Is Reimbursement For Mileage Considered Income

In the case of mileage reimbursement the dollar amount received is not taxable as income as long as it does not exceed the IRS limit which is 55 cents per mile in 2009. There is always a question of whether or not the reimbursement is taxable income when the employees self-employed freelancers and rideshare drivers consider issues regarding mileage reimbursement.

Policy Considerations For Mileage Reimbursement I T E I Fyle

Policy Considerations For Mileage Reimbursement I T E I Fyle

Has a business connection.

Is reimbursement for mileage considered income. Who pays the tax on reimbursed mileage to a 1099 independent contractor. Many do because its a smart way to attract and retain employees. An accountable plan is an expense allowance for reimbursement that follows these requirements.

Yes in general any money you pay an independent contractor is their income. Since an independent contractor is deemed to have their own business that expense is theirs to deduct. Yes its included in your taxable income because thats how its being reported to the IRS.

The tax impact varies depending on if its whats known as an accountable plan. The Non- Accountable Plan - If your employees do not provide proof of expenses for work car allowances or mileage reimbursement then you are considered a non-accountable employer by IRS standards. 0 found this answer helpful 2 lawyers agree.

However I have created two vendors codes mainly for small contractors one for reimbursed expenses like air travel and hotels not 1099 and another for their fees. Please note if they reimburse you at a higher rate than the Tax Office rate you will need to declare the excess as income when filing your tax return at the end of the financial year. Using the standard mileage rates on your taxes If youre deducting mileage on your taxes you can calculate your deduction amount using the standard rates.

Reimbursements made at the standard Internal Revenue Service rate are not considered income so they are not subject to tax. Adjusted Income Limitation Rates In essence the expenses covered by the medical mileage deduction cant exceed a certain point. This point is basically the percentage of your adjusted gross income.

Mileage Reimbursement by the IRS never be considered as income hence the tax for this can not be paid. Although you will pay income tax on your reimbursements you can deduct all mileage expenses despite receiving reimbursements. The IRS sets a standard mileage reimbursement rate.

Especially when they are turning oringial receipts. But you can deduct business mileage as a business expense which will subtract it from your taxable income. The excess payments made from the employer to an employee goes down as income but not salary.

If you offer mileage reimbursement that may impact an employees taxable income. But in order to report your income and expenses from a. For instance the rate from July 1 2020 is 072 per km.

Also the payment given to the employees as a mileage expense reimbursement. If your employer reimburses you 100 per km the excess 028 per km needs to be declared as income. While it is permitted to reimburse employees at any rate reimbursements in excess of the IRS standard rate are considered taxable income.

Not surprisingly the IRS demands from employees what it calls adequate accounting. Comply with IRS Rules Employees should only have to pay income taxes on the wages they earn and certain taxable fringe benefits. For 2020 the federal mileage rate is 0575 cents per mile.

Additionally it is not considered income to an employee and therefore is nontaxable. Depending on age as the most relevant factor there are two rates and two categories of adjusted income limitations. There is no law that says employers have to offer mileage reimbursement.

Anything you pay to a contractor is 1099 income. Mileage reimbursement is tax deductible for employers and independent contractors. Opposing counsel will likely argue that your spouse has to drive to and from work and does not get compensated for that gas mileage and ware and tear so it.

So for example if the employer gives an employee a 100 monthly mileage allowance and the employee only drives 100 miles that month the employee would need to return the excess 46 dollars based on the 54 cent per mileage reimbursement. A car allowance is considered as taxable income but the mileage driven may be tax-deductible. You will need to pay income tax on it and theres always the possibly it pushes you into a higher tax bracket.

Just know that any reimbursement above the standard mileage rates is taxable. Get every deduction you deserve TurboTax Deluxe searches more than 350 tax deductions and credits so you get your maximum refund guaranteed. Standard mileage reimbursement rate is exceeded.

Mileage reimbursement is compensation for ware and tear on your vehicle and gas costs hence it is not income. Reimbursements based on the federal mileage rate. For example if an employer reimburses an employee for mileage at more than the standard mileage rate then the excess is taxable income.

If an expense allowance is offered for mileage or other expenses then employees need to keep track of how much is spent and then give the employer back any excess.

Psa Payroll Checks How To Reimburse Employee Expenses Through Payroll Parishsoft

Psa Payroll Checks How To Reimburse Employee Expenses Through Payroll Parishsoft

Everything You Need To Know About Mileage Reimbursements

Everything You Need To Know About Mileage Reimbursements

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Is A Car Allowance Or Mileage Reimbursement Taxable Income

Is A Car Allowance Or Mileage Reimbursement Taxable Income

The Basics Of Employee Mileage Reimbursement Law Companymileage

The Basics Of Employee Mileage Reimbursement Law Companymileage

What Is The Average Company Car Allowance For Sales Reps

What Is The Average Company Car Allowance For Sales Reps

What You Need To Know About Creating The Best Vehicle Reimbursement

What You Need To Know About Creating The Best Vehicle Reimbursement

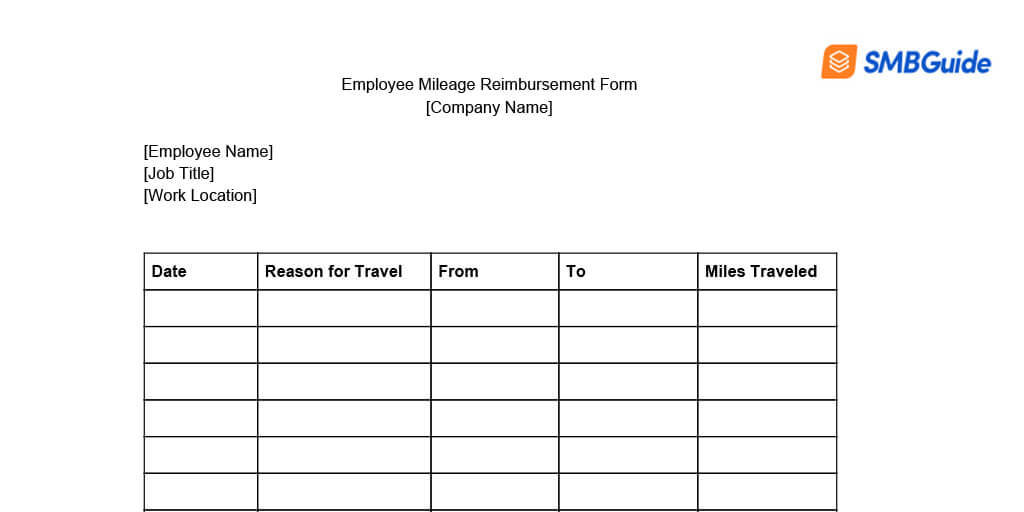

Mileage Reimbursement For Employees Info Free Download

Mileage Reimbursement For Employees Info Free Download

.png) Is Car Allowance Taxable Under Irs Rules I T E Policy I

Is Car Allowance Taxable Under Irs Rules I T E Policy I

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

How To Reimburse Employees For Mileage Expenses Car Allowance Vs Mileage Reimbursement

How To Reimburse Employees For Mileage Expenses Car Allowance Vs Mileage Reimbursement

Is A Car Allowance Or Mileage Reimbursement Taxable Income

Is A Car Allowance Or Mileage Reimbursement Taxable Income

Your Comprehensive Guide To 2019 Irs Mileage Reimbursement

Your Comprehensive Guide To 2019 Irs Mileage Reimbursement

Business Mileage Tracking Log Business Plan Template Free Daycare Business Plan Mileage Tracker

Business Mileage Tracking Log Business Plan Template Free Daycare Business Plan Mileage Tracker

Mileage Reimbursement For Employees Considered Taxable Wages

Mileage Reimbursement For Employees Considered Taxable Wages

Is A Mileage Reimbursement Taxable

Is A Mileage Reimbursement Taxable

2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

Is A Mileage Reimbursement Taxable

Is A Mileage Reimbursement Taxable

Non Profit Expense Reimbursement Guidelines And Best Practices

Non Profit Expense Reimbursement Guidelines And Best Practices