What Does Disregarded As An Entity Separate From Its Owner Mean

This is just for federal taxes though. A disregarded entity is a business structure other than a corporation that hasnt elected to be treated as a separate entity for federal tax purposes.

Disregarded Entity Irs Form Instructions W9manager

Disregarded Entity Irs Form Instructions W9manager

If your LLC is deemed a disregarded entity it simply means that in the eyes of the IRS your LLC is not taxed as an entity separate from you the owner.

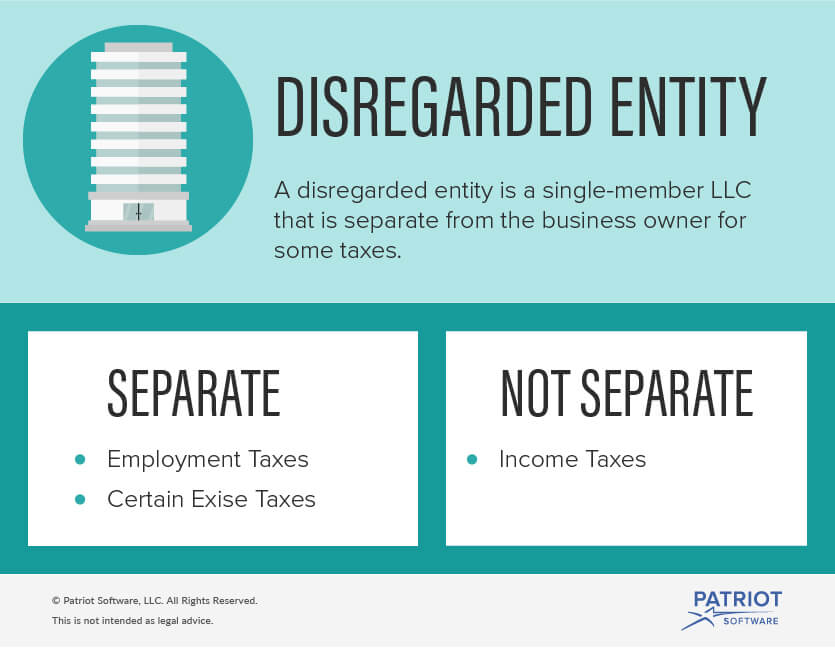

What does disregarded as an entity separate from its owner mean. For federal and state tax purposes the entity is disregarded meaning the entity does not file a separate tax return. For tax purposes the IRS treats the disregarded entity as part of the owners tax return. In other words these entities are regarded as separate in terms of liability but disregarded as separate in terms of taxation.

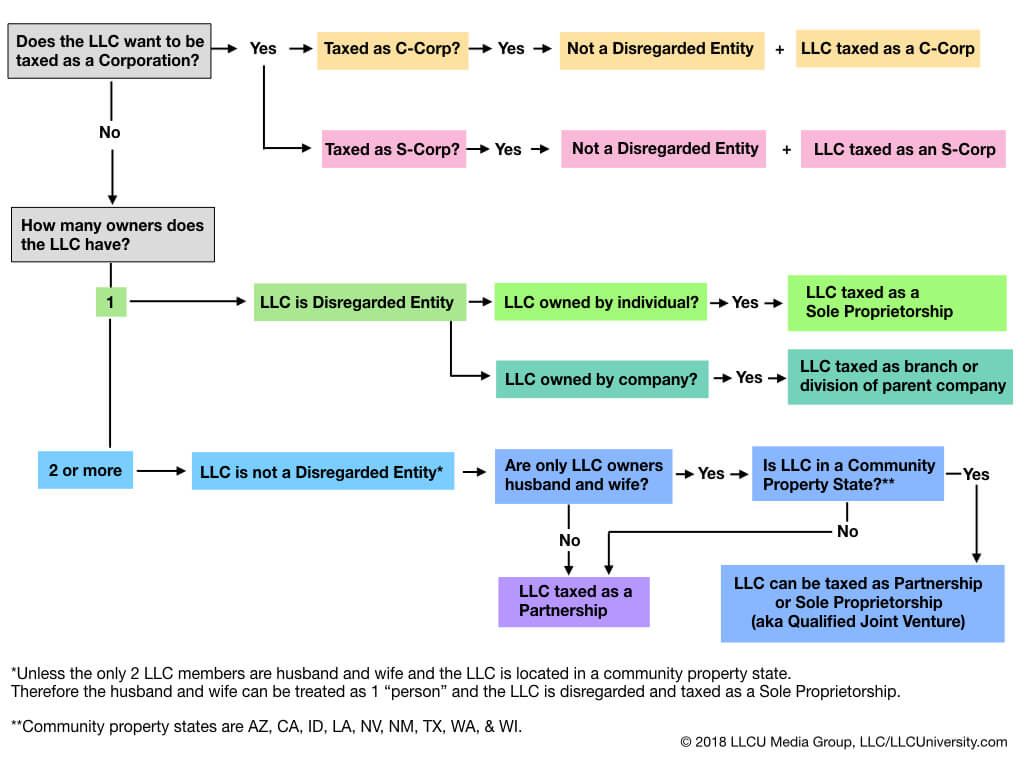

A single-member LLC SMLLC for example is considered to be a disregarded entity. Another way to say this is that the business is not separated from the owner for tax purposes. The business owner essentially wants the IRS to disregard the fact that the business is a.

A Disregarded Entity refers to a business entity owned by one person but is separate from its owner for liability purposes. The term disregarded entity refers to a business entity thats a separate entity from its owner but that is considered to be one in the same as the owner for federal tax purposes. An LLC is typically considered as a separate entity from the owners.

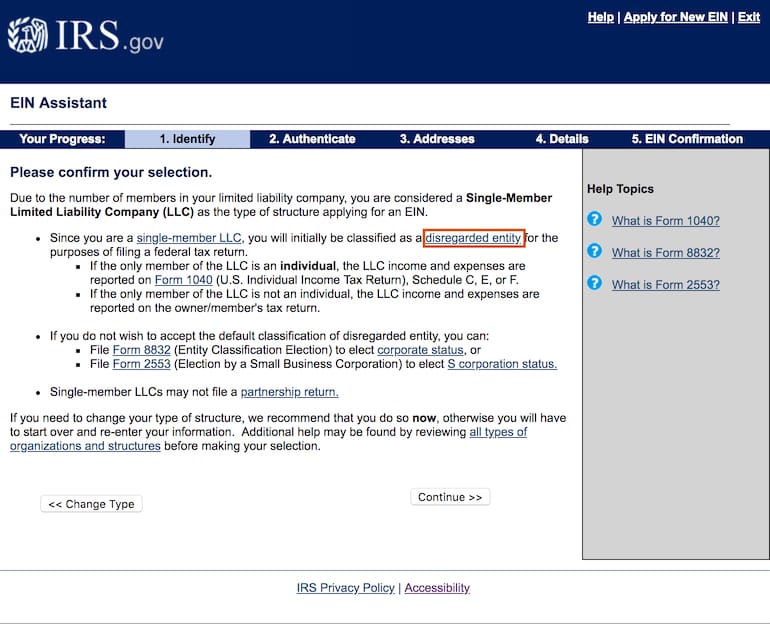

That means the business is not required to file its own tax return and instead the owner reports their business profits on their personal return. Federal tax purposes an entity that is disregarded as an entity separate from its owner is treated as a disregarded entity See Regulations section 3017701-2 c 2 iii. A disregarded entity is a single-member LLC.

The business has just one owner. 1 If this sounds like a double negative it is. However an LLC with only one member is disregarded as separate from its owner for income tax purposes.

However profits from it are reported on the owners personal tax returns. A disregarded entity is a one-person business structure thats not taxed separately from its owner. Enter the owners name on line 1.

A disregarded entity is a business entity considered separate from the owner when it comes to liability and the same as the owner for tax purposes. The name of the entity entered on line 1 should never be a disregarded entity. It must meet all three of these criteria.

Sole proprietorships and partnerships are not disregarded entities because the business does not exist as a separate entity from the owner. What is a disregarded entity. However for purposes of employment tax and certain excise taxes an LLC with only one member is still considered a separate entity.

1 3. A disregarded entity is a business unit that is separate from its owner except when it comes to taxes. Determining Disregarded Entity Status.

A disregarded entity is an incorporated business that is considered separate from the owner for liability purposes Point 1 above but is considered the same as the owner for tax purposes Point 2. An example of a disregarded entity is a single-member LLC as it absorbs the liabilities. Sole proprietorships and single-member LLCs are considered to be disregarded entities.

A disregarded entity refers to a business with one owner that is not recognized for tax purposes as an entity separate from its owner. The owner claims the business on personal taxes but when liability issues arise the owners personal assets are protected. A disregarded entity is a tax classification reserved for single-member limited liability companies LLC.

This is because the IRS disregards that the owner and business are separate from each other. Corporations are generally not disregarded for tax purposes. The IRS simply treats the LLC and its owner as the same person.

A disregarded entity refers to a business entity with one owner that is not recognized for tax purposes as an entity separate from its owner. For income tax purposes an LLC with only one member is treated as an entity disregarded as separate from its owner unless it files Form 8832 and affirmatively elects to be treated as a corporation. For legal purposes the LLC and its owner are still separate and the LLC still protects the personal assets of its owner.

Disregarded Entity is a term used by the IRS for Single-Member LLCs meaning that the LLC is ignored for tax purposes. In short a disregarded entity is a business that is not considered to be a separate entity from its owner for tax purposes. When you register your LLC with the state to form your business the Internal Revenue Service actually doesnt recognize that LLC as a business that needs to pay taxes.

The term disregarded entity refers to how a single-member limited liability company LLC may be taxed by the Internal Revenue Service IRS. A disregarded entity is a business that is separate from its owner but which elects to be disregarded as separate from the business owner for federal tax purposes.

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

Do I Need To File A Tax Return For An Llc With No Activity Legalzoom Com

Do I Need To File A Tax Return For An Llc With No Activity Legalzoom Com

What Is A Disregarded Entity Llc Legalzoom Com

What Is A Disregarded Entity Llc Legalzoom Com

What Is A Disregarded Entity Llc Llc University

What Is A Disregarded Entity Llc Llc University

Is The Single Member Llc A Solution For Me Mark J Kohler

Is The Single Member Llc A Solution For Me Mark J Kohler

What Is A Disregarded Entity And How Does It Affect Your Taxes

What Is A Disregarded Entity And How Does It Affect Your Taxes

What Is A Disregarded Entity Llc Llc University

What Is A Disregarded Entity Llc Llc University

How Do I Pay Myself From My Llc Salary Or Draw Bizfilings

How Do I Pay Myself From My Llc Salary Or Draw Bizfilings

What Is A Disregarded Entity Llc

What Is A Disregarded Entity Llc

Is An Llc Required To Have A Separate Bank Account Legalzoom Com

Is An Llc Required To Have A Separate Bank Account Legalzoom Com

Pros And Cons Of Being A Disregarded Entity Legalzoom Com

Pros And Cons Of Being A Disregarded Entity Legalzoom Com

Disregarded Entities What Is A Disregarded Entity Nav

Disregarded Entities What Is A Disregarded Entity Nav

Free Report What Does It Mean To Respect Corporate Formalities In Arizona Lotzar Law Firm P C Law Firm Corporate Business Perspective

Free Report What Does It Mean To Respect Corporate Formalities In Arizona Lotzar Law Firm P C Law Firm Corporate Business Perspective

7 Common Questions About Foreign Owned U S Llcs Answered By A Cpa O G Tax And Accounting

7 Common Questions About Foreign Owned U S Llcs Answered By A Cpa O G Tax And Accounting

What Is A Disregarded Entity Single Member Llc

What Is A Disregarded Entity Single Member Llc

Pros And Cons Of Being A Disregarded Entity Legalzoom Com

Pros And Cons Of Being A Disregarded Entity Legalzoom Com

Chief White Cloud Books Nooks Native American Quotes Native American Wisdom Native Indian

Chief White Cloud Books Nooks Native American Quotes Native American Wisdom Native Indian

What Is A Disregarded Entity Single Member Llc

What Is A Disregarded Entity Single Member Llc

Do I Have To Register As A Foreign Business Entity A Guide To Doing Business In Arizona Law Firm Income Tax Business Perspective

Do I Have To Register As A Foreign Business Entity A Guide To Doing Business In Arizona Law Firm Income Tax Business Perspective