Business Mileage Reimbursement Hmrc

For example if an employee travels 8000 business miles in their fully electric company car they can receive 320 in mileage for the tax year free of tax or NIC. 45p per mile is the tax-free approved mileage allowance for the first 10000 miles in the financial year its 25p per mile thereafter.

What You Need To Know About Owner Operator Vs Company Driver Taxes Right Now Trucking Business Tax Company

What You Need To Know About Owner Operator Vs Company Driver Taxes Right Now Trucking Business Tax Company

UPDATED FEB 26 2021.

Business mileage reimbursement hmrc. Authorised rates for business mileage reimbursement AMAP for private cars and vans utilised for business use are set by HMRC at 45p per mile for the first 10000 business miles and then 25p per mile thereafter. HMRC do allow the reimbursement of business mileage in company cars at a rate higher than AFR but will allow it to be paid without tax only if there is a robust system for calculating the true cost of mileage. The MAP is based on the actual business miles you have driven and is usually in line with the advisory rate by HMRC which covers costs such as.

HMRC calls this rate the Advisory Electricity Rate AER. With effect from 1 September 2018 the official mileage rate for electric company cars is 4 pence per mile. Trips to the bank and post office also qualify as business mileage if documented.

You must separate out personal driving from business driving by keeping contemporaneous records at the time of. Reimbursements over the above AMAP rates are taxable on the employee and must be reported to HMRC. Mileage Allowance Payments MAPs are what you pay your employee for using their own vehicle for business journeys.

In cases like these payment is approved and do not need to be reported by HMRC. If self employed mileage VAT costs can be reclaimed as a simple tax relief for motoring expenses. Heres what you should know.

Although you are responsible for any vehicle expenses as listed above your business mileage can be reimbursed through MAPs and paid out by your employer monthly. Only payments specifically for carrying passengers count and. You can also claim an extra 5p per mile if you have a passenger with you on a business drive.

However you may be able to claim the costs of buying a bicycle for work and consumables such as tyres or maintenance. His employer pays him 45p per mile for all business mileage. Welcome to our guide on mileage schemes reimbursement in the United Kingdom.

Employees can claim 45p per mile for the first 10000 business miles in the financial year and 25p per mile thereafter. If so HMRC lets you claim mileage tax relief. Ravis business mileage was 12000 miles.

If a business chooses to pay employees an amount towards the mileage costs these reimbursements are called Mileage Allowance Payments MAPs. Mileage allowance more than AMAP rate. If the drive is for business purposes you can claim tax back from HMRC.

Did you know you can also claim an extra 5p per mile if you have a passenger with you on a business drive. Any reimbursement by the employer for business mileage is tax and NIC free provided its no higher than the above AMAP rates. Mileage tax relief allows you to deduct the cost of business-related journeys from your salary or overall income.

The rates apply for any business journeys you make between 6 April 2018 and 5 April 2019. In this guide youll find a collection of articles to help you understand Her Majestys Revenue Customs HMRC business mileage. HMRC do not allow business mileage to be claimed by sole traders using a bicycle which is rather unfortunate for those green-minded among you or even cycle couriers.

AMAP rates for reclaiming business mileage. And when employees drive their company car on private journeys they will use the AER to repay the cost of electricity at 4p per mile. Ravi uses his own car for business travel.

From 1st September 2018 employees driving on business in a pure electric company car can claim 4p per mile. The business purpose should be the reason for the trip and you will need to have excellent records on the purpose in order to document the deduction. This means youll pay less tax to HMRC.

Youre allowed to pay your employee a certain amount of MAPs each year without. 5p per passenger per business mile for carrying fellow employees in a car or van on journeys which are also work journeys for them. HMRC obliged and issued a new electric car business allowance called the advisory electric rate AER.

Theyre identical to the rates that applied during 2017-18. The AMAP rate for a car for the first 10000 miles is 45p per mile and 25p per mile after that. Well also show you how to calculate your mileage deduction.

The latest business mileage rates or Approved Mileage Allowance Payments AMAP are. In the tax year 202021 he travelled 12000 miles on business. Instead of keeping records of all receipts and then separating business and personal use you can simply claim 45p per mile or 25p for mileage over 10000 on business mileage.

Our guide to HMRCs rules on mileage reimbursement. With this in mind heres a definitive look at the UKs business mileage-allowance rates for 2019-2020.

Mileage Log Form For Taxes Inspirational Free Mileage Log Templates Blog Business Plan Template Business Plan Template Mileage

Mileage Log Form For Taxes Inspirational Free Mileage Log Templates Blog Business Plan Template Business Plan Template Mileage

The Irs Mileage Deduction Lets You Write Off Miles For Taxes See The Standard Mileage Rates For 2017 2016 Amp Previous Mileage Deduction Mileage Guide Book

The Irs Mileage Deduction Lets You Write Off Miles For Taxes See The Standard Mileage Rates For 2017 2016 Amp Previous Mileage Deduction Mileage Guide Book

Free 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes Template Excel Report Template Templates Business Template

Free 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes Template Excel Report Template Templates Business Template

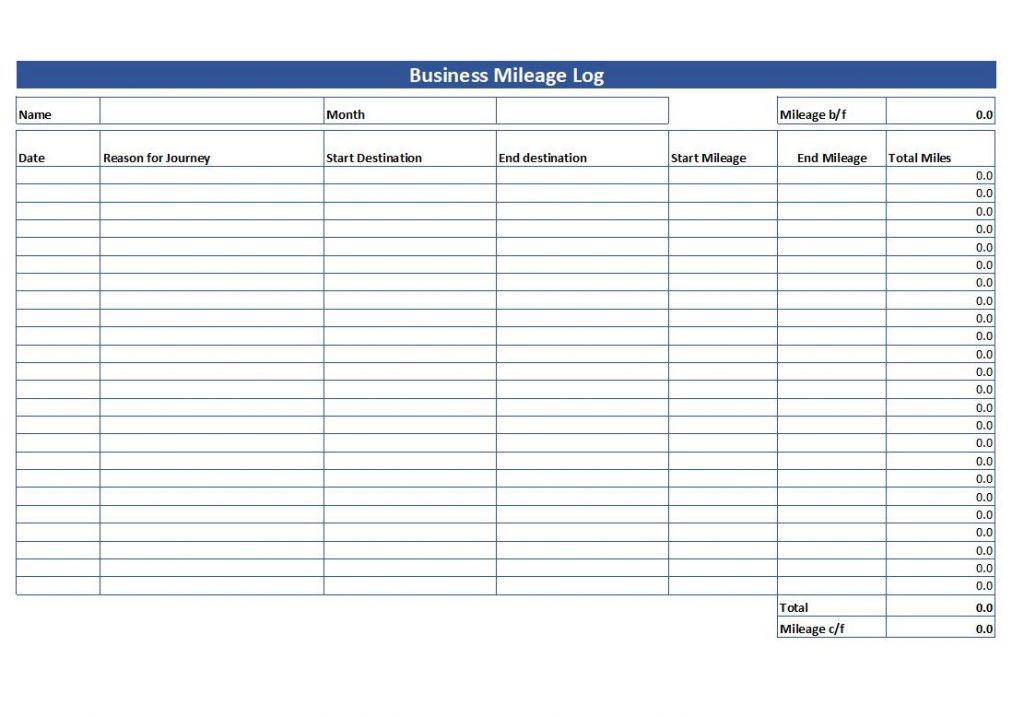

Simple Mileage Log Free Mileage Log Template Download

Simple Mileage Log Free Mileage Log Template Download

Mileage Reimbursement Form Template Mileage Log Printable Mileage Printable Mileage

Mileage Reimbursement Form Template Mileage Log Printable Mileage Printable Mileage

Mileage Log Form For Taxes Awesome Mileage Tracker Printable Bud More Mileage Tracker Printable Mileage Tracker Mileage Log Printable

Mileage Log Form For Taxes Awesome Mileage Tracker Printable Bud More Mileage Tracker Printable Mileage Tracker Mileage Log Printable

Business Mileage Chart Mileage Chart Chart Mileage

Business Mileage Chart Mileage Chart Chart Mileage

What Are The Business Mileage Rates For Employees Vehicles

What Are The Business Mileage Rates For Employees Vehicles

Premium Vehicle Auto Mileage Expense Form Mileage Tracker Mileage Tracker Printable Mileage Tracker App

Premium Vehicle Auto Mileage Expense Form Mileage Tracker Mileage Tracker Printable Mileage Tracker App

Vehicle Mileage Log Expense Form Free Pdf Download Mileage Log Printable Mileage Tracker Printable Mileage

Vehicle Mileage Log Expense Form Free Pdf Download Mileage Log Printable Mileage Tracker Printable Mileage

Uk Business Mileage Rates 2021 Car Petrol Allowances

Uk Business Mileage Rates 2021 Car Petrol Allowances

Automating Mileage Claims In The Uk Mileage App Mileage Tracking App About Uk

Automating Mileage Claims In The Uk Mileage App Mileage Tracking App About Uk

How To Claim Business Mileage Why It S Ok For The Business

How To Claim Business Mileage Why It S Ok For The Business

Daily Mileage Worksheet Printable Worksheets And In Gas Mileage Expense Report Template Great Cretive Templates Professional Templates Gas Mileage Mileage

Daily Mileage Worksheet Printable Worksheets And In Gas Mileage Expense Report Template Great Cretive Templates Professional Templates Gas Mileage Mileage

3 Ways To Record Business Miles Wikihow

3 Ways To Record Business Miles Wikihow

Calculate Business Mileage Using Hmrc S Rates For 2018 Mileiq Uk

Calculate Business Mileage Using Hmrc S Rates For 2018 Mileiq Uk

Mileage Expense Form Template Free Unique Business Mileage Claim Form Template Versatolelive Templates Funeral Program Template Medical Assistant Resume

Mileage Expense Form Template Free Unique Business Mileage Claim Form Template Versatolelive Templates Funeral Program Template Medical Assistant Resume

Hmrc Form P87 What You Need To Know For Taxes

Hmrc Form P87 What You Need To Know For Taxes

Vehicle Mileage Log Expense Form Free Pdf Download Mileage Log Printable Mileage Car Maintenance

Vehicle Mileage Log Expense Form Free Pdf Download Mileage Log Printable Mileage Car Maintenance