Indiana Business Tax Extension Form

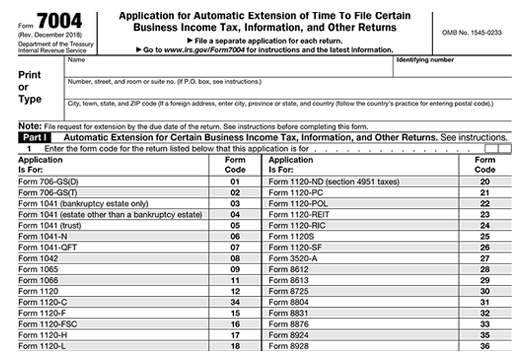

When amending for tax periods beginning after 12312018 use the Form IT-20 for that tax period and check the Amended box that fits your situation. E-filing Form 7004 Application for Automatic Extension to File Certain Business Income Tax Information and Other Returns Form 7004 can be e-filed through the Modernized e-File MeF platform.

What Is A Schedule C Tax Form H R Block

What Is A Schedule C Tax Form H R Block

Indiana offers an automatic 6-month extension to businesses that have a valid Federal extension IRS Form 7004 which moves the filing deadline to October 15 ie.

Indiana business tax extension form. County Rates Available Online-- Indiana county resident and nonresident income tax rates are available via Department Notice 1. ATTENTION-- ALL businesses in Indiana must file and pay their sales and withholding taxes electronically. Filing this form gives you until Oct.

If not you may file Form IT-9 to request an extension with Indiana. Indiana Department of Revenue is launching a new e-services portal to manage your corporate and business tax obligations. Economic Development for a Growing Economy Credit.

Form 4868 Addresses for Taxpayers and Tax Professionals If you live in. If you work in or have business income from Indiana youll likely need to file a tax return with us. Quarterly income tax return is due on the 20th day of the fourth sixth ninth and 12th months of the tax year.

Indiana Filing Due Date. Indiana Corporate Estimate Quarterly Income Tax ReturnExtension Payment. Extended Deadline with Indiana Tax Extension.

About Form 7004 Application for Automatic Extension of Time To File Certain Business Income Tax Information and Other Returns. Both the federal extension Form 4868 and Indiana extension Form IT. Indiana Department of Revenue.

To get started click on the appropriate link. To apply for an Indiana business extension mail your written request to the following address. Forms downloaded and printed from this page may be used to file taxes unless otherwise specified.

15 to file a return. E-file Your Extension Form for Free Individual tax filers regardless of income can use Free File to electronically request an automatic tax-filing extension. If you owe Indiana state taxes you must pay the tax due by the regular due date.

Indiana Department of Revenue Indiana Nonprofit Organization Unrelated Business Income Tax Return Calendar Year Ending December 31 2017 or Fiscal Year Beginning 2017 and Ending Check box if. Indiana Form IT-20X Amended Tax Return for Form IT-20. The state of Indiana provides the automatic extension of time to file business income tax returns with the State if the businesses have filed the federal extension Form 7004 and it is approved by the IRS.

To get the extension you must estimate your tax liability on this form. Business Tax Forms Download Here. Select the appropriate form from the table below to determine where to send the Form 7004 Application for Automatic Extension of Time to File Certain Business Income Tax Information and Other Returns File Form 7004 based on the appropriate tax form shown below.

INtax - Log In or Create new Account INtax will continue to provide the ability to file and pay for the following tax types until July 2022. Corporate Tax Forms Download Here. Federal tax forms such as the 1040 or 1099 can be found on the IRS website.

If an extension of time to file is not requested with the Internal Revenue Service using. More In Forms and Instructions. Indiana Department of Revenue.

Form 7004 a special extension of time to file a business income tax return with the state must be requested. Indianapolis IN 46204-2253 Form E-6 Request for Indiana Corporate Estimated Quarterly Income Tax Return Extension Payment. You filed for a federal extension of time to file Form 4868 by April 15 2020 then you automatically have an extension with Indiana.

Economic Development for a Growing Economy Retention Credit. And you ARE NOT. Whether youre a large multinational company a.

All the returns shown on Form 7004 are eligible for an automatic extension of time to file from the due date of the return. You can also pay the tax due online using httpsdorpaydoringov or mailing your Form. Indiana Current Year Tax Forms.

Information on e-filing Form 7004. Nonprofit organizations and farmers cooperatives have different annual filing dates. Use Form IT-9 Extension form to mail in a check or money order.

Business tax returns are due by April 15 or by the 15 th day of the 4 th month following the end of the taxable year for fiscal year filers. The form and any payment due should be sent to. Indiana Disaster Recovery Exemption.

If you do not have a federal extension of time to file and you cannot file by the April 15 2021 due date complete and file an Application for Extension of Time to File Form IT-9 on or before April 15. The fifth quarter extension form is to be used when a payment is due and. This extends the due date to Nov.

If not penalties and interest will be charged. To file andor pay business sales and withholding taxes please visit INTIMEdoringov. See IT-20 Corporate Income Tax booklet for details at wwwingovdor3489htm.

Use this form to amend Indiana Corporate Form IT-20 for tax periods beginning before 01012019. Use Form 7004 to request an automatic 6-month extension of time to file certain business income tax information and other returns.

Understanding The 1065 Form Scalefactor

Understanding The 1065 Form Scalefactor

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

What To Know About Filing A Business Tax Extension Businessnewsdaily Com Tax Extension Tax Refund Tax Exemption

What To Know About Filing A Business Tax Extension Businessnewsdaily Com Tax Extension Tax Refund Tax Exemption

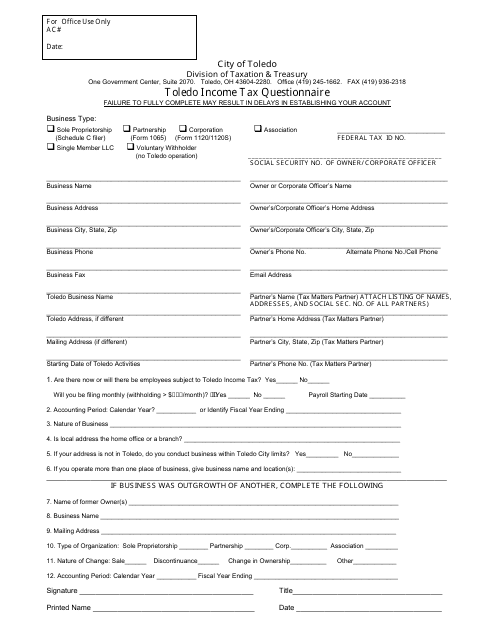

City Of Toledo Ohio Toledo Income Tax Questionnaire Form Download Fillable Pdf Templateroller

City Of Toledo Ohio Toledo Income Tax Questionnaire Form Download Fillable Pdf Templateroller

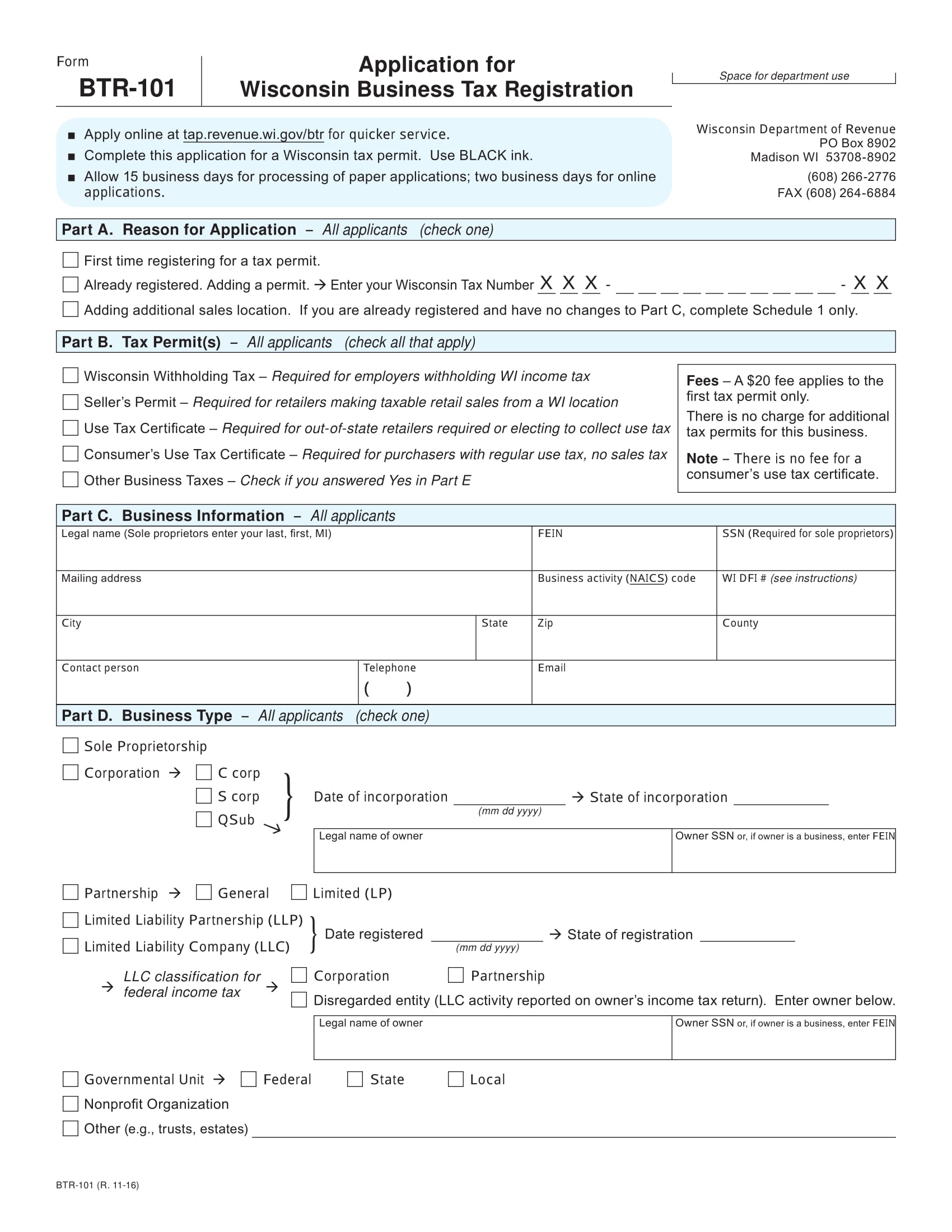

Fillable Form 7004 2018 V 1 Irs Forms Tax Extension Tax Forms

Fillable Form 7004 2018 V 1 Irs Forms Tax Extension Tax Forms

What Is A Schedule C Tax Form H R Block

What Is A Schedule C Tax Form H R Block

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

Free 20 The Taxpayer S Guide To Tax Forms In Pdf Ms Word Excel

Free 20 The Taxpayer S Guide To Tax Forms In Pdf Ms Word Excel

How To File A Business Tax Extension Daveramsey Com

How To File A Business Tax Extension Daveramsey Com

Understanding Your Federal Farm Income Taxes Income Tax Federal Income Tax Understanding Yourself

Understanding Your Federal Farm Income Taxes Income Tax Federal Income Tax Understanding Yourself

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

W 9 Form For Non Profits How To Fill It And Purpose Of The W 9 Form Form Applications In United States Application Gov

W 9 Form For Non Profits How To Fill It And Purpose Of The W 9 Form Form Applications In United States Application Gov

E File Irs Form 7004 Business Tax Extension Form 7004 Online

E File Irs Form 7004 Business Tax Extension Form 7004 Online

3 11 16 Corporate Income Tax Returns Internal Revenue Service

3 11 16 Corporate Income Tax Returns Internal Revenue Service

How To Fill Out Tax Form 7004 Tax Forms Irs Tax Forms Income

How To Fill Out Tax Form 7004 Tax Forms Irs Tax Forms Income

Tax Memo Onlyfans Content Creator Income Is Taxable Include It On Your Tax Returns Chris Whalen Cpa

Tax Memo Onlyfans Content Creator Income Is Taxable Include It On Your Tax Returns Chris Whalen Cpa

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

State Of Texas Sales Tax Exemption Form Fresh 25 Pertaining To Resale Certificate Request Letter Template Letter After Interview Lettering Letter Sample

State Of Texas Sales Tax Exemption Form Fresh 25 Pertaining To Resale Certificate Request Letter Template Letter After Interview Lettering Letter Sample