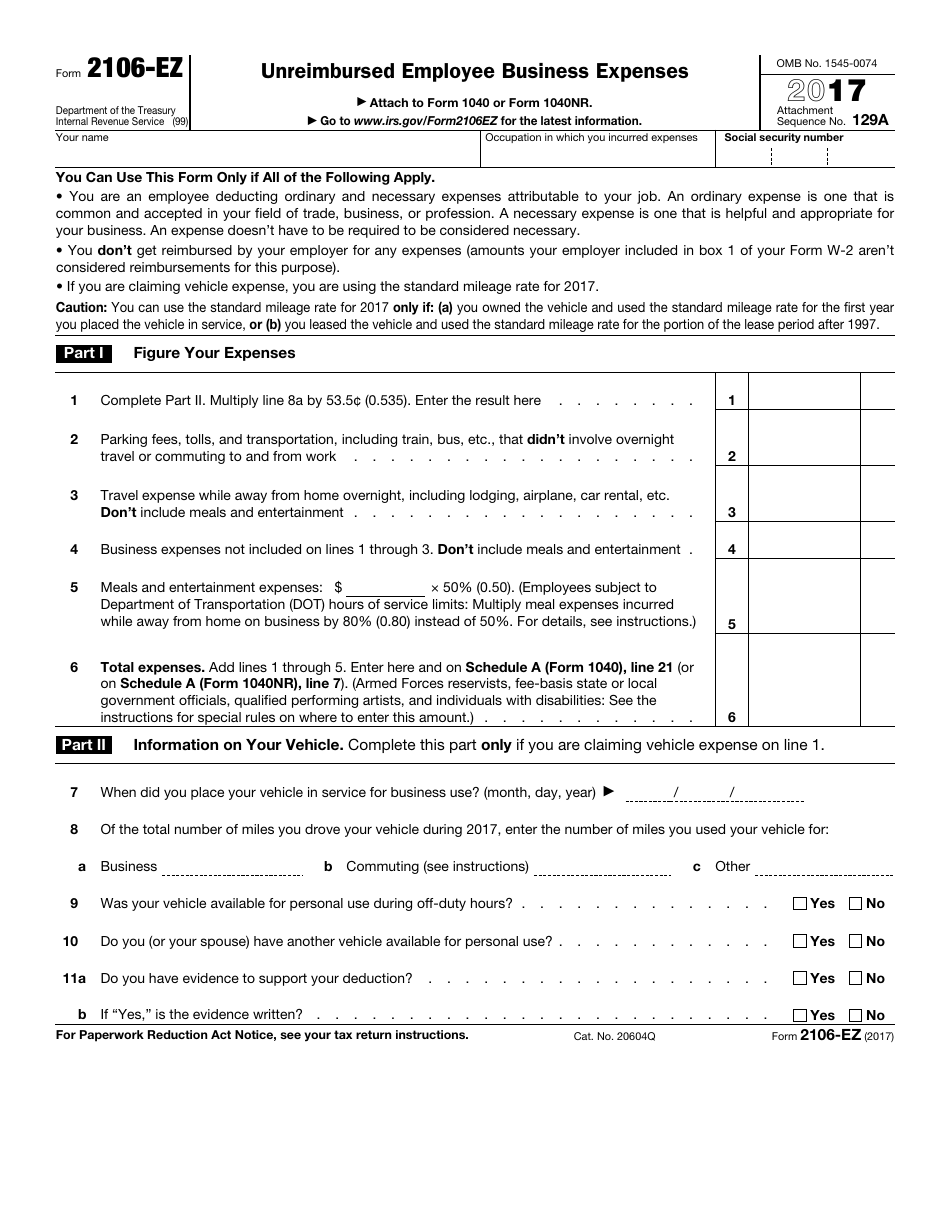

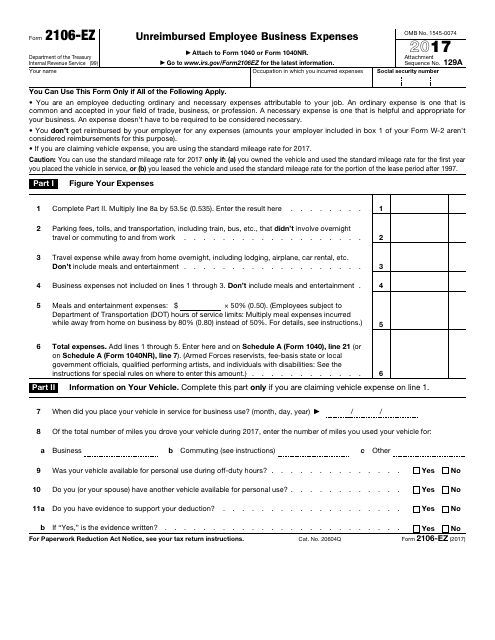

Form 2106ez Unreimbursed Employee Business Expenses

Form 2106ez Unreimbursed Employee Business Expenses

Https Www Irs Gov Pub Irs Prior I2106 2014 Pdf

Learn How To Fill The Form 2106 Employee Business Expenses Youtube

Learn How To Fill The Form 2106 Employee Business Expenses Youtube

Ryohee Form 2106 Employee Business Expenses

Ryohee Form 2106 Employee Business Expenses

Https Www Irs Gov Pub Irs Prior F2106 1964 Pdf

2106 Employee Business Expenses 2106 Schedule1

2106 Employee Business Expenses 2106 Schedule1

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

Irs Form 2106 Ez Download Fillable Pdf Or Fill Online Unreimbursed Employee Business Expenses Templateroller

Irs Form 2106 Ez Download Fillable Pdf Or Fill Online Unreimbursed Employee Business Expenses Templateroller

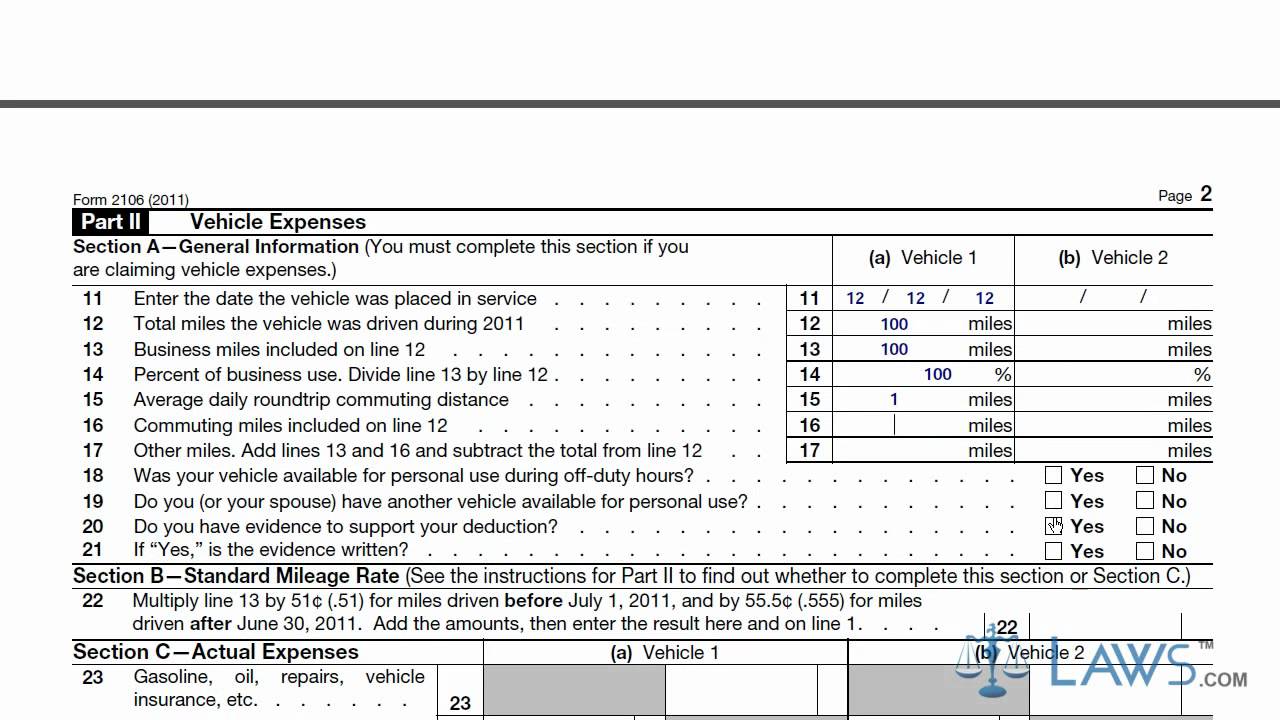

Irs Form 2106 Page 4 Line 17qq Com

Irs Form 2106 Page 4 Line 17qq Com

Irs Form 2106 Ez Download Fillable Pdf Or Fill Online Unreimbursed Employee Business Expenses Templateroller

Irs Form 2106 Ez Download Fillable Pdf Or Fill Online Unreimbursed Employee Business Expenses Templateroller

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

Irs Form 2106 Part 1 Page 3 Line 17qq Com

Irs Form 2106 Part 1 Page 3 Line 17qq Com

Form 2106 Employee Business Expenses

Https Www Irs Gov Pub Irs Utl 2015 Ntf Employee Business Expense Eng Pdf

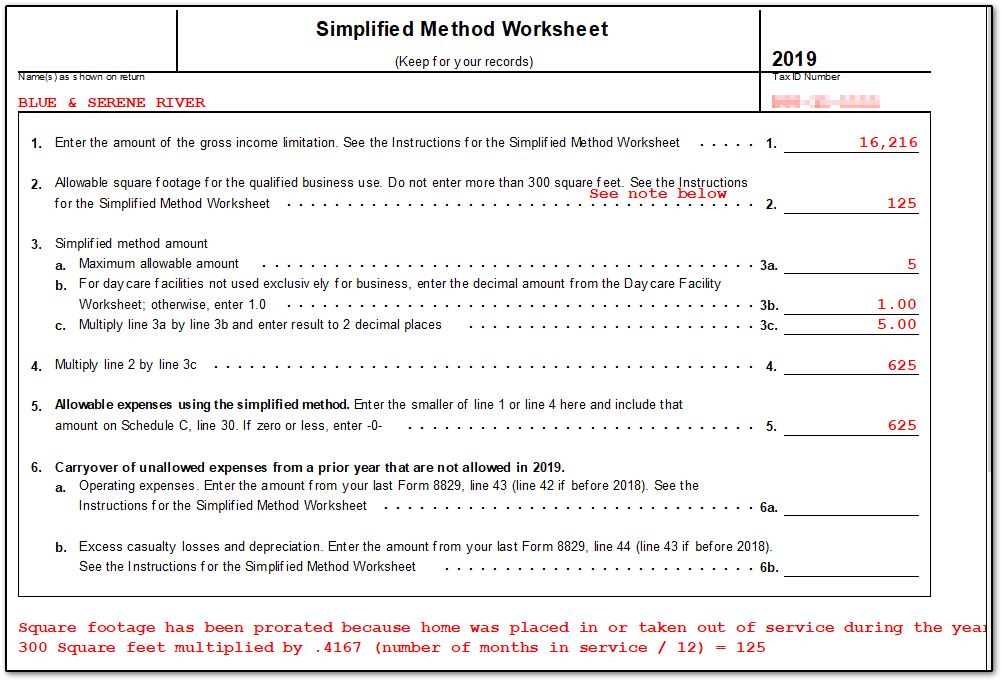

Form 8829 Office In Home How Does Form 8829 Office In Home Function In Drake Tax Note This Article Covers The Standard Method Only For Information On The Simplified Method Or Safe Harbor Method See Related Links Below Use Screen 8829 To

Form 8829 Office In Home How Does Form 8829 Office In Home Function In Drake Tax Note This Article Covers The Standard Method Only For Information On The Simplified Method Or Safe Harbor Method See Related Links Below Use Screen 8829 To

8829 Simplified Method Schedulec Schedulef

8829 Simplified Method Schedulec Schedulef