Business Mileage Claim Form P87

A P87 form is the document you use to use to claim tax relief for your work expenses. Tax Relief For Employee Business Mileage.

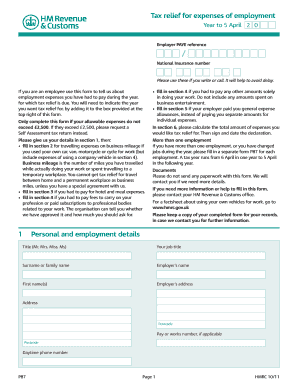

P87 Form To Print Page 1 Line 17qq Com

P87 Form To Print Page 1 Line 17qq Com

On your self-assessment government form.

Business mileage claim form p87. The amount shown on the service summary page is your total expenses for the year. Download our free mileage claim template form as an Excel spreadsheet. Please note that this form is produced by HM Revenue Customs and is public sector information licensed under the Open Government Licence v30.

Report your mileage used for business with this log and reimbursement form template. Subtract the received MAP from the approved amount you should have received. You can complete your P87 form online or by completing a postal form.

If your claim surpasses 2500 you should file a self-evaluation government form. Mileage log and expense report. Hybrid cars claim at the petrol or diesel rate.

Claiming your mileage deduction is easy. If youre self-employed include the mileage deduction in your self assessment tax return. P87 Tax relief for expenses of employment As a service to our clients we have provided you with some of the forms you will require for your business activity.

The P87 form allows you to claim income tax relief against your employment expenses including business mileage. If you usually do not need to complete a tax return you can use form P87 on HMRCs website to claim MAR. Add up the Mileage Allowance Payments you have received throughout the year.

Deduct your managers mileage limit if applicable. You can only claim tax relief if your employer hasnt reimbursed you for your expenses. Alternatively if you do not file a self-evaluation assessment form use form P87.

With regards to previous years expenses for mileage you would do one of the following. These expenses are the ones that you are required to pay for yourself by your employer but you use for work purposes. If youve received partial reimbursementfor instance you receive 25p per mile rather than HMRCs approved mileage rate of 45p per mileyou can claim tax relief on the difference.

Using the advisory fuel rates above you can calculate what percentage of the business mileage rate applies to fuel and calculate the VAT on that element. For sums not exactly 2500 file your claim. HMRC Tax Form P87.

Mileage and reimbursement amounts are calculated for you to submit as an expense report. There are three different ways to make the claim via form P87. A P87 is an HMRC form that you need to use to claim income tax relief on certain employment expenses.

Fully electric cars only. Do note however that youll have to file a self assessment tax return if youre claiming more than 2500. You have 4 years from the end of a tax year to make a claim and you can claim for any number of jobs but you can only submit the form online if youre claiming for mileage in relation to less than 5 jobs.

Download The Form P87 This form can be filled online by signing in to Government Gateway or by downloading the form and sending it through post. Youll need to deal directly with HMRC or engage a tax agent to act on your behalf. Total business mileage First 10000 miles enter the amount up to 10000 miles x 40p up to 5 April 2011 Over 10000 miles enter the amount over 10000 miles x 25p Maximum tax-free amount cars and vans box 1 plus box 2 Motorcycles All business mileage x 24p Cycles All business mileage x 20p Mileage allowance relief.

Complete a form P87. Claiming your business miles is a form of tax relief meaning the cost of your mileage will reduce your tax bill at the end of the year. When using a vehicle for your business its important to keep accurate records of every work journey including the dates and mileage.

1Fill in a P87 form for the years in question if the expense claim for the year is below 2500. First 10000 business miles in the tax year Each business mile over 10000 in the tax year. Electricity is not classed as a fuel for car fuel benefit purposes.

This website uses cookies to help us improve your experience. If youre employed you can claim using Form P87. The address is on the form.

Then you can download and complete a P87 form. You can find previous rates at the Govuk website Advisory Fuel Rates page. You also have to use Self Assessment if you have work expenses of over 2500 to claim for in one year.

You can only claim your tax refunds with a P87 if youre an employee. Add up your business mileage for the whole year.

2014 2021 Form Uk Hmrc P87 Fill Online Printable Fillable Blank Pdffiller

2014 2021 Form Uk Hmrc P87 Fill Online Printable Fillable Blank Pdffiller

How To Fill Out Your P87 Tax Form Flip

How To Fill Out Your P87 Tax Form Flip

Tax Relief P87 Tax Relief Form

Mileage Claim Form For Pirelli Page 1 Line 17qq Com

Mileage Claim Form For Pirelli Page 1 Line 17qq Com

Tax Relief Mileage Tax Relief Form

2011 Form Uk Hmrc P87 Fill Online Printable Fillable Blank Pdffiller

2011 Form Uk Hmrc P87 Fill Online Printable Fillable Blank Pdffiller

Mileage Claim Form For Pirelli Page 1 Line 17qq Com

Mileage Claim Form For Pirelli Page 1 Line 17qq Com

What Is A P87 Form How To Make The Most Of Form P87 Reliasys

What Is A P87 Form How To Make The Most Of Form P87 Reliasys

Hmrc Form P87 Pdf Download Rzkn Koerpenoc Site

Hmrc Form P87 Pdf Download Rzkn Koerpenoc Site

Mileage Claim Form For Pirelli Page 1 Line 17qq Com

Mileage Claim Form For Pirelli Page 1 Line 17qq Com

Tax Relief Mileage Tax Relief Form

Do You Know Your Maps From Your Amaps Pdf Aat

Do You Know Your Maps From Your Amaps Pdf Aat

How To Fill Out Your P87 Tax Form Flip

How To Fill Out Your P87 Tax Form Flip

Uniform Tax Rebate Form P87 Download Tax Refund Tax Rebates

Uniform Tax Rebate Form P87 Download Tax Refund Tax Rebates

P87 Form Fill Out And Sign Printable Pdf Template Signnow

P87 Form Fill Out And Sign Printable Pdf Template Signnow

Hmrc Form P87 What You Need To Know For Taxes

Hmrc Form P87 What You Need To Know For Taxes

Using P87 To Claim Tax Relief On Expenses Avanti Tax Accountants

Using P87 To Claim Tax Relief On Expenses Avanti Tax Accountants