What Paperwork Is Needed For A Sole Proprietorship

Regulations vary by industry state and locality. 9 rows 944 Employers Annual Federal Tax Return.

The sole trader receives all profits subject to.

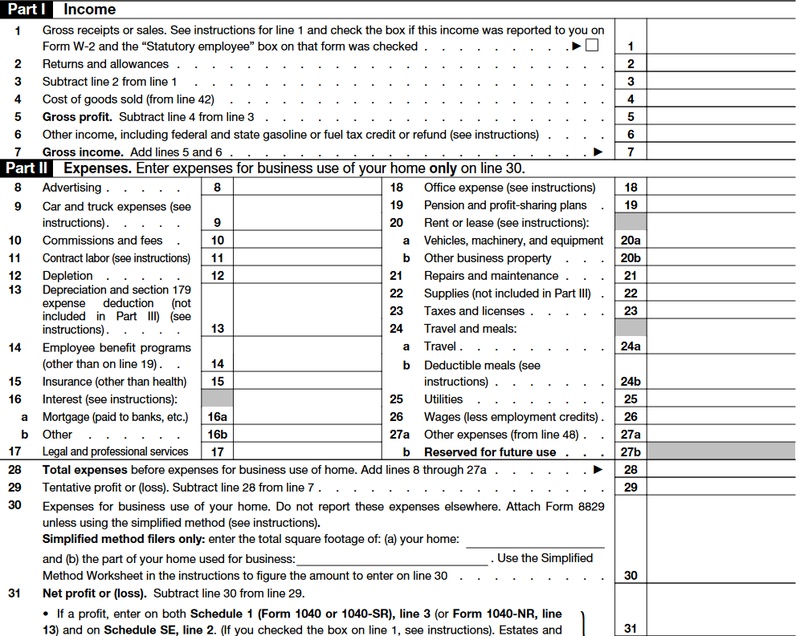

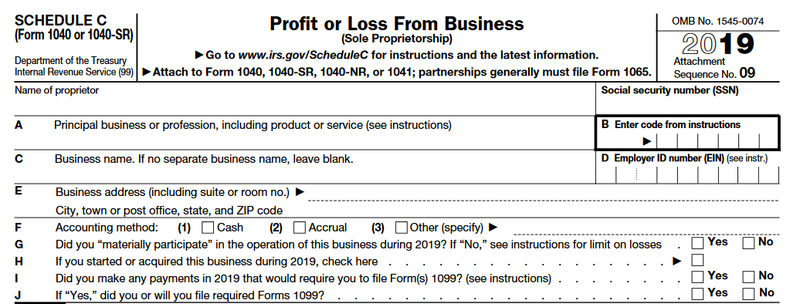

What paperwork is needed for a sole proprietorship. Forms for Sole Proprietorship. You can find Form 1040 instructions here and the instructions for Schedule C here. Other Documents The other documents that are also required for the registration of sole proprietorship are Voter Id Passport Driving License Electricity Bills copy or gas bill or phone bill Personal Bank Account Cancel Cheque Bank Statement and Passbook FrontPage etc.

Providing information on social. The Following IRS forms. There are two separate types of corporation ownership and this affects the type of proof that is needed.

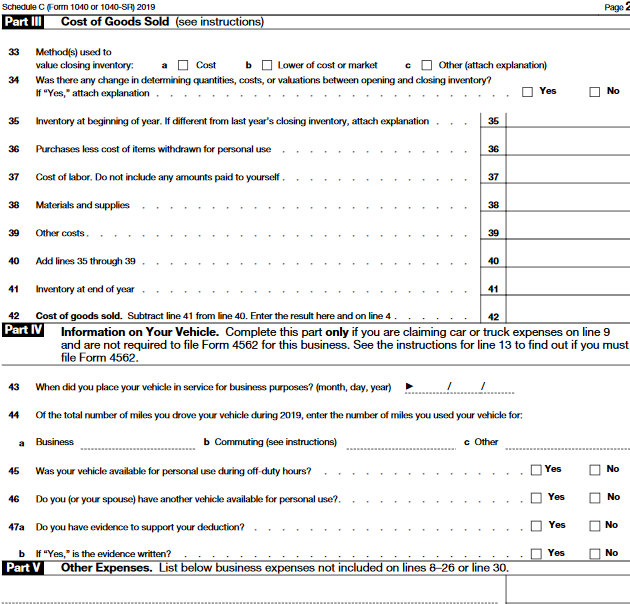

The documents needed to start a sole proprietorship will depend on the type of business youre registering. 2019 IRS Form 940 for any unemployment costs. Sole Proprietorship Self Employed with Employees 1.

How to Start a Sole Proprietorship. Use the Licensing Permits tool to find a listing of federal state and local permits licenses and registrations youll need to run a business. Sole proprietors who will be collecting BusinessTrustee Taxes need to.

What Are the Key Documents Needed for a Sole Proprietorship. 2019 IRS Form 941 for quarterly salary wages commissions and tips. A sole proprietor doesnt need to have a current account for the business transaction.

W-2 Wage and Tax Statement and W-3 Transmittal of Wage and Tax Statements. Drivers License Photo ID 2. What tax forms to use as a sole proprietorship.

A sole proprietor engaged in a regulated trade or profession must also obtain a. If you operate as a sole proprietor youll need to submit your 2019 IRS Form 1040-C. PPP Documents Needed.

File a Schedule C. If you are a freelance writer for example you are a sole proprietor. To set up a sole proprietorship business all you need an Aadhaar and PAN number.

Report wages tips and other compensation and withheld income social security and Medicare taxes for employees. The specific paperwork necessary for this registration varies by state. Personal Questionnaire If the Sole Proprietor is married and the spouse does not have community property interest in the business you are required to provide a partition agreement or other evidence indicating the spouse does not have community property interest in the business.

The main form is Schedule C on IRS Form 1040. Service Business If you are planning to have services company and you will not have any. If your sole proprietorship has a name other than your own in most states you must register it as a trade name or doing business as name with the state in which you operate the business.

The business owner uses their own tax ID number to claim the businesss profits and losses. Trade Permit or Professional License. An S Corporation is closely aligned with a sole proprietorship.

Use this form to -. S Corporation owners can prove business ownership with the following documents. Every business owner including sole proprietors must obtain a business license from either the.

2019 IRS Form 944 annualized. It the standard form of business among the entrepreneurs and they operate in the form of small shops kiosks or direct services such as cobblers and salons. Sole proprietorship documents are any forms required in the state in which your sole proprietorship is operating in order to legally do business.

Forms of Business Ownership Sole proprietorship A sole proprietorship is a kind of business unit owned by one person. Register with MassTaxConnect Pay Massachusetts personal income tax on business profits File Form 1 Massachusetts Resident Income Tax Return or Form 1-NRPY Massachusetts NonresidentPart-Year Resident. But like all businesses you need to obtain the necessary licenses and permits.

A sole proprietorship also known as the sole trader individual entrepreneurship or proprietorship is a type of enterprise owned and run by one person and in which there is no legal distinction between the owner and the business entityA sole trader does not necessarily work aloneit is possible for the sole trader to employ other people. This business units formation is relatively simpler because than other business units since only a few legal. 2019 IRS Form W-3.

You can also voluntarily choose other certifications like Shop Act and MSME to avail of numerous benefits.

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

A Sole Proprietorship Also Known As The Sole Trader Or Simply A Proprietorship Is A Type Of Business E How To Raise Money Sole Proprietorship Sole Proprietor

A Sole Proprietorship Also Known As The Sole Trader Or Simply A Proprietorship Is A Type Of Business E How To Raise Money Sole Proprietorship Sole Proprietor

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

The Federal Tax Forms For A Sole Proprietorship Dummies

The Federal Tax Forms For A Sole Proprietorship Dummies

Sole Proprietorship Meaning Sole Proprietorship Definition

Sole Proprietorship Meaning Sole Proprietorship Definition

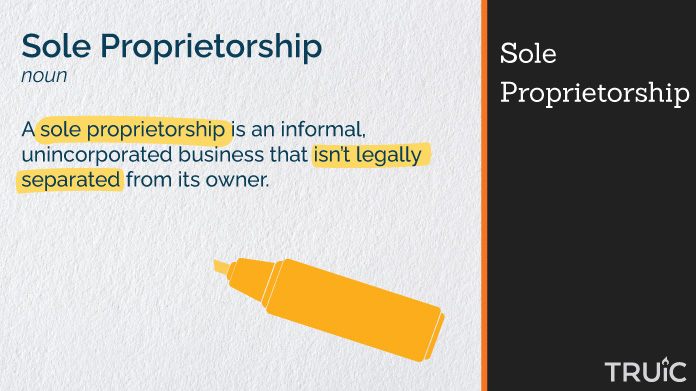

Pros And Cons Of A Sole Proprietorship

Pros And Cons Of A Sole Proprietorship

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

Sole Proprietorship Vs Llc A Guide To Tax Benefits Liabilities

Sole Proprietorship Vs Llc A Guide To Tax Benefits Liabilities

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

Do You Need Ein For Sole Proprietorship Employer Identification Number Sole Proprietorship Federal Taxes

Do You Need Ein For Sole Proprietorship Employer Identification Number Sole Proprietorship Federal Taxes

5 Sole Proprietorship Pros And Cons

5 Sole Proprietorship Pros And Cons

Form X1 Form Free Download 1 Facts You Never Knew About Form X1 Form Free Download Organisation Name Facts You Never Know

Form X1 Form Free Download 1 Facts You Never Knew About Form X1 Form Free Download Organisation Name Facts You Never Know

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietorship Definition Advantages And Disadvantages

Sole Proprietorship Definition Advantages And Disadvantages

Sole Proprietorship Meaning Features Needs Advantages Disadvantages

Sole Proprietorship Meaning Features Needs Advantages Disadvantages

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Tax Tips For Sole Proprietors Sole Proprietor Small Business Tax Business Tax Deductions

Tax Tips For Sole Proprietors Sole Proprietor Small Business Tax Business Tax Deductions

When Does A Sole Proprietor Need An Ein How To Start An Llc

When Does A Sole Proprietor Need An Ein How To Start An Llc