Tax Filing For Sole Proprietorship Malaysia

In the process of filing Form B a sole proprietor needs to prepare various information to determine the chargeable income and tax payable ie. Sole proprietorships are pass-through entities.

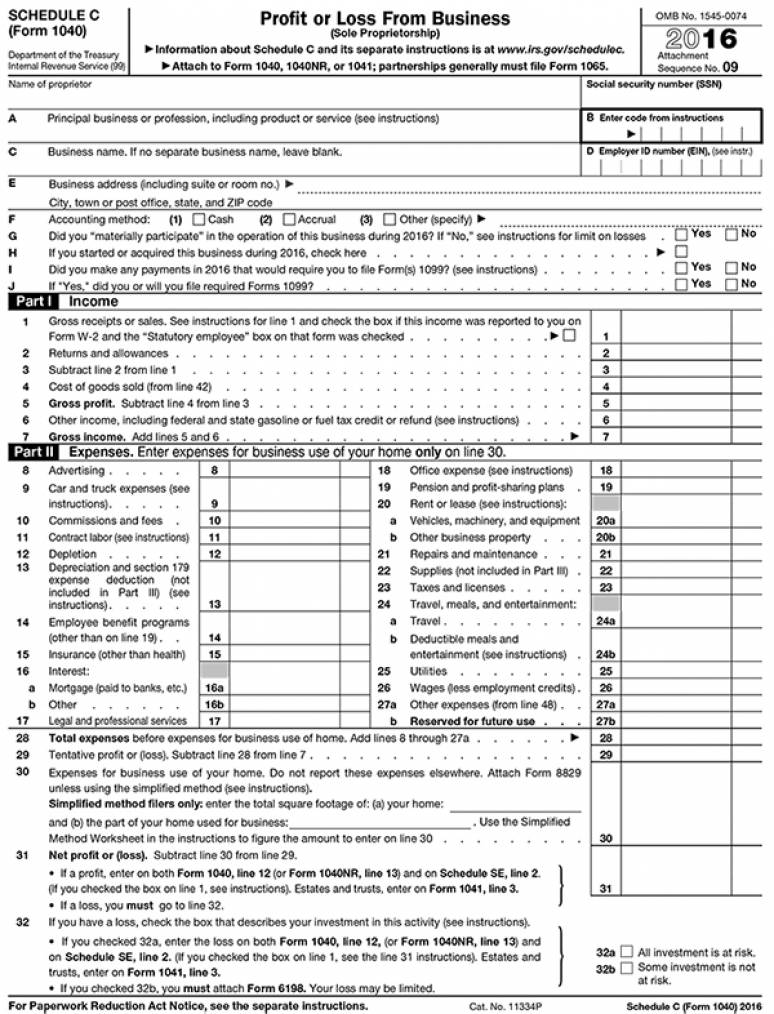

Profit Or Loss From Business Sole Proprietorship Irs Tax Form 1040 Schedule C 2016 Package Of 100 U S Government Bookstore

Profit Or Loss From Business Sole Proprietorship Irs Tax Form 1040 Schedule C 2016 Package Of 100 U S Government Bookstore

You have to report this income in your tax return.

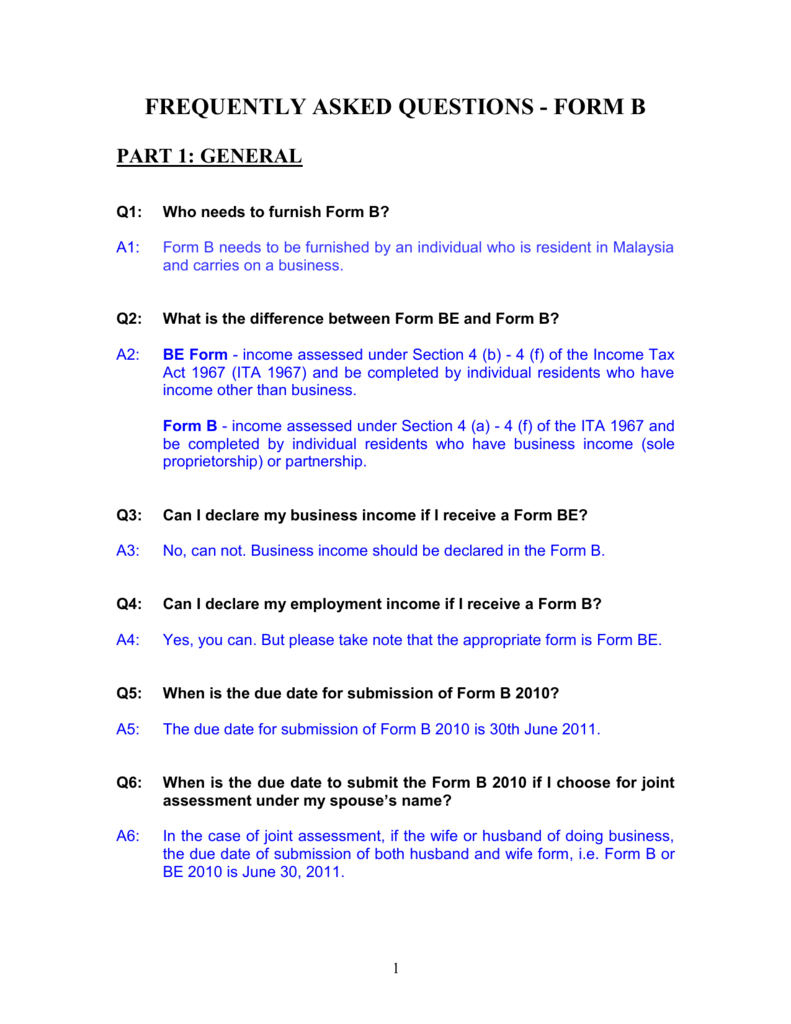

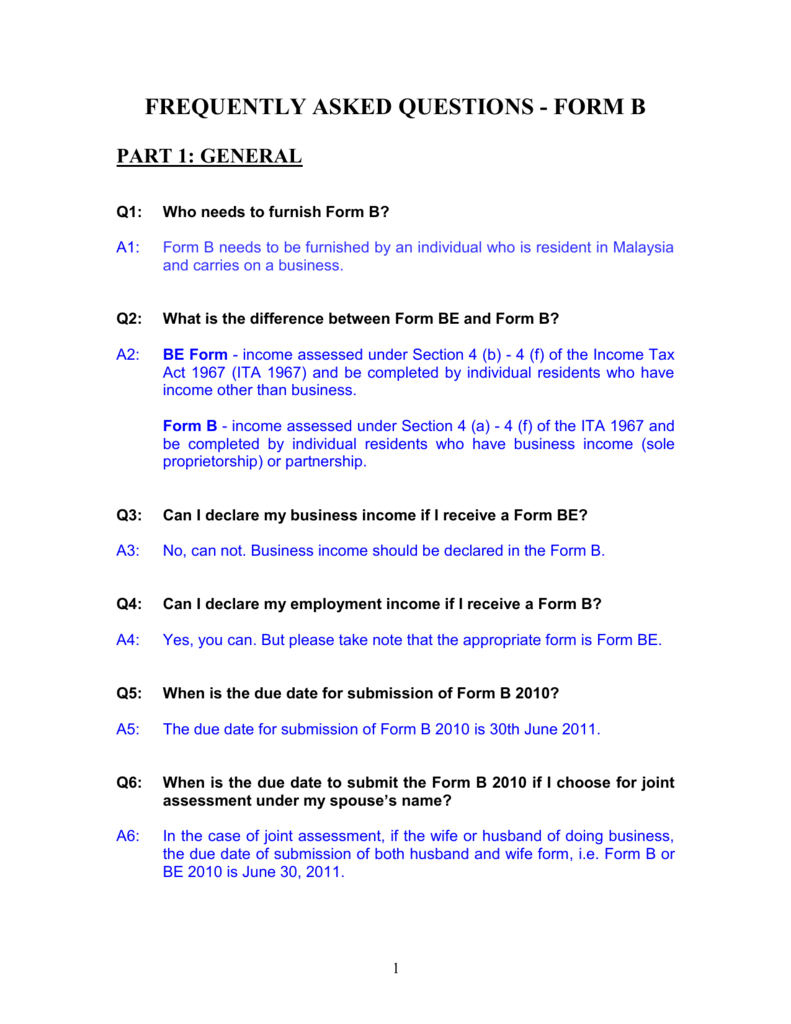

Tax filing for sole proprietorship malaysia. For many small-scale online businesses in Malaysia Sole Proprietorship single owner or Partnership more than one owner is enough and the cheapest option. The taxation process is much linear in case of sole proprietorship than that of SDN BHD. Instead of filing Form BE which is filed by individuals under employment or having non-business income sole proprietors file Form B before 30 June on a yearly basis.

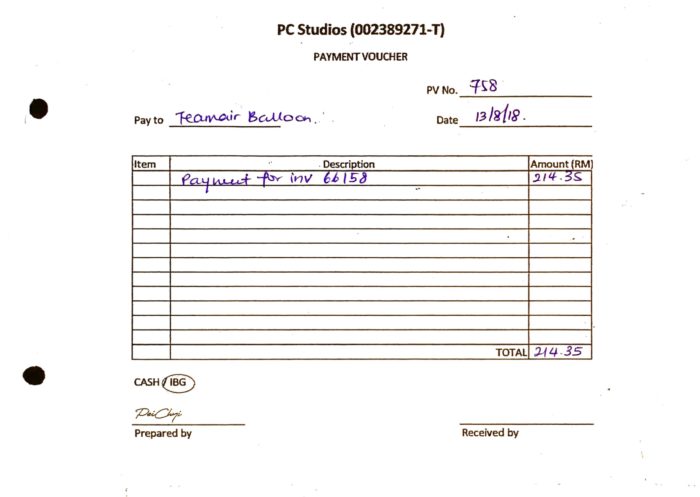

Business code guideline can be obtained. Esubmission of Alphalist of Employees. WITHHOLDING TAX COMPENSATION.

Form 1040 reports your personal income while Schedule C is where youll record business income. Income tax filing for sole proprietors is straightforward. A sole proprietor is a self-employed individual and must pay self-employment taxes Social SecurityMedicare tax based on the income of the business.

30 June every year Refer to accounts statement supporting documents other income statement and receipts Fill in the correct business code when filling the Income Tax Return Form ITRF. The deadline for filing of Form B by the a person carrying a business such as sole proprietor is by 30 June of the following year The deadline for filing Form P by a partnership excluding limited liability partnerships LLPs is by 30 June of the following year. Other taxes paid by a sole proprietorship in Malaysia are.

The trade tax or corporate tax is fully subsidized in sole ownership business. As of 2018 it is stated that you must pay taxes if your annual income exceeds RM34000 per year. If you do not receive the notificationincome tax return from IRAS please check your filing requirements XLS 55KB.

Sole proprietorships in Malaysia are charged the income tax on a gradual scale applied to the individual income from 2 to 26. Self Employed Sole Proprietors Partners If you have received full-time or part-time income from trade business vocation or profession you are considered a self-employed person. Self-employment tax is included in Form 1040 for federal taxes calculated using Schedule SE.

This page shows the relevant information to. Sole proprietors file need to file two forms to pay federal income tax for the year. Secondly theres Schedule C which reports business profit and loss.

Firstly theres Form 1040 which is the individual tax return. For subsequent years it needs to be done within 90 days from the end of your LLPs financial year. WITHHOLDING TAX EXPANDED.

Go to an SSM. Once the tax file has been registered you must apply for a PIN number at the nearest IRB branch for first-time login into the e-Filing system. If the owner is an individual the activities of the LLC will generally be reflected on.

She will be paying RM 31300 in income tax for YA 2021 and its calculation is. In case of limited liability Company in Malaysia standard corporate tax is applicable and need to pay on time. Distribution of BIR Form 2316 to.

All profits and losses go directly to the business owner. WITHHOLDING TAX COMPENSATION. To start with first lets calculate Janets income tax payment for YA 2021 if she succeeds in attaining as much as RM 250000 in PBT as a sole proprietor in YA 2021.

This allows you the flexibility to choose a financial year that makes sense. However the owner needs to pay a self employment tax. Your first annual declaration needs to be done within 18 months from your LLPs registration date.

REQUIRED ATTACHMENT in general and if applicable. Thereby no separate tax return file is needed. Registration of a tax file can be done at the nearest Inland Revenue Board of Malaysia IRB branch or online via e-Daftar at the IRB website with a copy of your identification card passport.

If Janet Remains a Sole Proprietor. Form 1040 or 1040-SR Schedule C Profit or Loss from Business Sole Proprietorship Form 1040 or 1040-SR Schedule E Supplemental Income or Loss Form 1040 or 1040-SR Schedule F Profit or Loss from Farming. Sole proprietorship private limited company Deadline for submission of Form B P and payment of tax payable if any.

So yes if you are a freelancer you are subject to income tax and therefore must file. At the beginning of the year and usually by 15 Mar IRAS will send you a notification or an individual income tax return Form B or B1 to report your income from business or as well as your income from all other sources. 9 rows A sole proprietor is someone who owns an unincorporated business by.

Beginner S Tax Guide For Online Businesses In Malaysia Free Malaysia Today Fmt

Beginner S Tax Guide For Online Businesses In Malaysia Free Malaysia Today Fmt

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

10 Highlights For Malaysia Income Tax Filing Youtube

10 Highlights For Malaysia Income Tax Filing Youtube

Form B Lembaga Hasil Dalam Negeri

Form B Lembaga Hasil Dalam Negeri

Beginner S Tax Guide For Online Businesses In Malaysia Free Malaysia Today Fmt

Beginner S Tax Guide For Online Businesses In Malaysia Free Malaysia Today Fmt

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

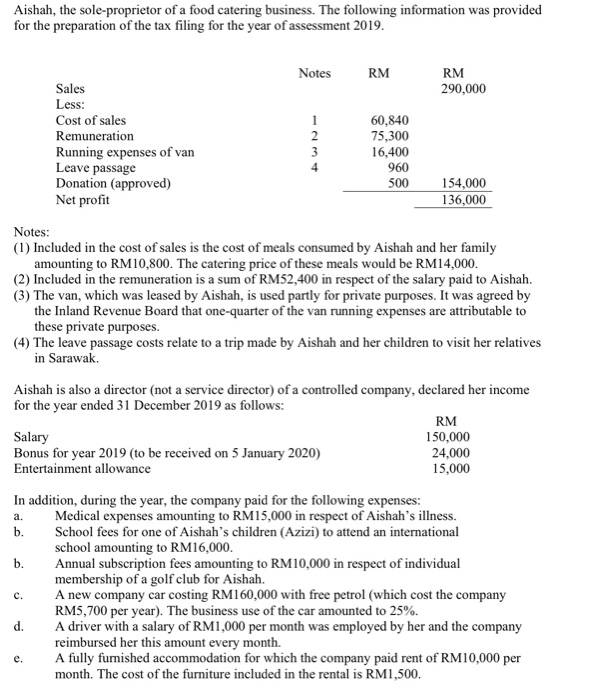

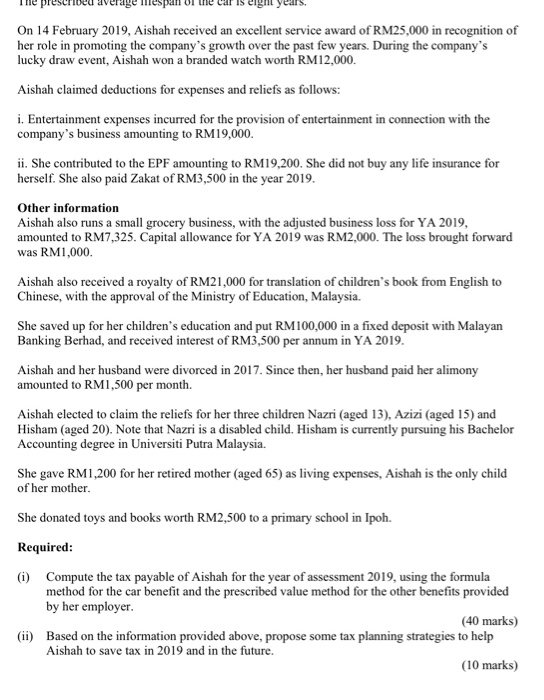

Aishah The Sole Proprietor Of A Food Catering Bus Chegg Com

Aishah The Sole Proprietor Of A Food Catering Bus Chegg Com

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Aishah The Sole Proprietor Of A Food Catering Bus Chegg Com

Aishah The Sole Proprietor Of A Food Catering Bus Chegg Com

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Sole Proprietorship Malaysia Income Tax

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A