How Does The Ppp Small Business Loan Work

What you may not have known is that sole proprietors independent contractors and gig workers are also eligible for PPP. The SBA created a primer for businesses applying for their first PPP loans that explains various companies calculations.

Ppp Small Business Loan Application Sba Downloadable Coronavirus Relief Form Cpa Practice Advisor

Ppp Small Business Loan Application Sba Downloadable Coronavirus Relief Form Cpa Practice Advisor

Employee and compensation levels are maintained The loan proceeds are spent on payroll costs and other eligible expenses.

How does the ppp small business loan work. Please have the following documents ready when you apply. Small enterprises or NGOs with 500 or fewer employees are entitled to other SBA 7a loans. According to the SBA over 5 million businesses received loans through this funding program.

The loan proceeds are used to cover payroll costs and most mortgage interest rent and. The federal Paycheck Protection Program PPP reopens this month with an additional 284 billion that entrepreneurs can borrow to help keep their businesses afloat. The funds received by small businesses can be fully forgiven if used in a way approved by the Small Business Administration SBA If youve secured a first or applied for a second SBA Paycheck Protection Program loan in 2021 its important to calculate your payroll costs and determine how you will use the funds to keep your business stable.

When the coronavirus pandemic forced businesses across the country to close the government created the Paycheck Protection Program PPP to give small businesses an immediate influx of cash via forgivable loans. The Paycheck Protection Program PPP was created under the CARES Act to provide a financial lifeline to small businesses during the COVID-19 pandemic. The loan can be forgiven if.

That means using the bulk of your funds at least 60 on payroll costs. If the money is spent on payroll and other approved expenses the PPP loan can convert to. First Draw PPP loans made to eligible borrowers qualify for full loan forgiveness if during the 8- to 24-week covered period following loan disbursement.

The loan amounts will be forgiven as long as. Small companies 501c19 veterans organizations tribal businesses and small-sized agricultural cooperatives who match SBAs size standards. All loan terms will be the same for everyone regardless of which lender they use to obtain their loan.

Small businesses and nonprofits were able to apply for loans that matched up to 25. Your PPP loan essentially becomes a grant provided you use the proceeds as outlined by the Small Business Administration. The Paycheck Protection Program PPP authorizes up to 349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis.

Through the PPP businesses with up to 500 employees and some other companies can receive a loan for 25 times their monthly payroll costs up to 10 million. First-Draw PPP loans are available for the lesser of 10 million or 25 times your average monthly payroll. All loan terms will be the same for everyone.

The Paycheck Protection Program PPP authorizes up to 669 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis. For first-time PPP loans businesses and nonprofits can apply for a maximum loan amount equal to 25 times their average monthly 2019 payroll or a maximum of 10 million. You can apply for the new PPP loan if you are a sole proprietor Independent Contractor or self-employed.

If you have previously received a Paycheck Protection Program PPP loan certain businesses are eligible for a Second Draw PPP loan. The Small Business Administrations PPP loans gave billions of dollars to encourage small business owners to maintain their payroll and keep their workers employed. An SBA-backed loan that helps businesses keep their workforce employed during the COVID-19 crisis.

3 Heres the math for small businesses. The Biden administration announced several changes to the Paycheck Protection Program this week more strictly limiting which small businesses are eligible to receive forgivable loans. Second-Draw loans up to 2 million are available for.

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

How To Fill Out The Ppp First Draw Application Form Tom Copeland S Taking Care Of Business

How To Fill Out The Ppp First Draw Application Form Tom Copeland S Taking Care Of Business

Top Ppp Loan Lenders Updated Approved Banks Providers

Ppp Small Business Loan Application Sba Downloadable Coronavirus Relief Form Cpa Practice Advisor

Ppp Small Business Loan Application Sba Downloadable Coronavirus Relief Form Cpa Practice Advisor

Paycheck Protection Program How It Works Funding Circle

Paycheck Protection Program How It Works Funding Circle

Why Smbs Can T Wait Long For The Sba S Ppp Pymnts Com

Why Smbs Can T Wait Long For The Sba S Ppp Pymnts Com

Small Business Administration Sba Loans Immediately Available To Child Care Providers First Five Years Fund

Small Business Administration Sba Loans Immediately Available To Child Care Providers First Five Years Fund

New Ppp Loan Rules Make More Money Available To Artists And Other One Person Businesses Cerf

New Ppp Loan Rules Make More Money Available To Artists And Other One Person Businesses Cerf

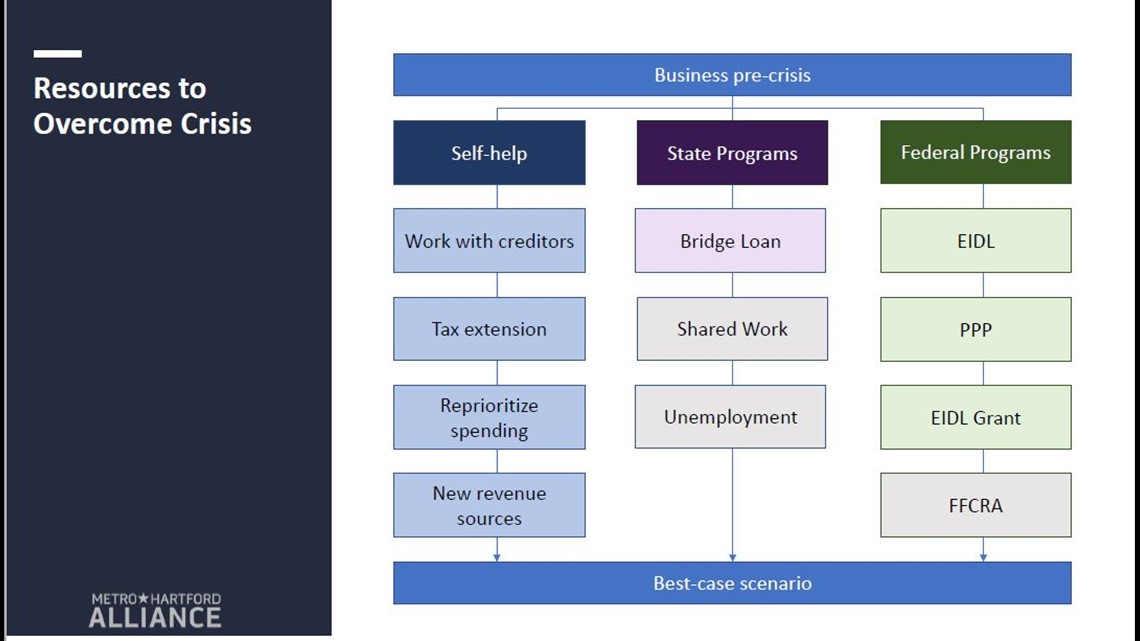

Guide To Small Business Administration Loans Fox61 Com

Guide To Small Business Administration Loans Fox61 Com

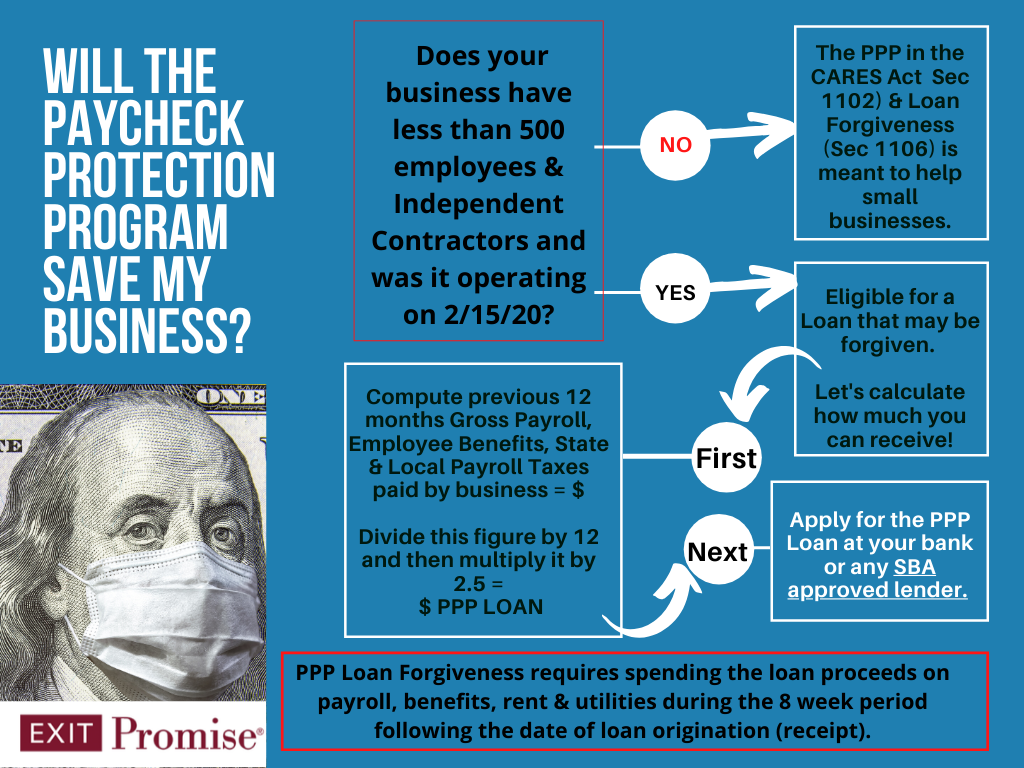

How The Paycheck Protection Loans Work Exit Promise

How The Paycheck Protection Loans Work Exit Promise

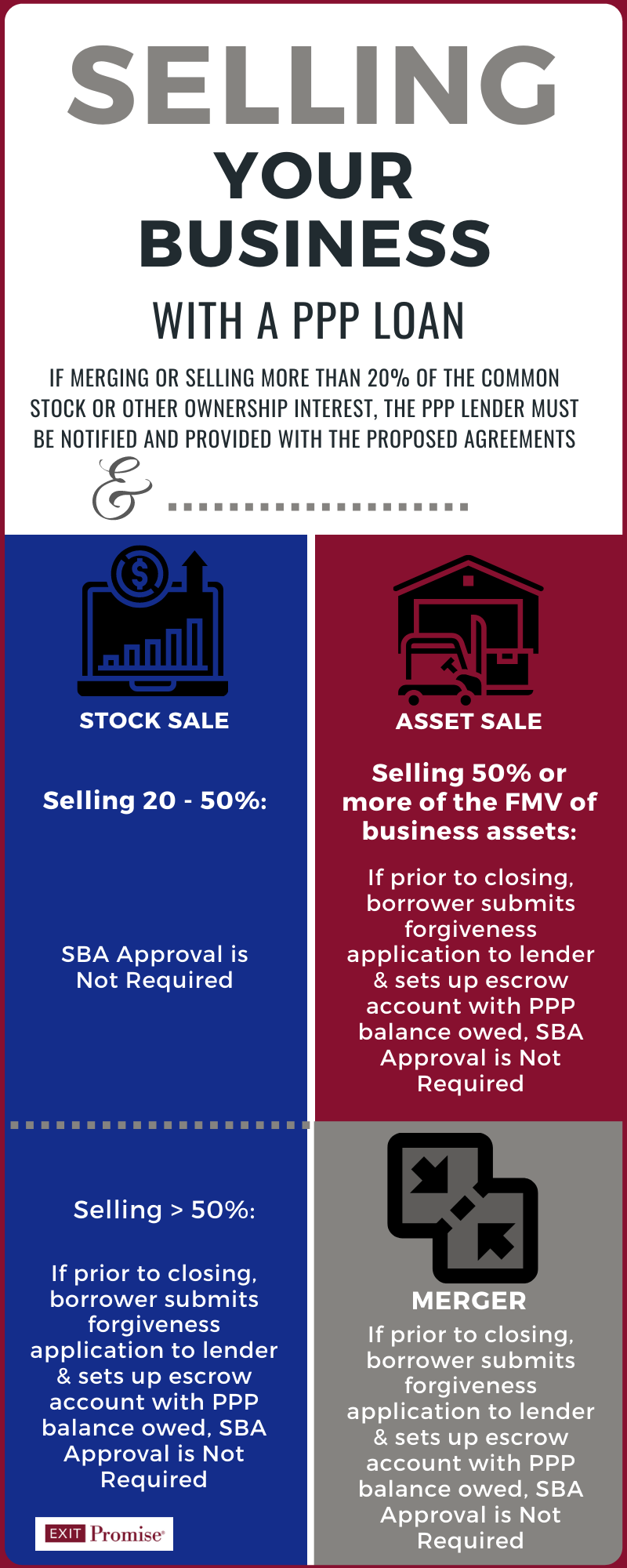

Ppp Loan When Selling A Business Exit Promise

Ppp Loan When Selling A Business Exit Promise

How To Make Sense Of The Ppp Loan Program For Vc Backed Startups By Mark Suster Both Sides Of The Table

How To Make Sense Of The Ppp Loan Program For Vc Backed Startups By Mark Suster Both Sides Of The Table

Sba Paycheck Protection Ppp Loans For Construction How To Apply

Sba Paycheck Protection Ppp Loans For Construction How To Apply

How To Apply For The Sba Payroll Protection Program Loan Simple Guide

How To Apply For The Sba Payroll Protection Program Loan Simple Guide

Small Business Entrepreneurship Council

Small Business Entrepreneurship Council

Ppp Loan Program Extended Loan Data Released What Small Businesses Need To Know

Ppp Loan Program Extended Loan Data Released What Small Businesses Need To Know

Paycheck Protection Program How It Works Funding Circle