Nevada Business Registration Form Sales Tax

On the fourth line list your previous Nevada SalesUse Tax Permit Number and the Employment Security Division ESD Account Number of the previous owner. If there is more than one previous owner attach an additional sheet.

Https Tax Nv Gov Uploadedfiles Taxnvgov Content Onlineservices Automotive 1 Pdf

Often however they will indicate the estimated amount of Nevada sales tax due as taxes paid to Utah.

Nevada business registration form sales tax. DBA as shown on the Nevada Business Registration form Estimated total monthly receipts. Welcome to the Nevada Tax Center The easiest way to manage your business tax filings with the Nevada Department of Taxation. Register File and Pay Online with Nevada Tax Registering to file and pay online is simple if you have your current 10 digit taxpayers identification number TID a recent payment amount and general knowledge of your business.

Nevada Sales Tax Identification Number Request. This form reflects the increased tax rate for Lander County effective 040104. Continue to Sales Tax Application.

Proceeding will direct you to the registration form. This is done via an application to the Department of Revenue after a business has registered their business and obtained an EIN number. Other business registration fees may apply.

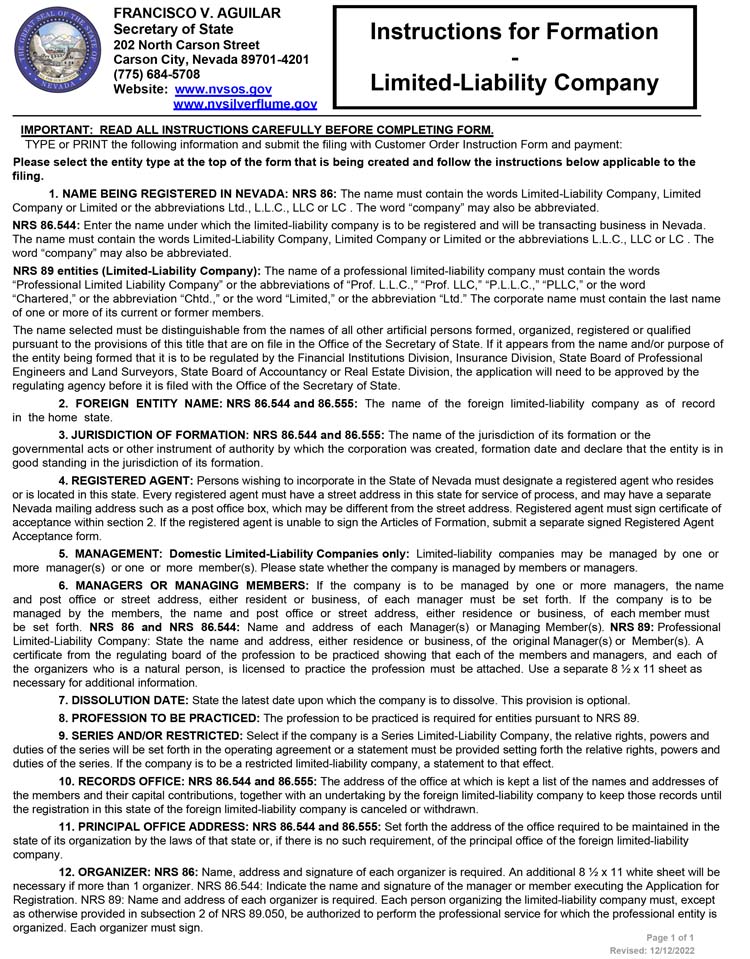

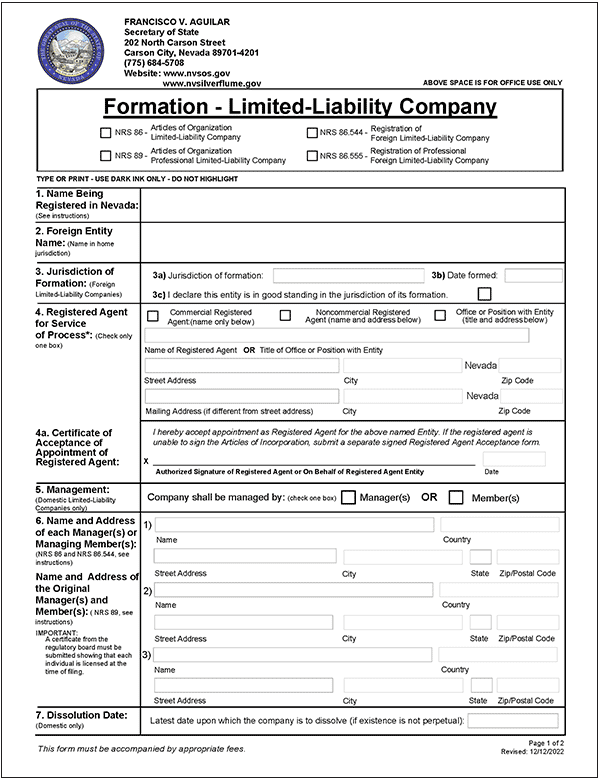

File the completed Application for SalesUse Tax Exemption for ReligiousCharitableEducational Organizations with a copy of your IRS determination letter to the Nevada. Sales and use tax is a common form of business taxation in the state of Nevada. Do you wish to get a NEW State Business License and are a Corporation Limited-Liability Company Limited Partnership Limited-Liability Partnership Limited-Liability Limited Partnership or Business Trust not yet on file with the Nevada Secretary of States office.

A service of the Nevada Department of Taxation. It also reflects the reduction of the collection allowance to 0005 or one half of a percent. Log In or Sign Up to get started with managing your business and filings online.

Estimated total Nevada monthly TAXABLE receipts. File and Pay Online. Nevada sales tax differs by county from 6 to 8 percent.

Local governments will provide penalties for companies that fail to comply with the proper collection reporting and payment of sales and use tax. 1 I Am Applying For. In order to register you will need the following information.

Sales tax is a tax. However depending on the nature of your business you may need to register for additional expenses. Dealers who have questions on the calculation of sales tax should contact the Title Section at 775 684-4810.

This allows your business to collect sales tax on behalf of your local and state governments. The standard monthly or quarterly tax return used by the majority of people reporting sales and use tax. Marketplace Facilitator Certificate of Collection.

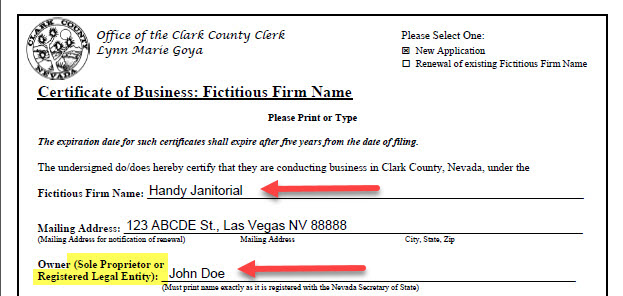

Nevada Sales Tax Application. The Nevada Tax Center a page on the Nevada Department of Taxations website allows you to register for a Sales or Use tax permit check for additional required permits manage your account and revise your. NEVADA BUSINESS REGISTRATION Please see instructions regarding form detail and online registration options.

SEND A COPY TO EACH AGENCY Unemployment Insurance Employment Security Division - ESD SalesUse Tax Permit Modified Business Tax Department of Taxation Local Business License. Utah dealers do not pay sales tax to Utah on out-of-state vehicle sales. Contact each states individual department of revenue for more about registering your business.

All Marketplace Facilitators are required to provide a copy of this. NEVADA BUSINESS REGISTRATION Please see instructions regarding form detail and online registration options. Effective July 1 2017 and pursuant to AB324 the fee to renew your Document Preparation Service registration is 25 non refundable and.

It is imperative that you renew on time pursuant to NRS 240A110 as you are required to submit an online application to renew your registration at least 30 days before the date of expiration. Application for a Single Business State Sales Tax Number. Nevada has no corporate tax and nonprofits are exempt from the annual business license fee if they obtain 501 c tax-exempt status with the IRS but your nonprofit will still need to apply for sales tax exemption if your purpose is religious charitable or educational.

General Purpose Forms Resale Certificate. SEND A COPY TO EACH AGENCY Unemployment Insurance Employment Security Division - ESD SalesUse Tax Permit Modified Business Tax Department of Taxation Local Business License. If so follow this link to find the appropriate forms and processes to register if a Nevada entity or qualify if a non-Nevada.

A Certificate of Registration is valid for one year and must be renewed annually. This form must be used when the holder of a sales tax permit purchases something that he will later. 188 BUSINESS STATE SALES TAX NUMBER.

NEVADA BUSINESS REGISTRATION FORM INSTRUCTIONS. Silver Flume SilverFlume Nevadas Business Portal first stop to start and manage your business in Nevada including new business checklist Nevada LLC Digital Operating Agreement real-time online entity formation State Business License Initial List Annual List State Business License renewal Sales Use Tax permit Taxation eClearance Receipt Workers Compensation eAffirmation of. The state of Nevada charges 1500 per application for a sales tax permit.

In areas where sales and use tax apply a seller must obtain a Sales Tax ID Number or Sellers Permit. 1 I Am Applying For.

How To Get A Sales Tax Exemption Certificate In Colorado Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Colorado Startingyourbusiness Com

Incorporate In Nevada Do Business The Right Way

How To Register For A Sales Tax Permit In Nevada Taxvalet

How To Register For A Sales Tax Permit In Nevada Taxvalet

Nevada Llc Registered Agent Truic Guide

Nevada Llc Registered Agent Truic Guide

Apostille Nevada Secretary Of State

Https Tax Nv Gov Uploadedfiles Taxnvgov Content Faqs Website 20close 20account 20form 20 205 14 19 Pdf

Https Tax Nv Gov Uploadedfiles Taxnvgov Content Forms Certificate 20of 20compliance 20letter 205 19 16 Pdf

Stumped How To Form An Illinois Llc The Easy Way

Nevada Llc How To Start An Llc In Nevada Truic Guides

Nevada Llc How To Start An Llc In Nevada Truic Guides

Stumped How To Form A Hawaii Llc The Easy Way

Stumped How To Form A Maryland Llc The Easy Way

How To Get A Nevada Resale Certificate Startingyourbusiness Com

How To Get A Nevada Resale Certificate Startingyourbusiness Com

Https Tax Nv Gov Uploadedfiles Taxnvgov Content Onlineservices Basic 20training Revised Pdf

New York Certificate Of Authority Foreign New York Corporation

Https Tax Nv Gov Uploadedfiles Taxnvgov Content Onlineservices Basic 20training Revised Pdf

Stumped How To Form A Nevada Llc The Easy Way

Https Tax Nv Gov Uploadedfiles Taxnvgov Content Forms Vol Dis 01 01 Voluntary Disclosure Pdf

Https Tax Nv Gov Uploadedfiles Taxnvgov Content Onlineservices Automotive 1 Pdf